Question

Pls use above information to answer : a. What is the total amount of income tax expense that Oracle reports in its fiscal 2019 income

Pls use above information to answer :

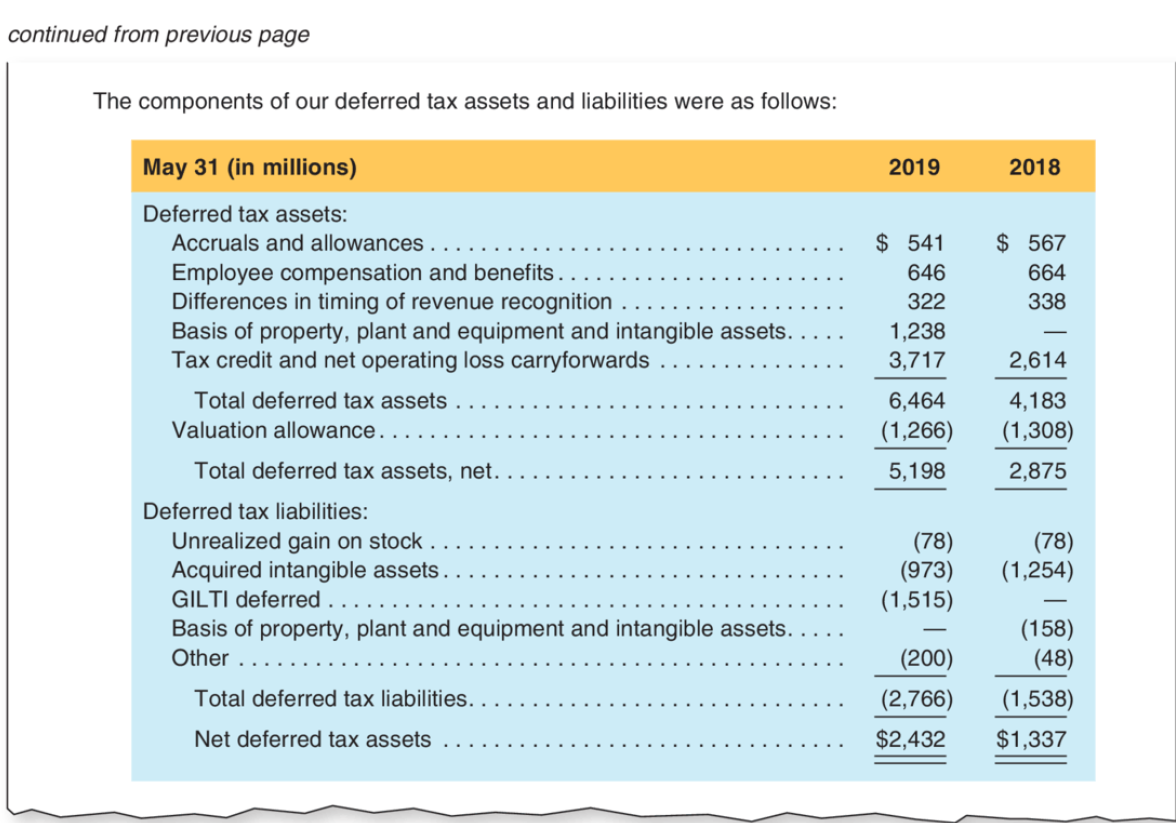

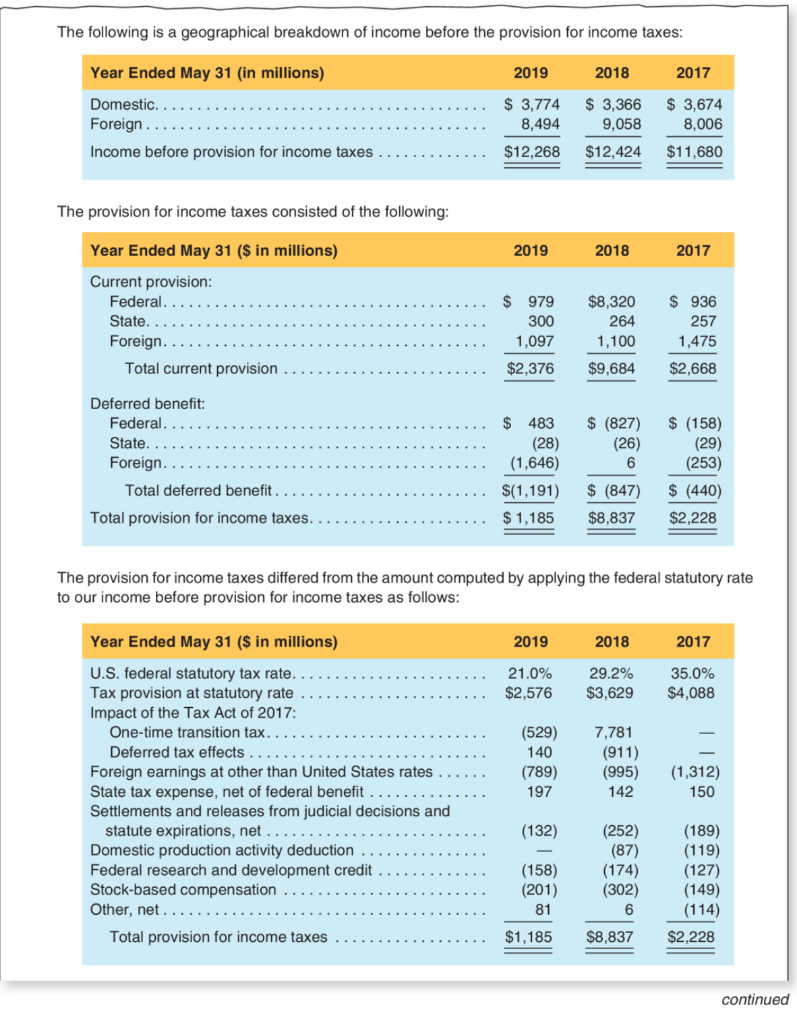

a. What is the total amount of income tax expense that Oracle reports in its fiscal 2019 income statement? What portion of this expense did Oracle pay during 2019 or expect to pay in 2020? b. Explain how the deferred tax liability called "Acquired intangible assets" arises. Under what circumstances will the company settle this liability? Under what circumstances might this liability be deferred indefinitely? c. Explain how the deferred tax asset called "Employee compensation and benefits" arises. Why is it recognized as an asset? d. Explain how the deferred tax asset called "Tax credit and net operating loss carryforwards" arises. Under what circumstances will Oracle realize the benefits of this asset? e. Oracle reports a 20 19 valuation allowance of $ 1,266 million. How does this valuation allowance arise? How did the change in valuation allowance for 2019 affect net income? Valuation allowances typically relate to questions about the realizability of tax loss carryforwards. Under what circumstances might Oracle not realize the benefits of its tax loss carryforwards? f Calculate Oracle's effective (average) tax rate for each year. g. Oracle reconciles the difference between its total provision for income tax and the statutory rate. What item explains most of the difference in fiscal 2017 compared to fiscal 2018? h. If not for the effects of the Tax Cuts and Jobs Act of 2017, what would have been Oracle's effective tax rate each year?

continued from previous page The components of our deferred tax assets and liabilities were as follows: 2019 2018 May 31 (in millions) Deferred tax assets: Accruals and allowances Employee compensation and benefits. Differences in timing of revenue recognition Basis of property, plant and equipment and intangible assets. Tax credit and net operating loss carryforwards Total deferred tax assets . Valuation allowance. $ 541 646 322 1,238 3,717 $ 567 664 338 2,614 6,464 (1,266) 5,198 4,183 (1,308) 2,875 Total deferred tax assets, net. Deferred tax liabilities: Unrealized gain on stock . Acquired intangible assets. GILTI deferred .. Basis of property, plant and equipment and intangible assets. Other (78) (973) (1,515) (78) (1,254) (158) (48) (1,538) $1,337 (200) (2,766) $2,432 Total deferred tax liabilities.. Net deferred tax assets The following is a geographical breakdown of income before the provision for income taxes: Year Ended May 31 (in millions) 2019 2018 2017 Domestic Foreign ... Income before provision for income taxes $ 3,774 8,494 $ 3,366 9,058 $ 3,674 8,006 $12,268 $12,424 $11,680 The provision for income taxes consisted of the following: 2019 2018 2017 $ 936 Year Ended May 31 ($ in millions) Current provision: Federal... State. Foreign. Total current provision $ 979 300 1,097 $8,320 264 1,100 257 1,475 $2,376 $9,684 $2,668 Deferred benefit: Federal. State Foreign... Total deferred benefit. Total provision for income taxes. $ (827) (26) 6 $ 483 (28) (1,646) $(1,191) $ 1,185 $ (158) (29) (253) $ (440) $2,228 $ (847) $8,837 The provision for income taxes differed from the amount computed by applying the federal statutory rate to our income before provision for income taxes as follows: Year Ended May 31 ($ in millions) 2019 2018 2017 21.0% $2,576 29.2% $3,629 35.0% $4,088 (529) 140 7,781 (911) (995) 142 (789) (1,312) 150 197 U.S. federal statutory tax rate. Tax provision at statutory rate Impact of the Tax Act of 2017: One-time transition tax. Deferred tax effects Foreign earnings at other than United States rates State tax expense, net of federal benefit Settlements and releases from judicial decisions and statute expirations, net ..., Domestic production activity deduction Federal research and development credit Stock-based compensation Other, net. Total provision for income taxes (132) (158) (201) 81 (252) (87) (174) (302) 6 (189) (119) (127) (149) (114) $1,185 $8,837 $2,228 continued continued from previous page The components of our deferred tax assets and liabilities were as follows: 2019 2018 May 31 (in millions) Deferred tax assets: Accruals and allowances Employee compensation and benefits. Differences in timing of revenue recognition Basis of property, plant and equipment and intangible assets. Tax credit and net operating loss carryforwards Total deferred tax assets . Valuation allowance. $ 541 646 322 1,238 3,717 $ 567 664 338 2,614 6,464 (1,266) 5,198 4,183 (1,308) 2,875 Total deferred tax assets, net. Deferred tax liabilities: Unrealized gain on stock . Acquired intangible assets. GILTI deferred .. Basis of property, plant and equipment and intangible assets. Other (78) (973) (1,515) (78) (1,254) (158) (48) (1,538) $1,337 (200) (2,766) $2,432 Total deferred tax liabilities.. Net deferred tax assets The following is a geographical breakdown of income before the provision for income taxes: Year Ended May 31 (in millions) 2019 2018 2017 Domestic Foreign ... Income before provision for income taxes $ 3,774 8,494 $ 3,366 9,058 $ 3,674 8,006 $12,268 $12,424 $11,680 The provision for income taxes consisted of the following: 2019 2018 2017 $ 936 Year Ended May 31 ($ in millions) Current provision: Federal... State. Foreign. Total current provision $ 979 300 1,097 $8,320 264 1,100 257 1,475 $2,376 $9,684 $2,668 Deferred benefit: Federal. State Foreign... Total deferred benefit. Total provision for income taxes. $ (827) (26) 6 $ 483 (28) (1,646) $(1,191) $ 1,185 $ (158) (29) (253) $ (440) $2,228 $ (847) $8,837 The provision for income taxes differed from the amount computed by applying the federal statutory rate to our income before provision for income taxes as follows: Year Ended May 31 ($ in millions) 2019 2018 2017 21.0% $2,576 29.2% $3,629 35.0% $4,088 (529) 140 7,781 (911) (995) 142 (789) (1,312) 150 197 U.S. federal statutory tax rate. Tax provision at statutory rate Impact of the Tax Act of 2017: One-time transition tax. Deferred tax effects Foreign earnings at other than United States rates State tax expense, net of federal benefit Settlements and releases from judicial decisions and statute expirations, net ..., Domestic production activity deduction Federal research and development credit Stock-based compensation Other, net. Total provision for income taxes (132) (158) (201) 81 (252) (87) (174) (302) 6 (189) (119) (127) (149) (114) $1,185 $8,837 $2,228 continuedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started