Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Plum Limited is a listed company on the Hong Kong Stock Exchange. Its main business is the sales of fresh and dried plums. Plum

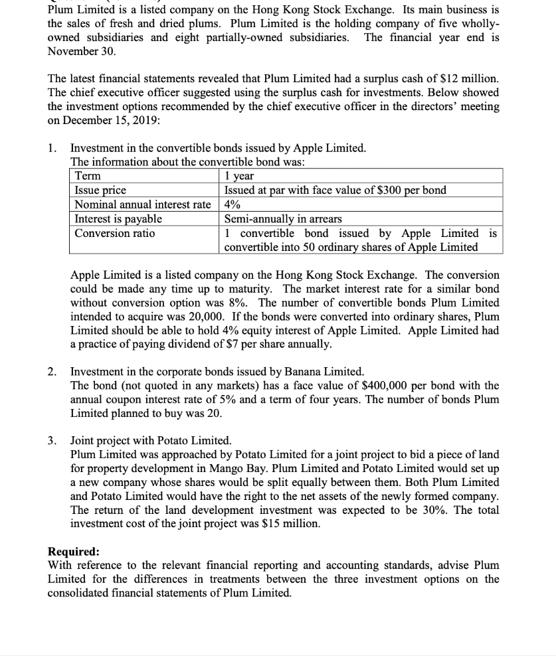

Plum Limited is a listed company on the Hong Kong Stock Exchange. Its main business is the sales of fresh and dried plums. Plum Limited is the holding company of five wholly- owned subsidiaries and eight partially-owned subsidiaries. The financial year end is November 30. The latest financial statements revealed that Plum Limited had a surplus cash of $12 million. The chief executive officer suggested using the surplus cash for investments. Below showed the investment options recommended by the chief executive officer in the directors' meeting on December 15, 2019: 1. Investment in the convertible bonds issued by Apple Limited. The information about the convertible bond was: Term Issue price 1 year Issued at par with face value of $300 per bond Nominal annual interest rate 4% Interest is payable Conversion ratio Semi-annually in arrears 1 convertible bond issued by Apple Limited is convertible into 50 ordinary shares of Apple Limited Apple Limited is a listed company on the Hong Kong Stock Exchange. The conversion could be made any time up to maturity. The market interest rate for a similar bond without conversion option was 8%. The number of convertible bonds Plum Limited intended to acquire was 20,000. If the bonds were converted into ordinary shares, Plum Limited should be able to hold 4% equity interest of Apple Limited. Apple Limited had a practice of paying dividend of $7 per share annually. 2. Investment in the corporate bonds issued by Banana Limited. The bond (not quoted in any markets) has a face value of $400,000 per bond with the annual coupon interest rate of 5% and a term of four years. The number of bonds Plum Limited planned to buy was 20. 3. Joint project with Potato Limited. Plum Limited was approached by Potato Limited for a joint project to bid a piece of land for property development in Mango Bay. Plum Limited and Potato Limited would set up a new company whose shares would be split equally between them. Both Plum Limited and Potato Limited would have the right to the net assets of the newly formed company. The return of the land development investment was expected to be 30%. The total investment cost of the joint project was $15 million. Required: With reference to the relevant financial reporting and accounting standards, advise Plum Limited for the differences in treatments between the three investment options on the consolidated financial statements of Plum Limited.

Step by Step Solution

★★★★★

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 The treatment of the three investment options on the consolidated financial statements of Plum Limited will differ depending on the accounting standards used Generally investments are recorde...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started