Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Plz give me new detailed answer. I dont want same answer was given last time. If its same one which was uploded before i will

Plz give me new detailed answer. I dont want same answer was given last time. If its same one which was uploded before i will give tumbs down

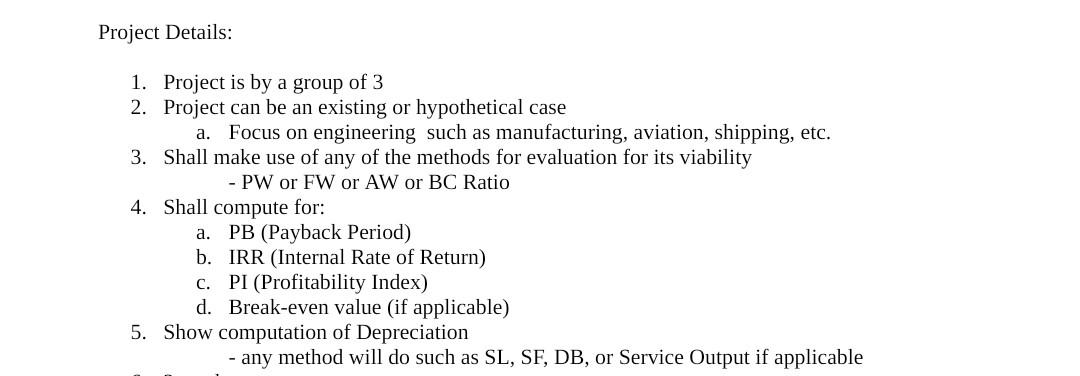

Project Details: 1. Project is by a group of 3 2. Project can be an existing or hypothetical case a. Focus on engineering such as manufacturing, aviation, shipping, etc. 3. Shall make use of any of the methods for evaluation for its viability - PW or FW or AW or BC Ratio 4. Shall compute for: a. PB (Payback Period) b. IRR (Internal Rate of Return) C. PI (Profitability Index) d. Break-even value (if applicable) 5. Show computation of Depreciation any method will do such as SL, SF, DB, or Service Output if applicableStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started