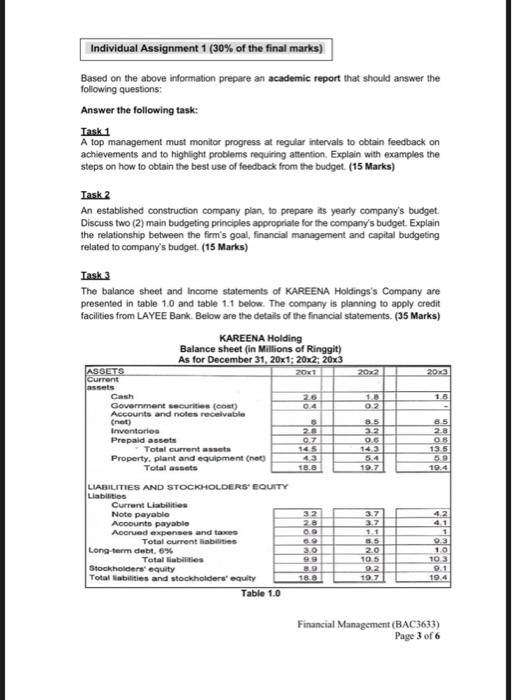

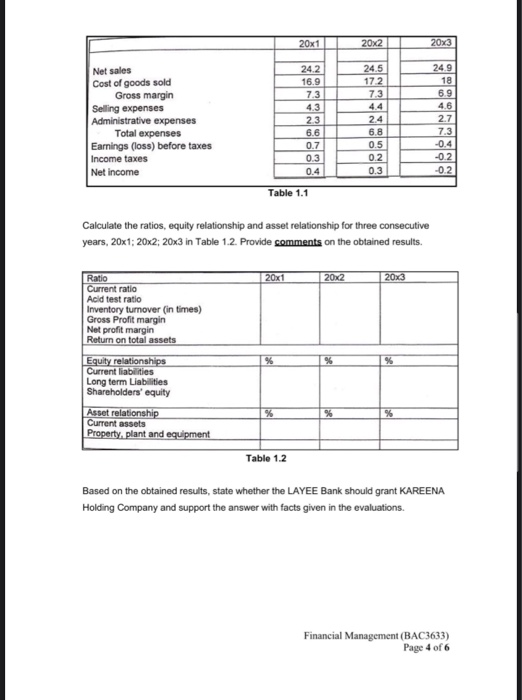

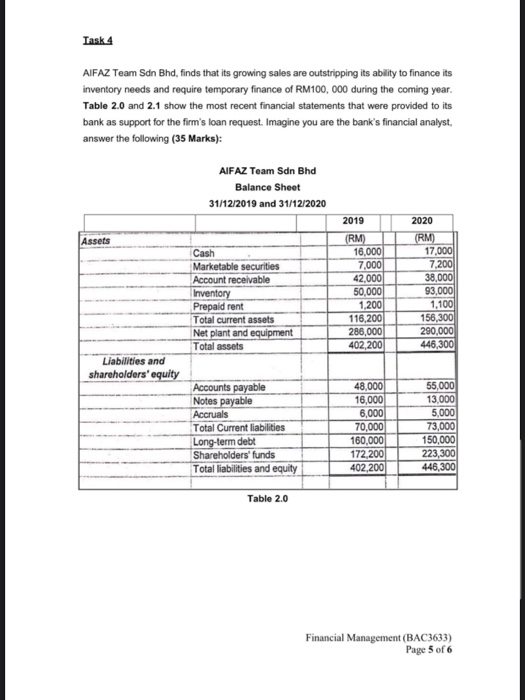

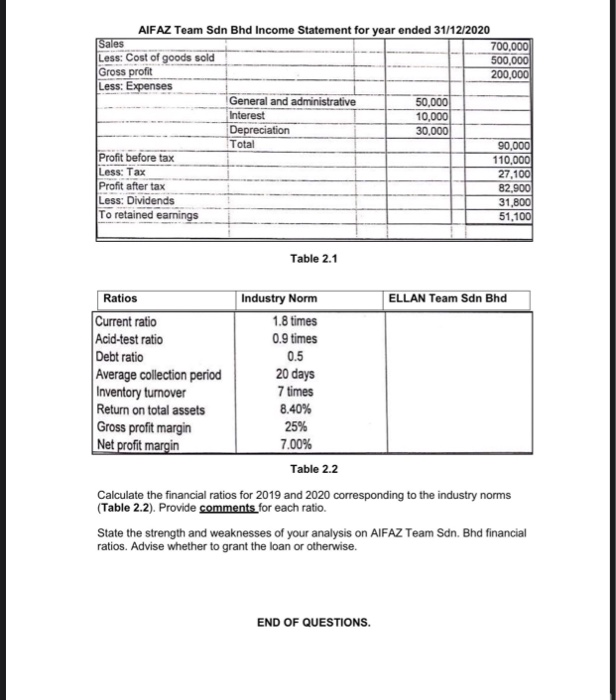

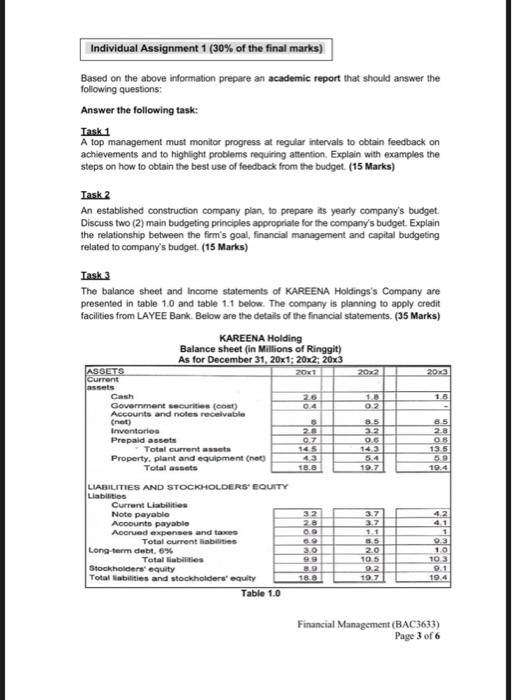

Individual Assignment 1 (30% of the final marks) Based on the above information prepare an academic report that should answer the following questions: Answer the following task: Task 1 A top management must monitor progress at regular intervals to obtain feedback on achievements and to highlight problems requiring attention. Explain with examples the steps on how to obtain the best use of feedback from the budget. (15 Marks) Task 2 An established construction company plan, to prepare its yearly company's budget. Discuss two (2) main budgeting principles appropriate for the company's budget. Explain the relationship between the firm's goal, financial management and capital budgeting related to company's budget. (15 Marks) Task 3 The balance sheet and income statements of KAREENA Holdings's Company are presented in table 1.0 and table 1.1 below. The company is planning to apply credit facilities from LAYEE Bank. Below are the details of the financial statements. (35 Marks) KAREENA Holding Balance sheet (in Millions of Ringgit) As for December 31, 20x1; 20x2 20x3 ASSETS 20x1 20x2 20x3 Current assets Cash 25 Government securities (cost) Accounts and notes receivable (net) Inventories 3.2 Prepaid assets 0.5 - Total current assets Property. plant and equipment (net) Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Liabilities Current Liabilities Note payable 32 Accounts payable Accrued expenses and tases Total current abilities Long-term debt, 6% Total liabilities Stockholders' equity Total liabilities and stockholders' equity 19.71 Table 1.0 16 02 0.8 59 19.7 4.2 4.1 3.7 30 85 2.0 10.5 10 103 2.1 19.4 Financial Management (BAC3633) Page 3 of 6 20x1 20x2 20x3 Net sales Cost of goods sold Gross margin Selling expenses Administrative expenses Total expenses Earnings (loss) before taxes Income taxes Net income 242 16.9 7.3 4.3 23 6.6 0.7 03 0.4 24.5 172 73 4.4 24 6.8 0.5 0.2 0.3 24.9 18 6.9 4.6 2.7 7.3 -0.4 -02 -0.2 Table 1.1 Calculate the ratios, equity relationship and asset relationship for three consecutive years, 20x1; 20x2; 20x3 in Table 1.2. Provide comments on the obtained results. 20x1 20x2 20x3 Ratio Current ratio Acid test ratio Inventory turnover (in times) Gross Profit margin Net profit margin Return on total assets % % Equity relationships Current liabilities Long term Liabilities Shareholders' equity % % % Asset relationship Current assets Property, plant and equipment Table 1.2 Based on the obtained results, state whether the LAYEE Bank should grant KAREENA Holding Company and support the answer with facts given in the evaluations. Financial Management (BAC3633) Page 4 of 6 Task 4 AIFAZ Team Sdn Bhd, finds that its growing sales are outstripping its ability to finance its inventory needs and require temporary finance of RM100,000 during the coming year. Table 2.0 and 2.1 show the most recent financial statements that were provided to its bank as support for the firm's loan request. Imagine you are the bank's financial analyst, answer the following (35 Marks): AIFAZ Team Sdn Bhd Balance Sheet 31/12/2019 and 31/12/2020 Assets Cash Marketable securities Account receivable Inventory Prepaid rent Total current assets Net plant and equipment Total assets 2019 (RM) 16,000 7,000 42,000 50.000 1,200 116,200 286,000 402,200 2020 (RM) 17,000 7.200 38,000 93,000 1,100 156,300 290,000 446,300 Liabilities and shareholders' equity Accounts payable Notes payable Accruals Total Current liabilities Long-term debt Shareholders' funds Total liabilities and equity 48,000 16,000 6,000 70,000 160,000 172 200 402,200 55,000 13,000 5,000 73,000 150,000 223,300 446,300 Table 2.0 Financial Management (BAC3633) Page 5 of 6 AIFAZ Team Sdn Bhd Income Statement for year ended 31/12/2020 Sales 700,000 Less: Cost of goods sold 500,000 Gross profit 200,000 Less: Expenses General and administrative 50,000 Interest 10,000 Depreciation 30.000 Total 90,000 Profit before tax 110,000 Less: Tax 27.100 Profit after tax 82.900 Less: Dividends 31,800 To retained earnings 51,100 Table 2.1 Ratios Industry Norm ELLAN Team Sdn Bhd Current ratio 1.8 times Acid-test ratio 0.9 times Debt ratio 0.5 Average collection period 20 days Inventory turnover 7 times Return on total assets 8.40% Gross profit margin 25% Net profit margin 7.00% Table 2.2 Calculate the financial ratios for 2019 and 2020 corresponding to the industry norms (Table 2.2). Provide comments for each ratio. State the strength and weaknesses of your analysis on AIFAZ Team Sdn. Bhd financial ratios. Advise whether to grant the loan or otherwise. END OF QUESTIONS Individual Assignment 1 (30% of the final marks) Based on the above information prepare an academic report that should answer the following questions: Answer the following task: Task 1 A top management must monitor progress at regular intervals to obtain feedback on achievements and to highlight problems requiring attention. Explain with examples the steps on how to obtain the best use of feedback from the budget. (15 Marks) Task 2 An established construction company plan, to prepare its yearly company's budget. Discuss two (2) main budgeting principles appropriate for the company's budget. Explain the relationship between the firm's goal, financial management and capital budgeting related to company's budget. (15 Marks) Task 3 The balance sheet and income statements of KAREENA Holdings's Company are presented in table 1.0 and table 1.1 below. The company is planning to apply credit facilities from LAYEE Bank. Below are the details of the financial statements. (35 Marks) KAREENA Holding Balance sheet (in Millions of Ringgit) As for December 31, 20x1; 20x2 20x3 ASSETS 20x1 20x2 20x3 Current assets Cash 25 Government securities (cost) Accounts and notes receivable (net) Inventories 3.2 Prepaid assets 0.5 - Total current assets Property. plant and equipment (net) Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Liabilities Current Liabilities Note payable 32 Accounts payable Accrued expenses and tases Total current abilities Long-term debt, 6% Total liabilities Stockholders' equity Total liabilities and stockholders' equity 19.71 Table 1.0 16 02 0.8 59 19.7 4.2 4.1 3.7 30 85 2.0 10.5 10 103 2.1 19.4 Financial Management (BAC3633) Page 3 of 6 20x1 20x2 20x3 Net sales Cost of goods sold Gross margin Selling expenses Administrative expenses Total expenses Earnings (loss) before taxes Income taxes Net income 242 16.9 7.3 4.3 23 6.6 0.7 03 0.4 24.5 172 73 4.4 24 6.8 0.5 0.2 0.3 24.9 18 6.9 4.6 2.7 7.3 -0.4 -02 -0.2 Table 1.1 Calculate the ratios, equity relationship and asset relationship for three consecutive years, 20x1; 20x2; 20x3 in Table 1.2. Provide comments on the obtained results. 20x1 20x2 20x3 Ratio Current ratio Acid test ratio Inventory turnover (in times) Gross Profit margin Net profit margin Return on total assets % % Equity relationships Current liabilities Long term Liabilities Shareholders' equity % % % Asset relationship Current assets Property, plant and equipment Table 1.2 Based on the obtained results, state whether the LAYEE Bank should grant KAREENA Holding Company and support the answer with facts given in the evaluations. Financial Management (BAC3633) Page 4 of 6 Task 4 AIFAZ Team Sdn Bhd, finds that its growing sales are outstripping its ability to finance its inventory needs and require temporary finance of RM100,000 during the coming year. Table 2.0 and 2.1 show the most recent financial statements that were provided to its bank as support for the firm's loan request. Imagine you are the bank's financial analyst, answer the following (35 Marks): AIFAZ Team Sdn Bhd Balance Sheet 31/12/2019 and 31/12/2020 Assets Cash Marketable securities Account receivable Inventory Prepaid rent Total current assets Net plant and equipment Total assets 2019 (RM) 16,000 7,000 42,000 50.000 1,200 116,200 286,000 402,200 2020 (RM) 17,000 7.200 38,000 93,000 1,100 156,300 290,000 446,300 Liabilities and shareholders' equity Accounts payable Notes payable Accruals Total Current liabilities Long-term debt Shareholders' funds Total liabilities and equity 48,000 16,000 6,000 70,000 160,000 172 200 402,200 55,000 13,000 5,000 73,000 150,000 223,300 446,300 Table 2.0 Financial Management (BAC3633) Page 5 of 6 AIFAZ Team Sdn Bhd Income Statement for year ended 31/12/2020 Sales 700,000 Less: Cost of goods sold 500,000 Gross profit 200,000 Less: Expenses General and administrative 50,000 Interest 10,000 Depreciation 30.000 Total 90,000 Profit before tax 110,000 Less: Tax 27.100 Profit after tax 82.900 Less: Dividends 31,800 To retained earnings 51,100 Table 2.1 Ratios Industry Norm ELLAN Team Sdn Bhd Current ratio 1.8 times Acid-test ratio 0.9 times Debt ratio 0.5 Average collection period 20 days Inventory turnover 7 times Return on total assets 8.40% Gross profit margin 25% Net profit margin 7.00% Table 2.2 Calculate the financial ratios for 2019 and 2020 corresponding to the industry norms (Table 2.2). Provide comments for each ratio. State the strength and weaknesses of your analysis on AIFAZ Team Sdn. Bhd financial ratios. Advise whether to grant the loan or otherwise. END OF QUESTIONS