Answered step by step

Verified Expert Solution

Question

1 Approved Answer

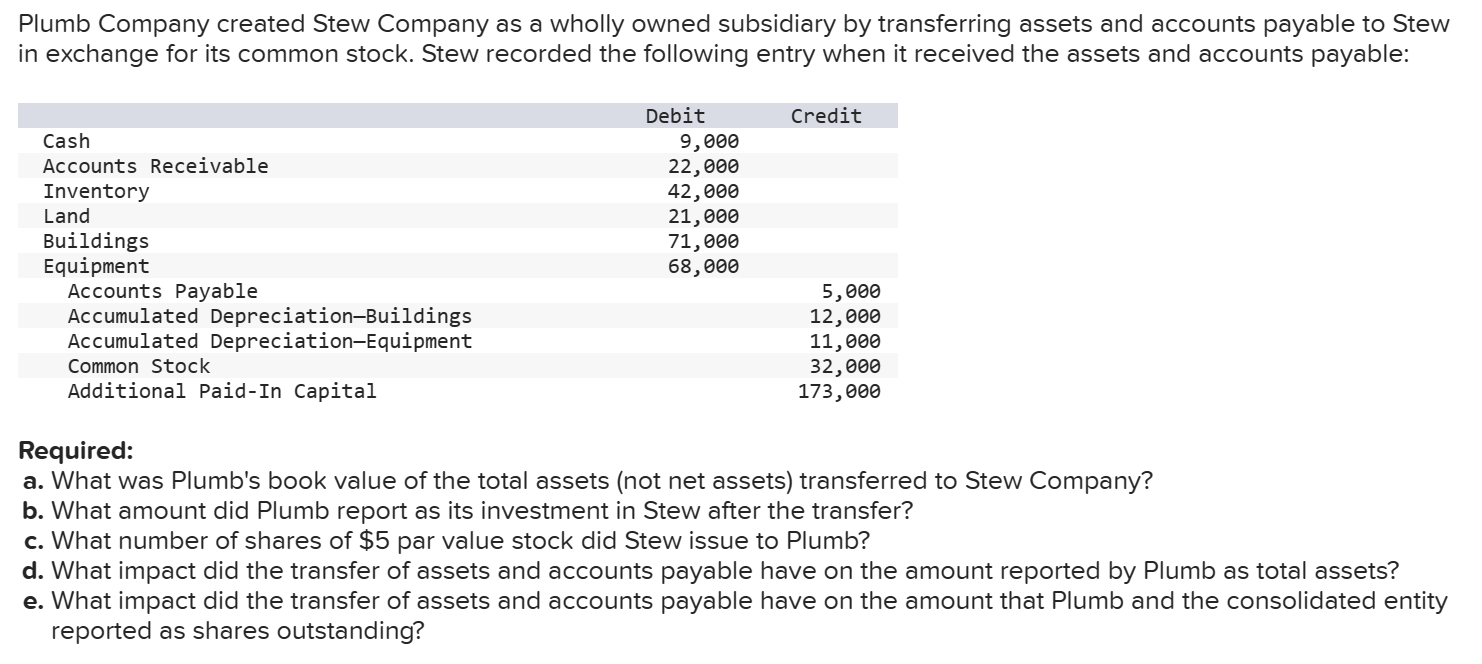

Plumb Company created Stew Company as a wholly owned subsidiary by transferring assets and accounts payable to Stew in exchange for its common stock.

Plumb Company created Stew Company as a wholly owned subsidiary by transferring assets and accounts payable to Stew in exchange for its common stock. Stew recorded the following entry when it received the assets and accounts payable: Cash Accounts Receivable Inventory Land Buildings Equipment Accounts Payable Accumulated Depreciation-Buildings Accumulated Depreciation-Equipment Common Stock Additional Paid-In Capital Required: Debit 9,000 Credit 22,000 42,000 21,000 71,000 68,000 5,000 12,000 11,000 32,000 173,000 a. What was Plumb's book value of the total assets (not net assets) transferred to Stew Company? b. What amount did Plumb report as its investment in Stew after the transfer? c. What number of shares of $5 par value stock did Stew issue to Plumb? d. What impact did the transfer of assets and accounts payable have on the amount reported by Plumb as total assets? e. What impact did the transfer of assets and accounts payable have on the amount that Plumb and the consolidated entity reported as shares outstanding?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started