Answered step by step

Verified Expert Solution

Question

1 Approved Answer

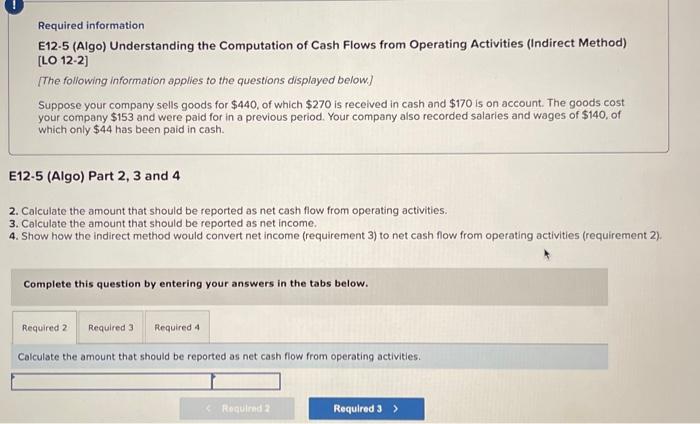

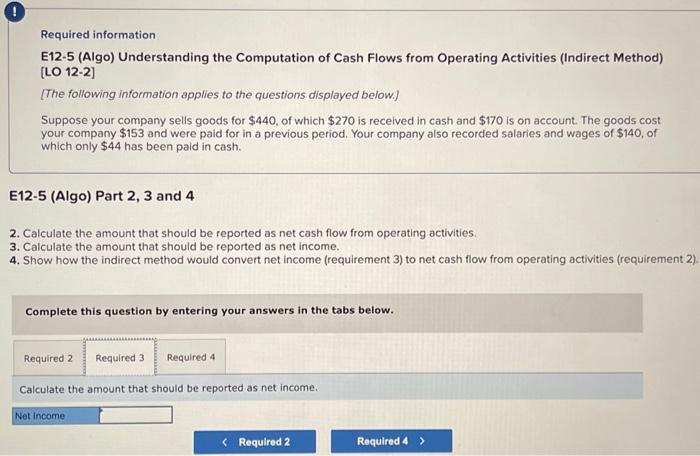

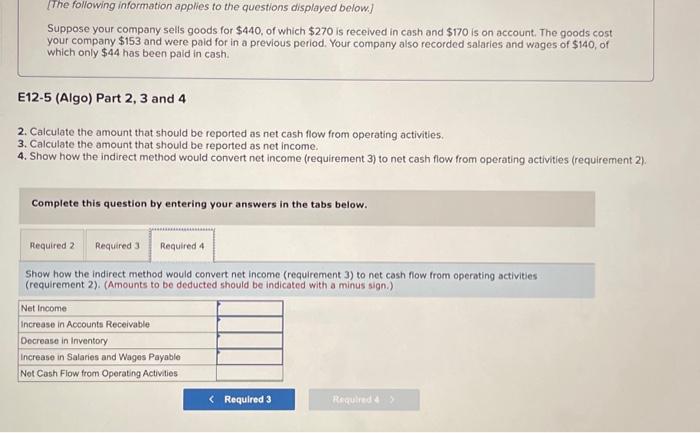

plz help asap Required information E12.5 (Algo) Understanding the Computation of Cash Flows from Operating Activities (Indirect Method) [LO 12-2] [The following information applies to

plz help asap

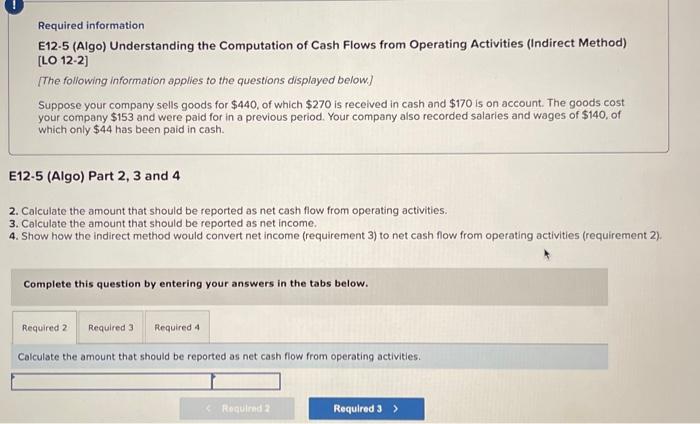

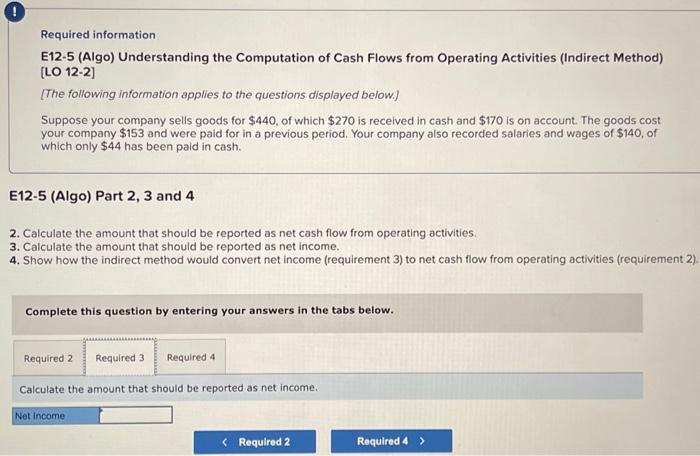

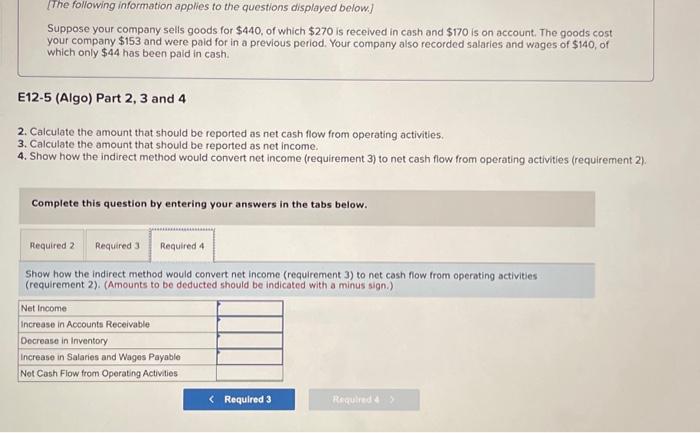

Required information E12.5 (Algo) Understanding the Computation of Cash Flows from Operating Activities (Indirect Method) [LO 12-2] [The following information applies to the questions displayed below.] Suppose your company sells goods for $440, of which $270 is received in cash and $170 is on account. The goods cost your company $153 and were paid for in a previous period. Your company also recorded salaries and wages of $140, of which only $44 has been paid in cash. E12-5 (Algo) Part 2, 3 and 4 2. Calculate the amount that should be reported as net cash flow from operating activities. 3. Calculate the amount that should be reported as net income. 4. Show how the indirect method would convert net income (requirement 3) to net cash flow from operating activities (requirement 2). Complete this question by entering your answers in the tabs below. Calculate the amount that should be reported as net cash flow from operating activities. Required information E12-5 (Algo) Understanding the Computation of Cash Flows from Operating Activities (Indirect Method) [LO122] [The following information applies to the questions displayed below.] Suppose your company sells goods for $440, of which $270 is received in cash and $170 is on account. The goods cost your company $153 and were paid for in a previous period. Your company also recorded salaries and wages of $140, of which only $44 has been paid in cash. 12-5 (Algo) Part 2, 3 and 4 Calculate the amount that should be reported as net cash flow from operating activities. Calculate the amount that should be reported as net income. Show how the indirect method would convert net income (requirement 3) to net cash flow from operating activities (requirement 2 Complete this question by entering your answers in the tabs below. Calculate the amount that should be reported as net income. [The following information applies to the questions displayed below.] Suppose your company sells goods for $440, of which $270 is recelved in cash and $170 is on account. The goods cost your company $153 and were paid for in a previous period. Your company also recorded salaries and wages of $140, of which only $44 has been paid in cash. E12-5 (Algo) Part 2, 3 and 4 2. Calculate the amount that should be reported as net cash flow from operating activities. 3. Calculate the amount that should be reported as net income. 4. Show how the indirect method would convert net income (requirement 3) to net cash flow from operating activities (requirement 3 Complete this question by entering your answers in the tabs below. Show how the indirect method would convert net income (requirement 3) to net cash flow from operating activities (requirement 2). (Amounts to be deducted should be indicated with a minus sign.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started