plz answer 5 of them

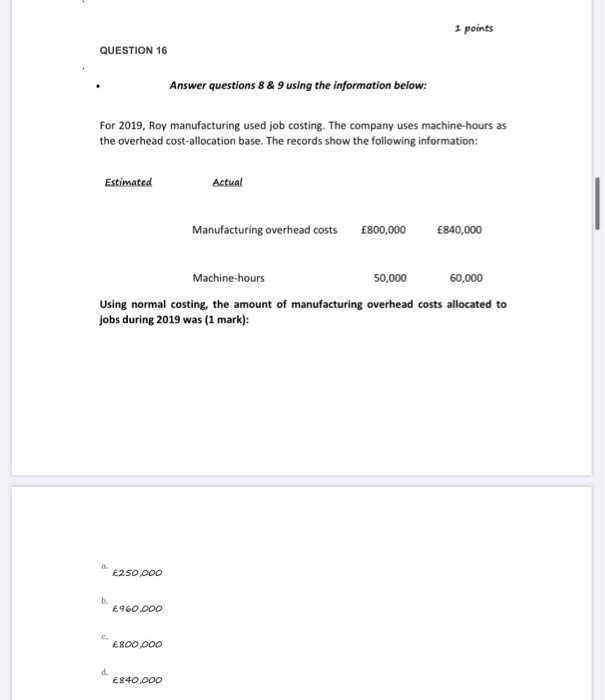

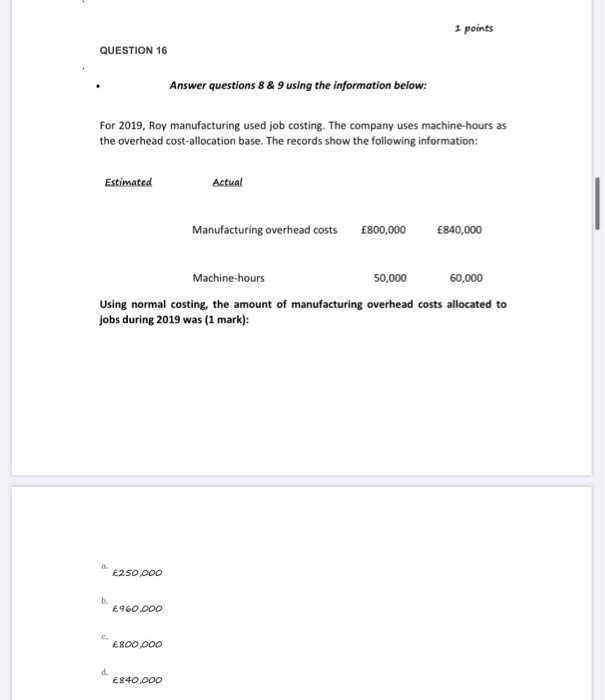

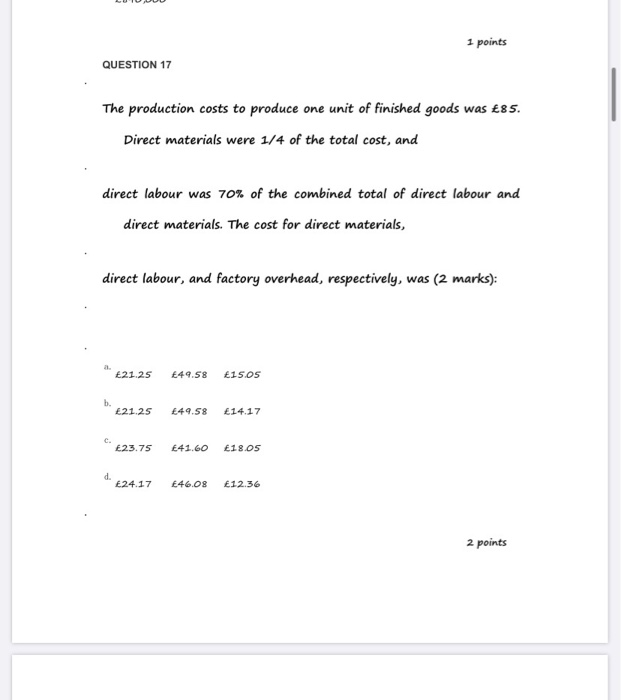

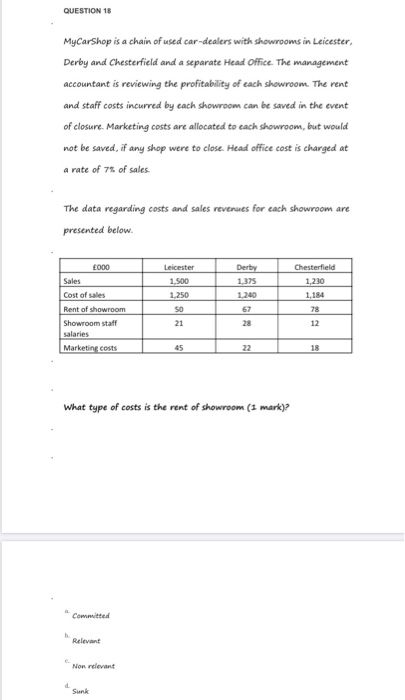

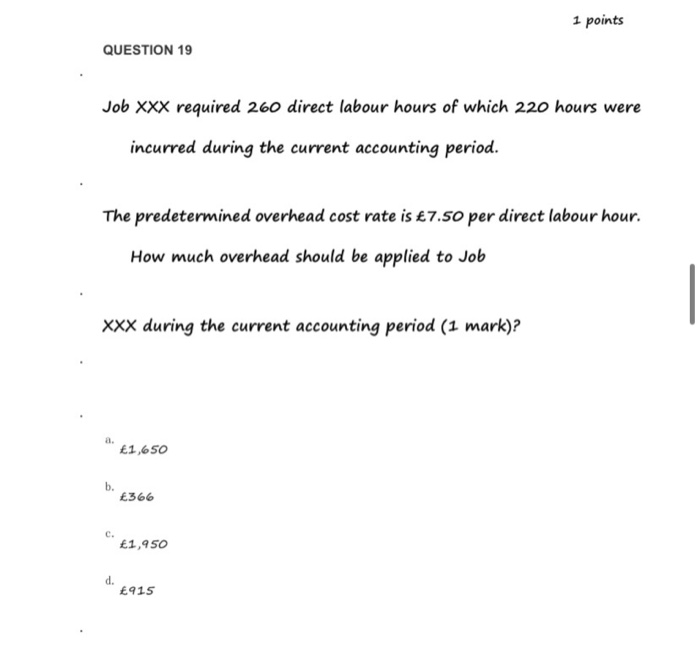

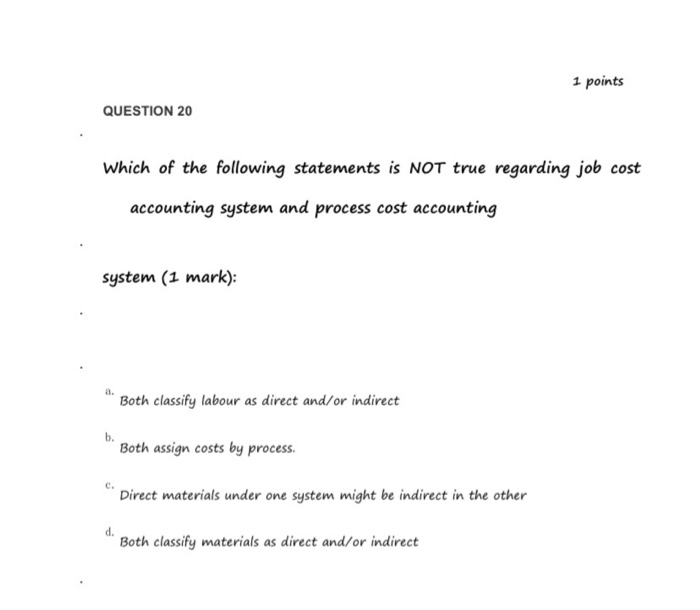

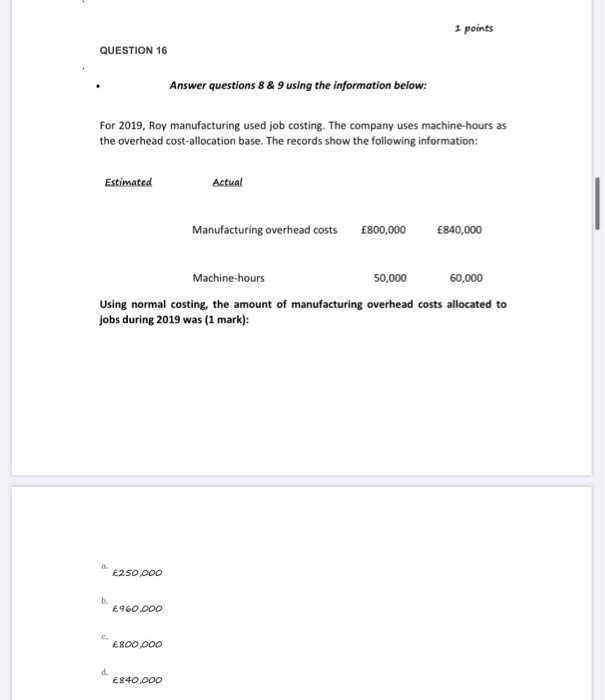

1 points QUESTION 16 Answer questions 8 & 9 using the information below: For 2019, Roy manufacturing used job costing. The company uses machine-hours as the overhead cost-allocation base. The records show the following information: Estimated Actual Manufacturing overhead costs 800,000 840,000 Machine-hours 50,000 60,000 Using normal costing, the amount of manufacturing overhead costs allocated to jobs during 2019 was (1 mark): 250,000 b. 960,000 800,000 d. 840,000 1 points QUESTION 17 The production costs to produce one unit of finished goods was 85. Direct materials were 1/4 of the total cost, and direct labour was 70% of the combined total of direct labour and direct materials. The cost for direct materials, direct labour, and factory overhead, respectively, was (2 marks): 21.25 49.58 15.OS b. 21.25 49.58 14.17 C. 23.75 41.60 18.05 d. E24.17 E46.08 12.36 2 points QUESTION 18 MyCarShop is a chain of used car-dealers with showrooms in Leicester, Derby and Chesterfield and a separate Head Office. The management accountant is reviewing the profitability of each showroom. The rent and staff costs incurred by each showroom can be saved in the event of closure. Marketing costs are allocated to cach showroom, but would not be saved, if any shop were to close. Head office cost is charged at a rate of 78 of sales The data regarding costs and sales revenues for each showroom are presented below Leicester Chesterfield Derby 1375 1,230 1.500 1.250 1240 E000 Sales Cost of sales Rent of showroom Showroom staff salaries Marketing costs 1,184 78 SO 21 28 12 45 22 18 What type of costs is the rent of showroom (1 mark)? Committed Relevant Non relevant Sunk 1 points QUESTION 19 Job XXX required 260 direct labour hours of which 220 hours were incurred during the current accounting period. The predetermined overhead cost rate is 7.50 per direct labour hour. How much overhead should be applied to Job XXX during the current accounting period (1 mark)? 1,650 b. 366 C. 1,950 d. 915 1 points QUESTION 20 Which of the following statements is NOT true regarding job cost accounting system and process cost accounting system (1 mark): Both classify labour as direct and/or indirect Both assign costs by process. Direct materials under one system might be indirect in the other d. Both classify materials as direct and/or indirect