Answered step by step

Verified Expert Solution

Question

1 Approved Answer

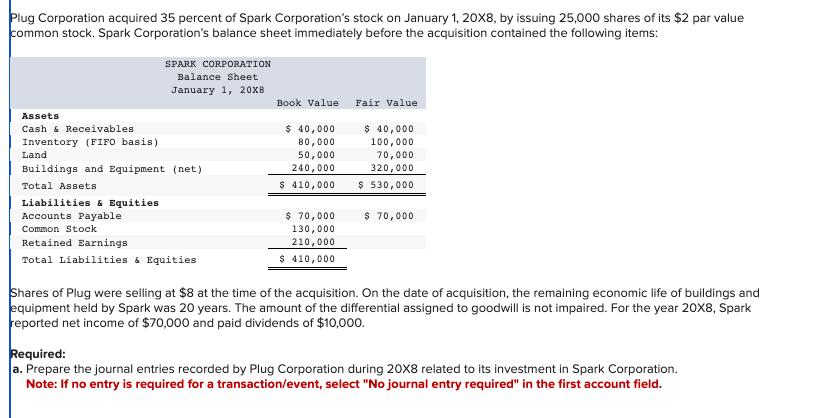

Plug Corporation acquired 35 percent of Spark Corporation's stock on January 1, 20X8, by issuing 25,000 shares of its $2 par value common stock.

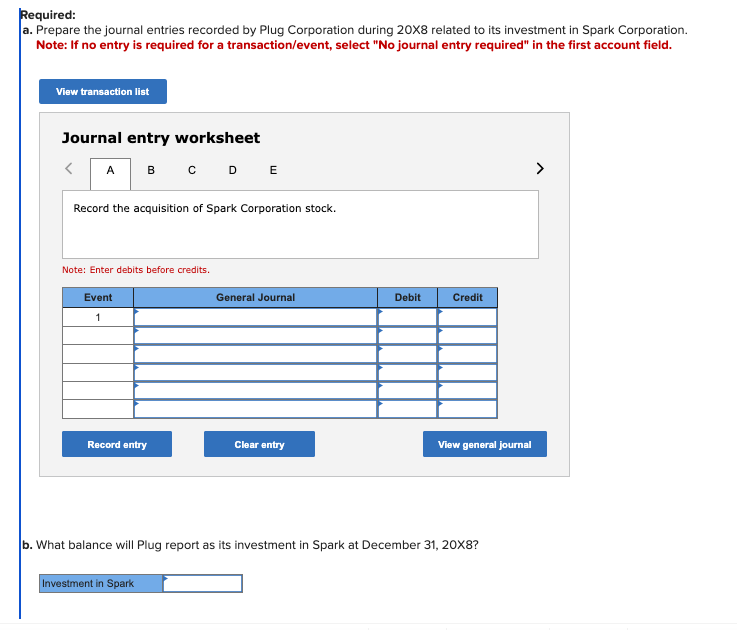

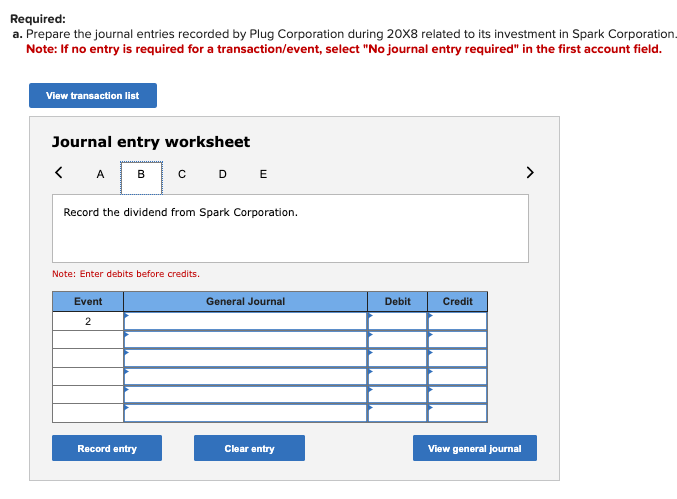

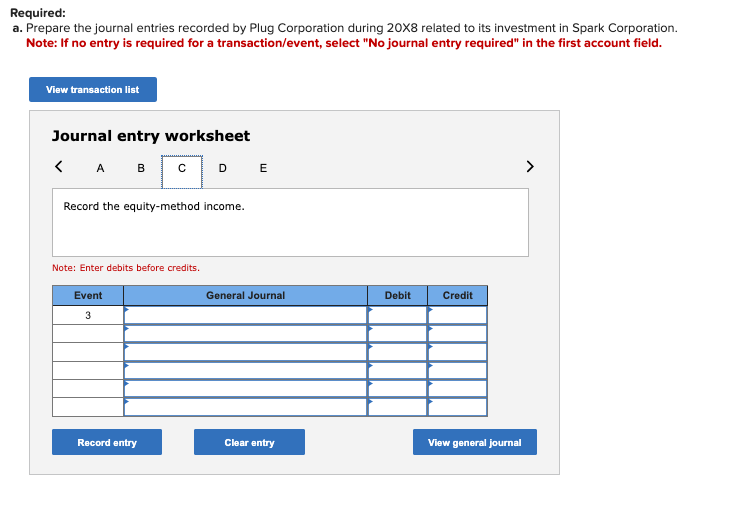

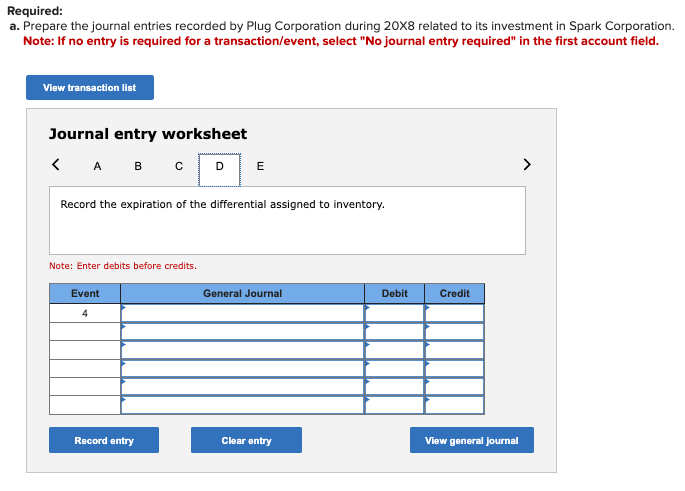

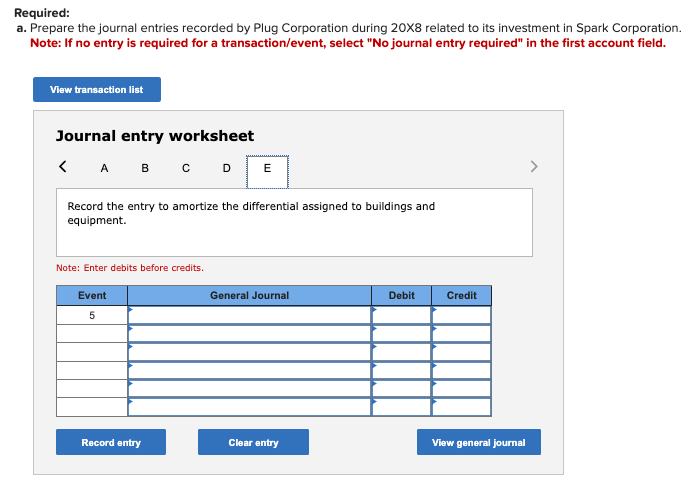

Plug Corporation acquired 35 percent of Spark Corporation's stock on January 1, 20X8, by issuing 25,000 shares of its $2 par value common stock. Spark Corporation's balance sheet immediately before the acquisition contained the following items: SPARK CORPORATION Balance Sheet Assets Cash & Receivables Inventory (FIFO basis) Land January 1, 20x8 Book Value Fair Value $ 40,000 80,000 $ 40,000 100,000 Buildings and Equipment (net) Total Assets Liabilities & Equities Accounts Payable Common Stock Retained Earnings Total Liabilities & Equities 50,000 240,000 70,000 320,000 $ 530,000 $ 410,000 $ 70,000 130,000 210,000 $ 70,000 $ 410,000 Shares of Plug were selling at $8 at the time of the acquisition. On the date of acquisition, the remaining economic life of buildings and equipment held by Spark was 20 years. The amount of the differential assigned to goodwill is not impaired. For the year 20X8, Spark reported net income of $70,000 and paid dividends of $10,000. Required: a. Prepare the journal entries recorded by Plug Corporation during 20X8 related to its investment in Spark Corporation. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Required: a. Prepare the journal entries recorded by Plug Corporation during 20X8 related to its investment in Spark Corporation. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheet < A B C D E Record the acquisition of Spark Corporation stock. Note: Enter debits before credits. Event 1 General Journal Debit Credit Record entry Clear entry View general journal b. What balance will Plug report as its investment in Spark at December 31, 20X8? Investment in Spark Required: a. Prepare the journal entries recorded by Plug Corporation during 20X8 related to its investment in Spark Corporation. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheet < A B C D E Record the dividend from Spark Corporation. Note: Enter debits before credits. Event 2 General Journal Debit Credit Record entry Clear entry View general journal Required: a. Prepare the journal entries recorded by Plug Corporation during 20X8 related to its investment in Spark Corporation. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheet < A B C DE Record the equity-method income. Note: Enter debits before credits. Event 3 General Journal Debit Credit Record entry Clear entry View general journal > Required: a. Prepare the journal entries recorded by Plug Corporation during 20X8 related to its investment in Spark Corporation. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheet < A B C D E Record the expiration of the differential assigned to inventory. Note: Enter debits before credits. Event 4 General Journal Debit Credit Record entry Clear entry View general journal Required: a. Prepare the journal entries recorded by Plug Corporation during 20X8 related to its investment in Spark Corporation. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer 1 Journal Entries Date Particulars Debit Credit A Investment in Spark Corporations Stock 2000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started