Answered step by step

Verified Expert Solution

Question

1 Approved Answer

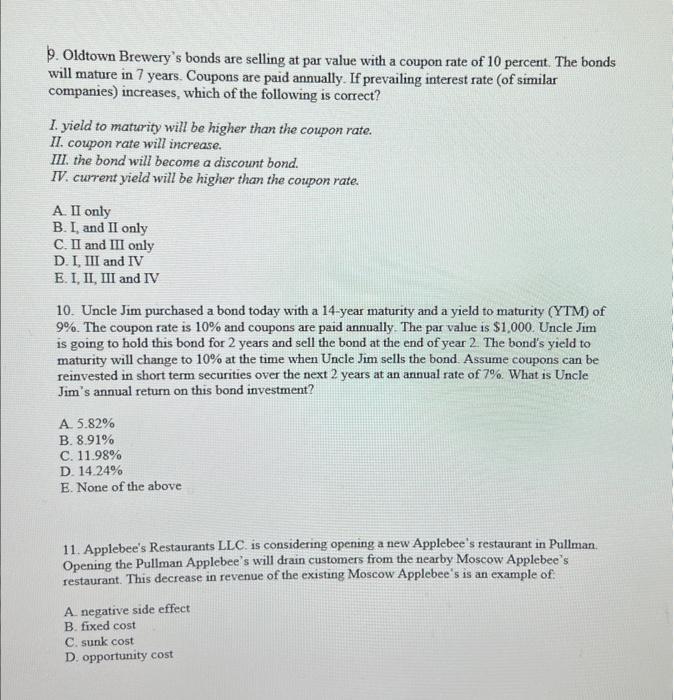

plz do 9, 10 and 11 and i will guve thumbs up! 9. Oldtown Brewery's bonds are selling at par value with a coupon rate

plz do 9, 10 and 11 and i will guve thumbs up!

9. Oldtown Brewery's bonds are selling at par value with a coupon rate of 10 percent. The bonds will mature in 7 years. Coupons are paid annually. If prevailing interest rate (of similar companies) increases, which of the following is correct? I. yield to maturity will be higher than the coupon rate. II. coupon rate will increase. III. the bond will become a discount bond. IV. current yield will be higher than the coupon rate. A. II only B. I, and II only C. II and III only D. I, III and IV E. I, II, III and IV 10. Uncle Jim purchased a bond today with a 14-year maturity and a yield to maturity (YTM) of 9%. The coupon rate is 10% and coupons are paid annually. The par value is $1,000. Uncle Jim is going to hold this bond for 2 years and sell the bond at the end of year 2 . The bond's yield to maturity will change to 10% at the time when Uncle Jim sells the bond. Assume coupons can be reinvested in short term securities over the next 2 years at an annual rate of 7%. What is Uncle Jim's annual return on this bond investment? A. 5.82% B. 8.91% C. 11.98% D. 14.24% E. None of the above 11. Applebee's Restaurants LLC is considering opening a new Applebee's restaurant in Pullman. Opening the Pullman Applebee's will drain customers from the nearby Moscow Applebee's restaurant. This decrease in revenue of the existing Moscow Applebee's is an example of: A. negative side effect B. fixed cost C. sunk cost D. opportunity cost

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started