Answered step by step

Verified Expert Solution

Question

1 Approved Answer

plz do second question answer Question 3 (10 marks) (Note this is Question 3 in the Pre-recorded Tutorial Questions) Multi-national enterprises (MNES) have been criticised

plz do second question answer

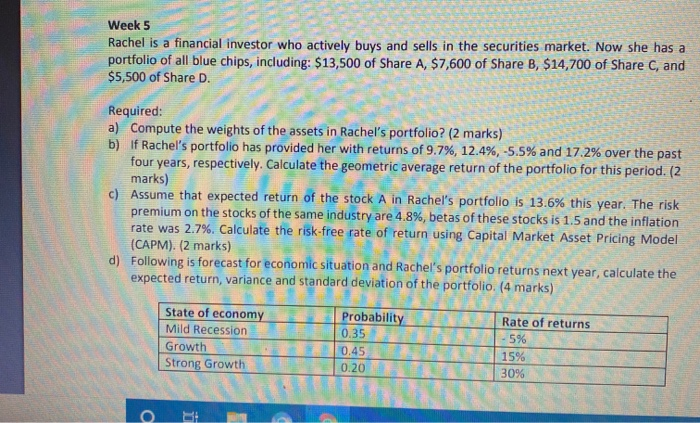

Question 3 (10 marks) (Note this is Question 3 in the Pre-recorded Tutorial Questions) Multi-national enterprises (MNES) have been criticised for having a "cash-cow" perspective of their host country's resources. Explain why this may be the case and provide examples in your response. Question 4 (10 marks) Week 5 Rachel is a financial investor who actively buys and sells in the securities market. Now she has a portfolio of all blue chips, including: $13,500 of Share A, $7,600 of Share B, $14,700 of Share C, and $5,500 of Share D. Required: a) Compute the weights of the assets in Rachel's portfolio? (2 marks) b) If Rachel's portfolio has provided her with returns of 9.7%, 12.4%, -5.5% and 17.2% over the past four years, respectively. Calculate the geometric average return of the portfolio for this period. (2 marks) c) Assume that expected return of the stock A in Rachel's portfolio is 13.6% this year. The risk premium on the stocks of the same industry are 4.8%, betas of these stocks is 1.5 and the inflation rate was 2.7%. Calculate the risk-free rate of return using Capital Market Asset Pricing Model (CAPM). (2 marks) d) Following is forecast for economic situation and Rachel's portfolio returns next year, calculate the expected return, variance and standard deviation of the portfolio (4 marks) State of economy Mild Recession Growth Strong Growth Probability 0.35 0.45 0.20 Rate of returns - 5% 15% 30% a Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started