Answered step by step

Verified Expert Solution

Question

1 Approved Answer

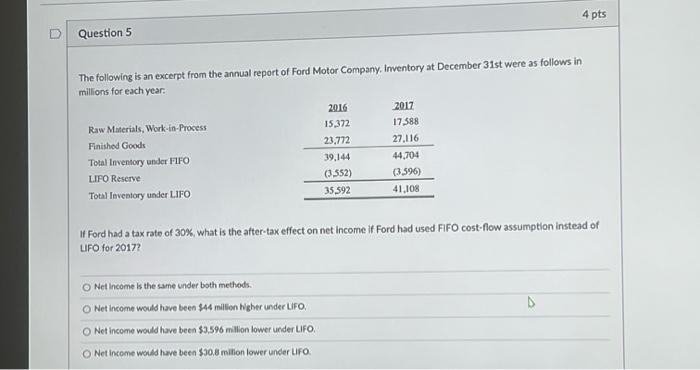

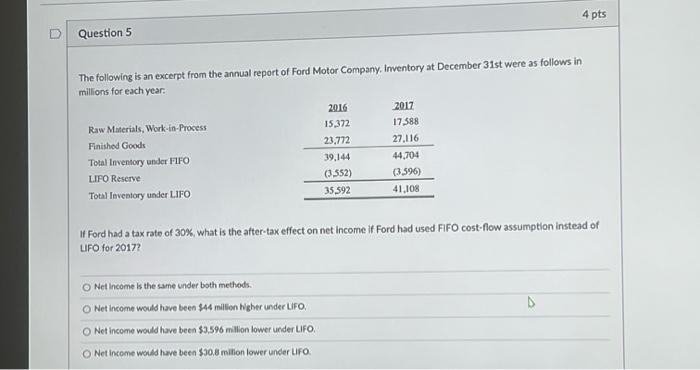

plz answer fast 4 pts Question 5 The following is an excerpt from the annual report of Ford Motor Company. Inventory at December 31st were

plz answer fast

4 pts Question 5 The following is an excerpt from the annual report of Ford Motor Company. Inventory at December 31st were as follows in millions for each year. 2016 2017 Row Materials, Work-in-Process 15,372 17,588 Finished Goods 23,772 27.116 Total Inventory under FIFO 39,144 44,704 LIFO Reserve (3.352) (3 396) Total Inventory under LIFO 35,592 41,108 If Ford had a tax rate of 30%, what is the after-tax effect on net income if Ford had used FIFO cost-flow assumption instead of LIFO for 2017? Net Income is the same under both methods. O Net Income would have been $44 million Higher under LIFO Net Income would have been $3.596 million lower under LIFO. O Net Income would have been $30,8 milion lower under uro

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started