Answered step by step

Verified Expert Solution

Question

1 Approved Answer

plz answer all Required information The following information applies to the questions displayed below.) Oslo Company prepared the following contribution format Income statement based on

plz answer all

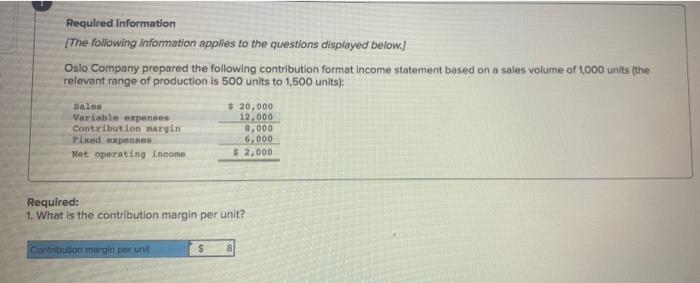

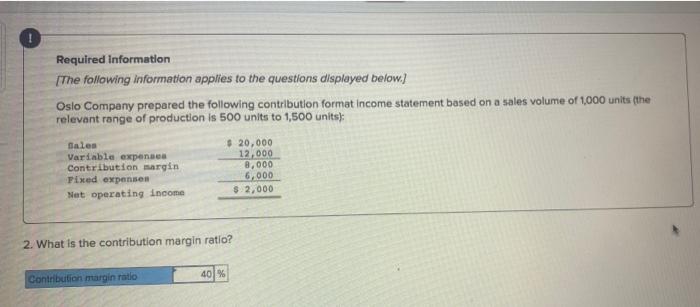

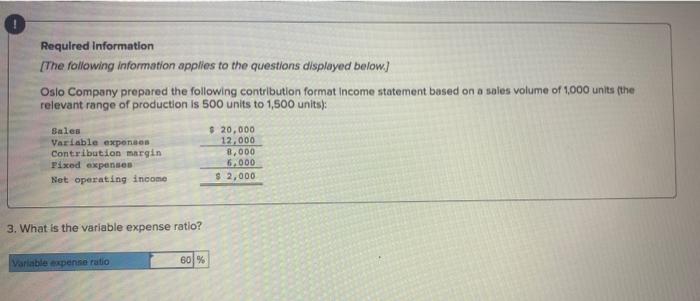

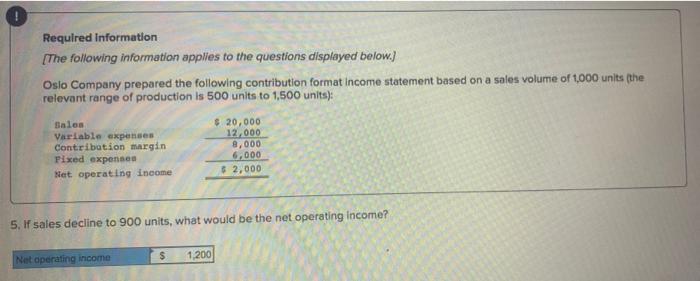

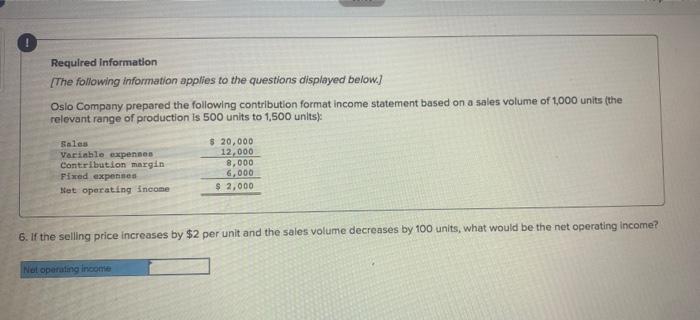

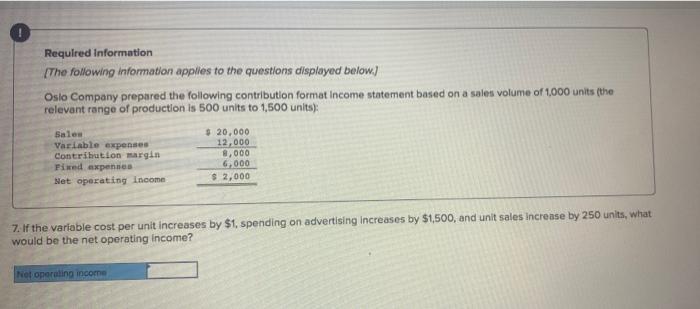

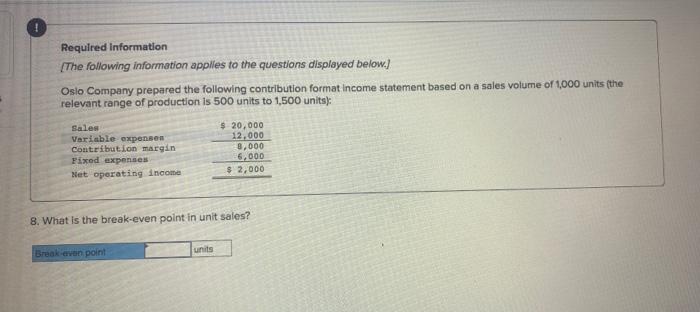

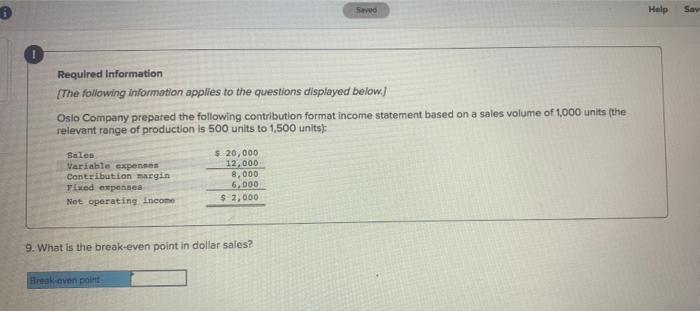

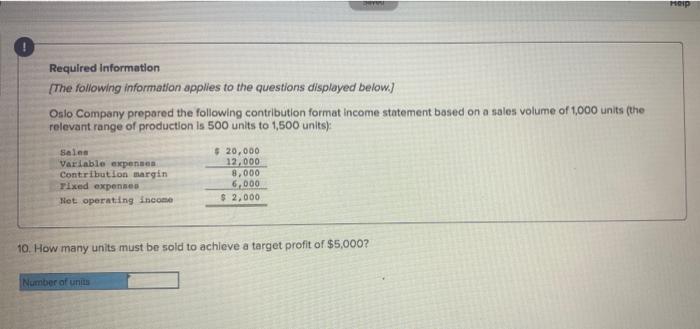

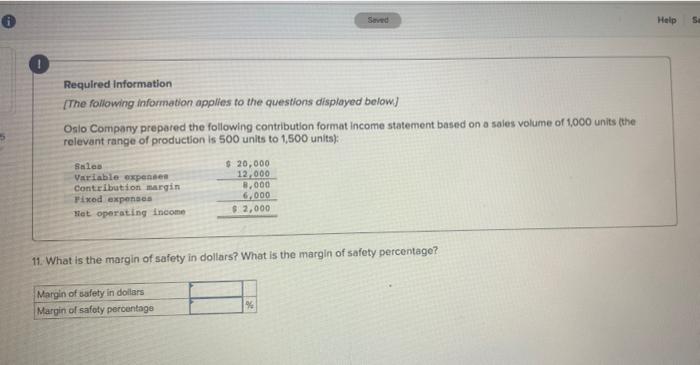

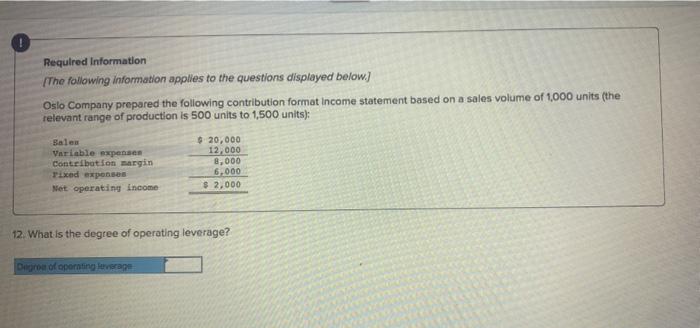

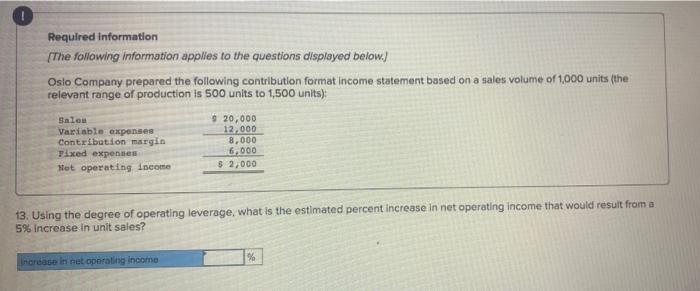

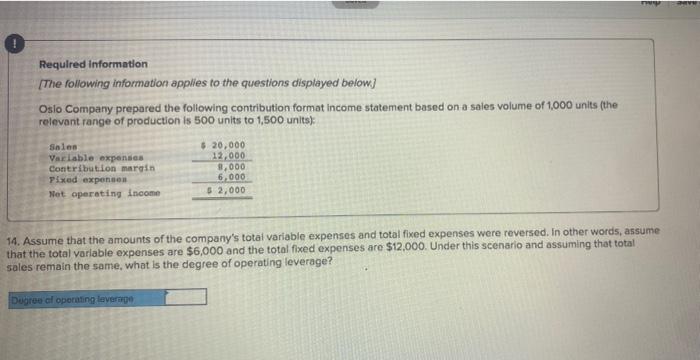

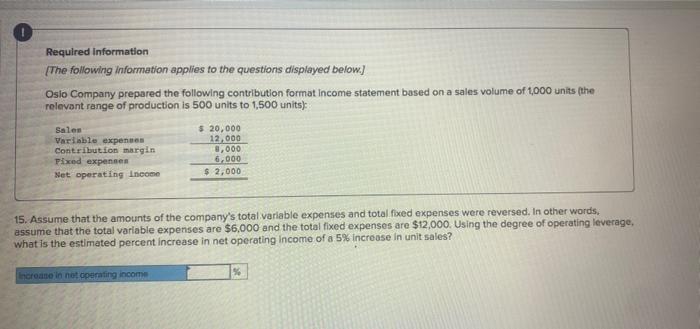

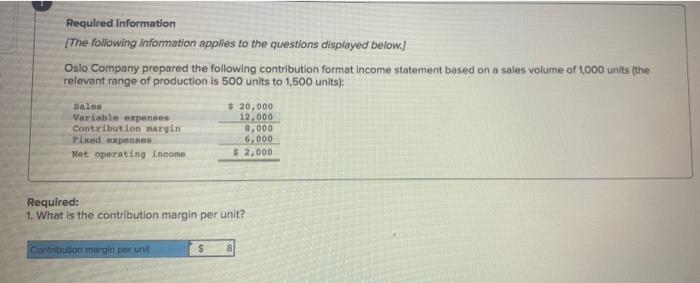

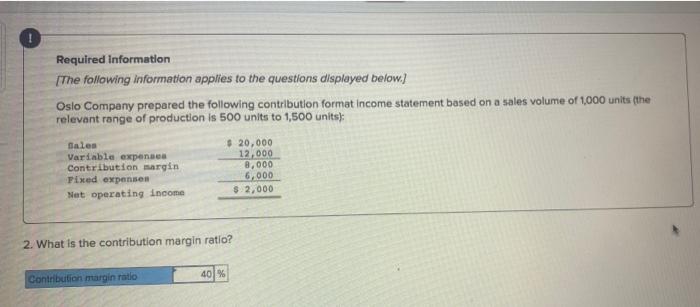

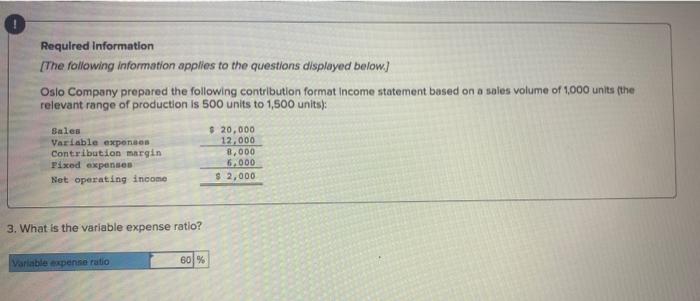

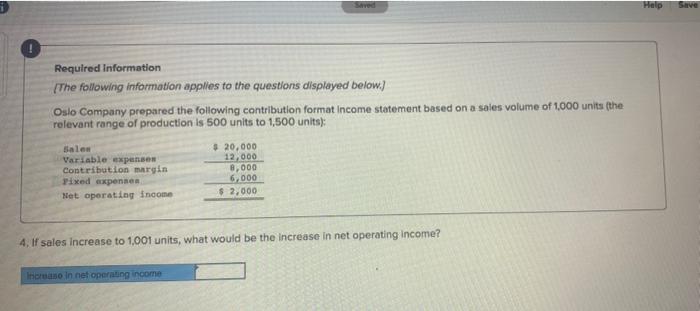

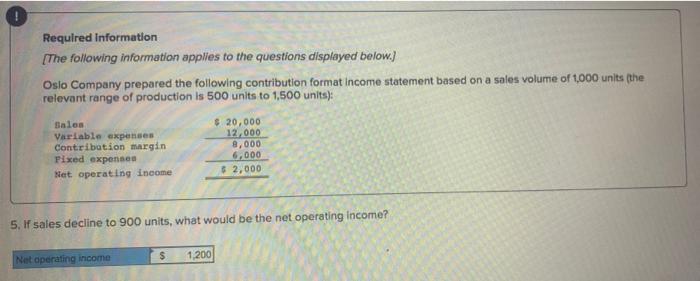

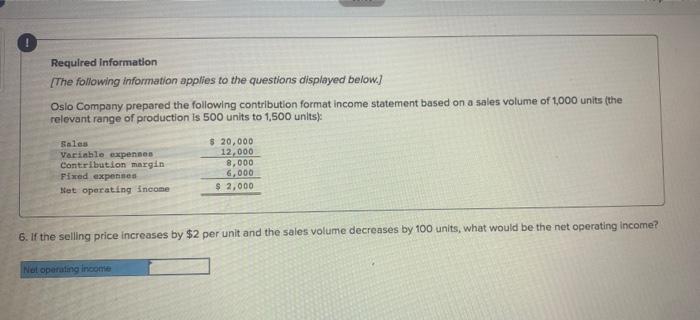

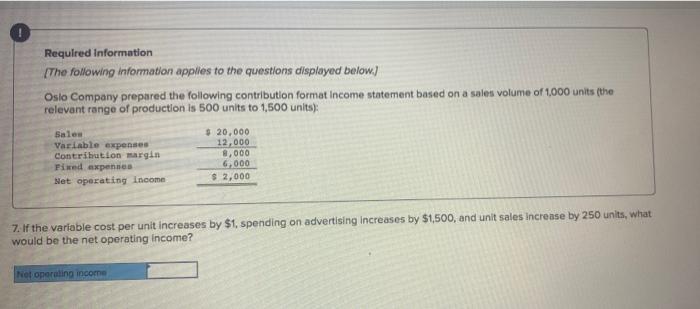

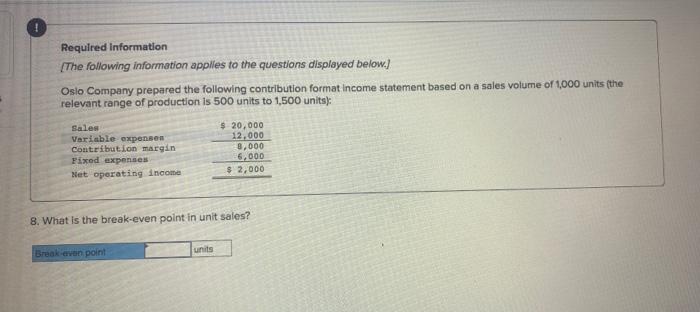

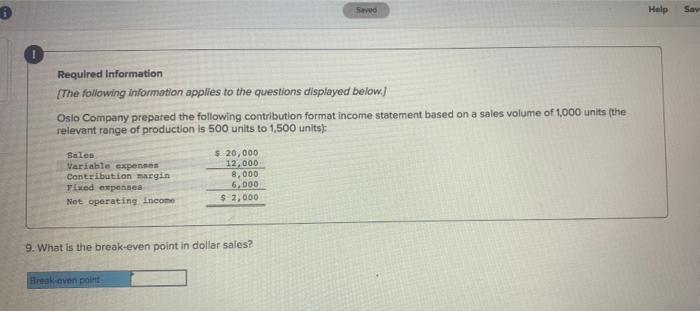

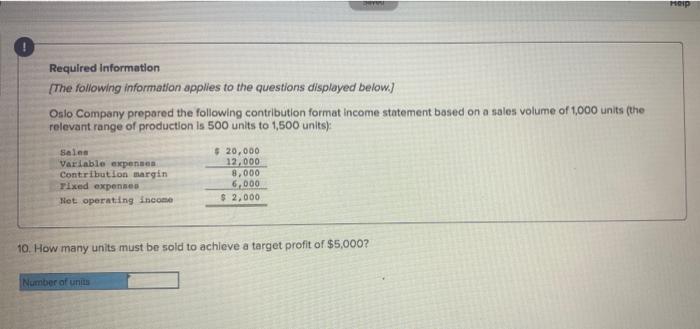

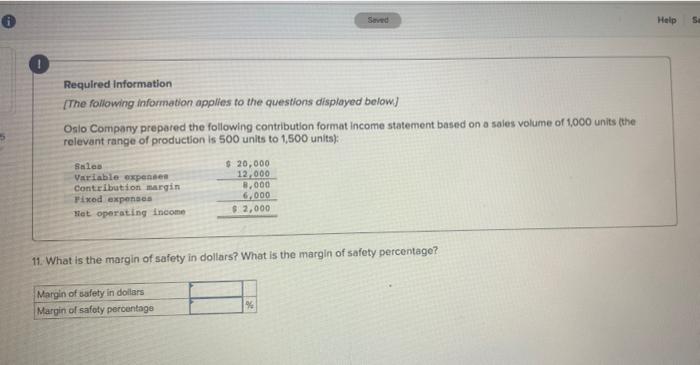

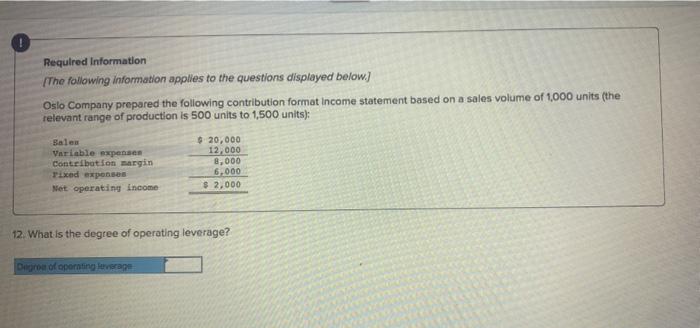

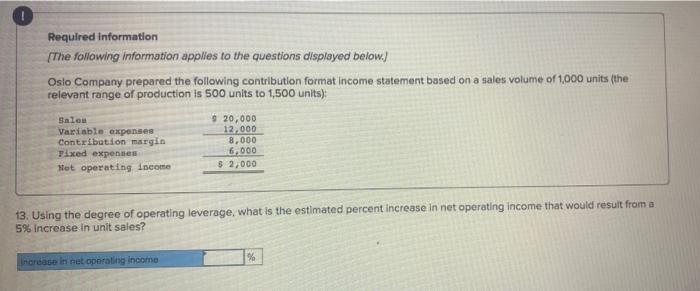

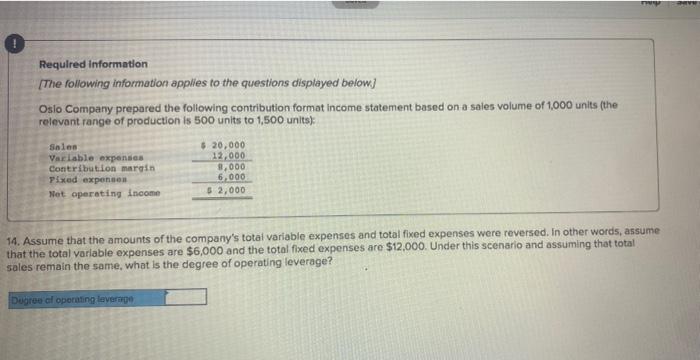

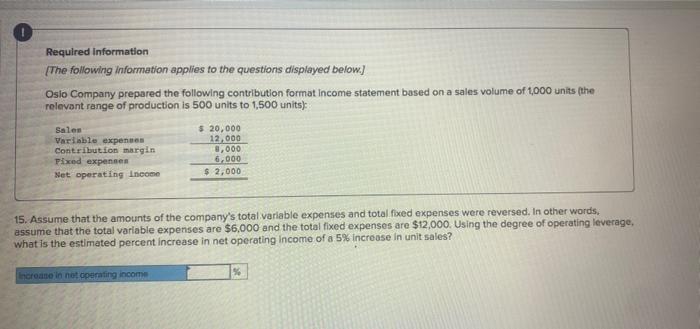

Required information The following information applies to the questions displayed below.) Oslo Company prepared the following contribution format Income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Boles 20,000 Variable expenses 12.000 Contribution margin 8,000 Fixed expen 6,000 Net operating income $ 2,000 Required: 1. What is the contribution margin per unit? Contribution margin per unit S 8 Required Information [The following information applies to the questions displayed below.) Oslo Company prepared the following contribution format Income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales Variable expenses Contribution margin Fixed expensen Net operating income $ 20,000 12,000 8,000 6,000 $ 2,000 2. What is the contribution margin ratio? 40% Contribution margin ratio Required information The following information applies to the questions displayed below) Oslo Company prepared the following contribution format Income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 20,000 12.000 2,000 6.000 $ 2,000 3. What is the variable expense ratio? Variable expenne ratio 60% Help Save Required Information The following information applies to the questions displayed below.) Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 20,000 12,000 8,000 6.000 $ 2,000 4. If sales increase to 1,001 units, what would be the increase in net operating income? Increase in net operating income Required Information [The following information applies to the questions displayed below.) Oslo Company prepared the following contribution format Income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Salon Variable expenses Contribution margin Fixed expenses Net operating income $ 20,000 12.000 8,000 6,000 $ 2,000 5. If sales decline to 900 units, what would be the net operating Income? S 1,200 Net operating income Required Information [The following information applies to the questions displayed below.] Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales Vacible expenses Contribution margin Fixed expenses Bet operating income $ 20,000 12,000 8,000 6,000 $ 2,000 6. If the selling price increases by $2 per unit and the sales volume decreases by 100 units, what would be the net operating Income? Net operating income Required Information The following information applies to the questions displayed below) Oslo Company prepared the following contribution format Income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units); Sales Variable expenses Contribution margin Fixed expenses Net operating Income 20,000 12,000 8,000 6,000 $ 2,000 7. If the variable cost per unit increases by $1. spending on advertising increases by $1,500, and unit sales increase by 250 units, what would be the net operating income? Net operating income Required Information [The following information applies to the questions displayed below.) Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales Variable expensen Contribution margin Fixed expenses Net operating income $ 20,000 12.000 8,000 6.000 $ 2,000 8. What is the break-even point in unit sales? Break-even point units Sed Help Say ! Required Information The following information applies to the questions displayed below) Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales Variable expenses Contribution margin Tixed expenses Net operating Income $ 20,000 12,000 8,000 6,000 $ 2,000 9. What is the break-even point in dollar sales? reak oven point Required Information [The following information applies to the questions displayed below.) Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales Variable expenses Contribution margin Tixed expenses Net operating income $ 20,000 12,000 8,000 6.000 $ 2,000 10. How many units must be sold to achieve a target profit of $5,000? Number of units Seved Help 0 Required Information [The following information applies to the questions displayed below) Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales Variable expenses Contribution margin Fixed expenses Het operating income $ 20,000 12,000 8.000 6.000 $2,000 11. What is the margin of safety in dollars? What is the margin of safety percentage? Margin of safety in dollars Margin of safety percentage % Required Information The following information applies to the questions displayed below.) Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Bale Variable expense Contribution margin Fixed expenses Net operating Income $ 20,000 12.000 8,000 6,000 $ 2,000 12. What is the degree of operating leverage? Degroof operating leverage Required information [The following information applies to the questions displayed below.) Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units); Salou Variable expenses Contribution margin Fixed expenses Net operating Income $ 20,000 12,000 8,000 6.000 $ 2.000 13. Using the degree of operating leverage, what is the estimated percent increase in net operating income that would result from a 5% Increase in unit sales? % Increase in net operating income Required information The following information applies to the questions displayed below] Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units) Solen Variable expenses Contribution margin Fixed expenses Net operating Income $ 20,000 12,000 8,000 6.000 $ 2,000 14. Assume that the amounts of the company's total variable expenses and total fixed expenses were reversed. In other words, assume that the total variable expenses are $6,000 and the total fixed expenses are $12.000. Under this scenario and assuming that total sales remain the same, what is the degree of operating leverage? Door al operating leverage Required Information {The following information applies to the questions displayed below.) Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales $ 20,000 Variable expenses 12,000 Contribution margin 3,000 Fixed expenses 6.000 Net operating Income $ 2,000 15. Assume that the amounts of the company's total variable expenses and total fixed expenses were reversed. In other words, assume that the total variable expenses are $6,000 and the total fixed expenses are $12,000. Using the degree of operating leverage, what is the estimated percent increase in net operating Income of a 5% increase in unit sales? Increano in not operating income %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started