Answered step by step

Verified Expert Solution

Question

1 Approved Answer

plz don't solve it if you r not sure! this is the third time i post this question You have purchased a machine costing $33,000.

plz don't solve it if you r not sure!

this is the third time i post this question

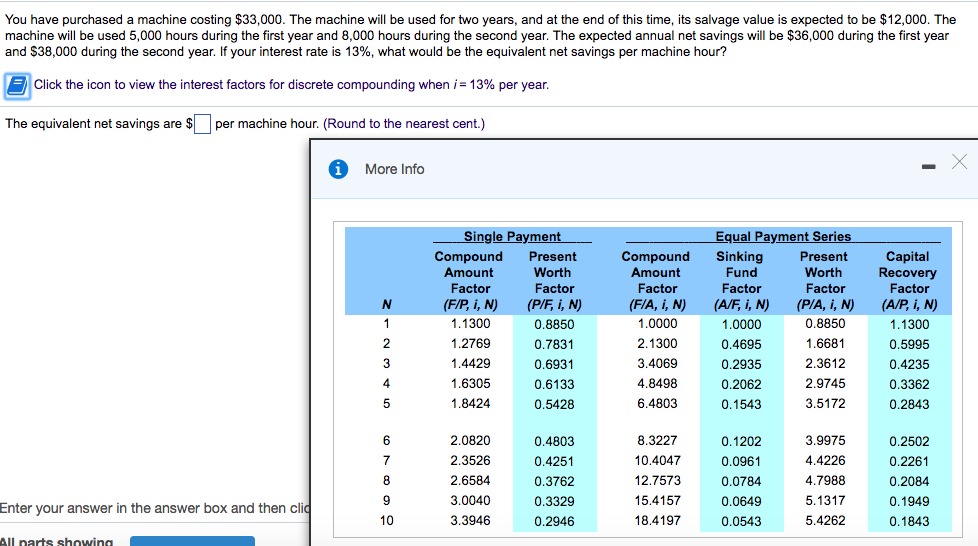

You have purchased a machine costing $33,000. The machine will be used for two years, and at the end of this time, its salvage value is expected to be $12,000. The machine will be used 5,000 hours during the first year and 8,000 hours during the second year. The expected annual net savings will be $36,000 during the first year and $38,000 during the second year. If your interest rate is 13%, what would be the equivalent net savings per machine hour? Click the icon to view the interest factors for discrete compounding when i-13% per year The equivalent net savings are Sper machine hour. (Round to the nearest cent.) More Info Single Payment Equal Payment Series Capital Recovery Factor (A/P, i, N) 1.1300 0.5995 0.4235 0.3362 0.2843 Compound Sinking Compound Present Worth Factor Amount Factor (FIA, ?, N) 1.0000 2.1300 3.4069 4.8498 6.4803 Fund Factor (AF, ?, N) 1.0000 0.4695 0.2935 0.2062 0.1543 Present Worth Factor (P/A, ?, N) 0.8850 1.6681 2.3612 2.9745 3.5172 Amount Factor (FIP i, N) (P/F, i, N) 1.1300 1.2769 1.4429 1.6305 1.8424 0.8850 0.7831 0.6931 0.6133 0.5428 4 2.0820 2.3526 2.6584 3.0040 3.3946 0.4803 0.4251 0.3762 0.3329 0.2946 8.3227 10.4047 12.7573 15.4157 18.4197 0.1202 0.0961 0.0784 0.0649 0.0543 3.9975 4.4226 4.7988 5.1317 5.4262 0.2502 0.2261 0.2084 0.1949 0.1843 Enter your answer in the answer box and then cli 10 All narts showingStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started