Answered step by step

Verified Expert Solution

Question

1 Approved Answer

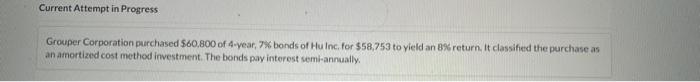

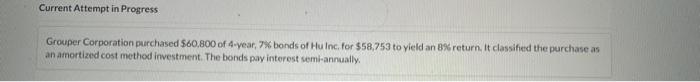

plz help i will upvote right away. choose out of the list down below... and solve Grouper Corporation purchased $60.800 of 4-year, 7% bonds of

plz help i will upvote right away. choose out of the list down below... and solve

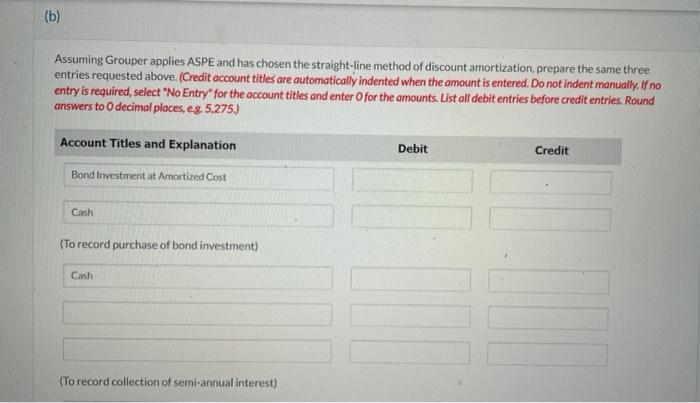

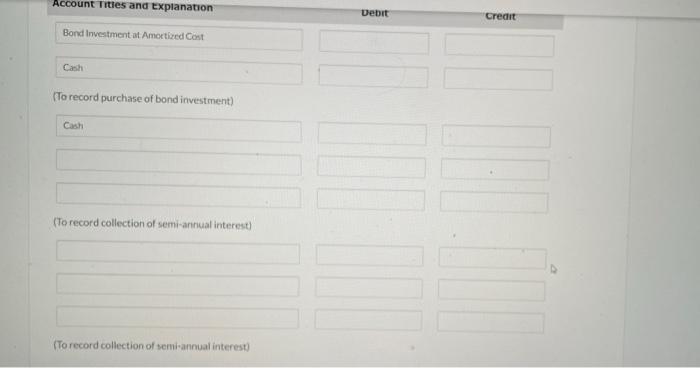

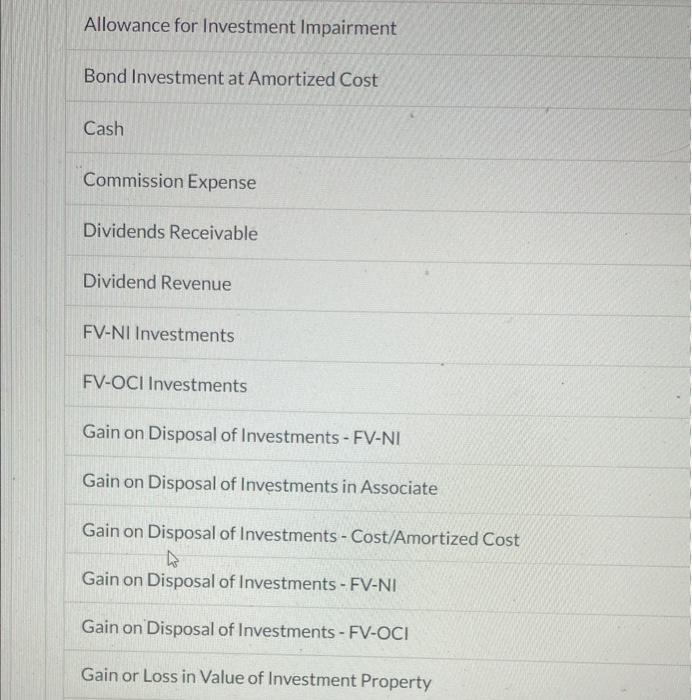

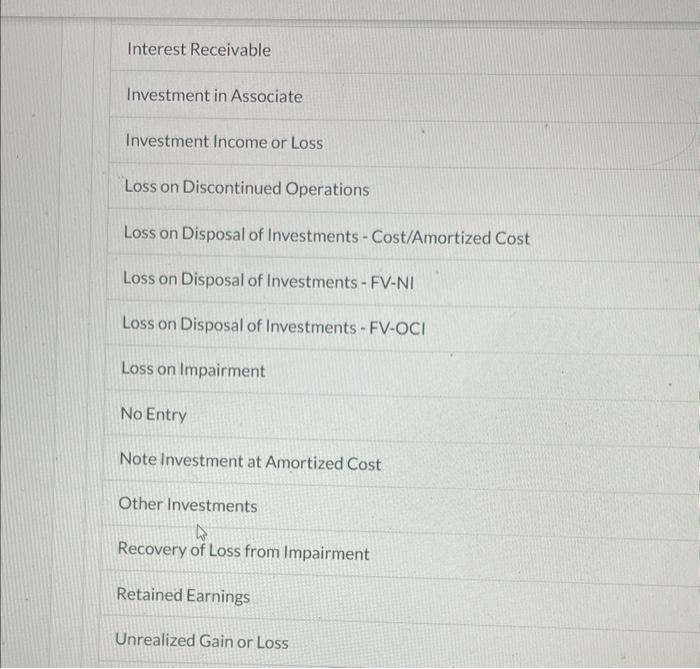

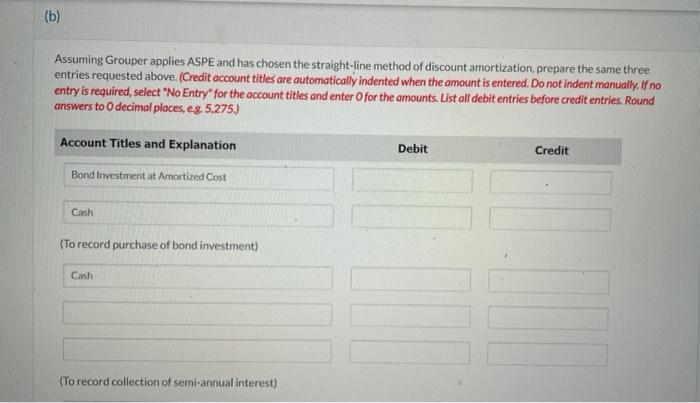

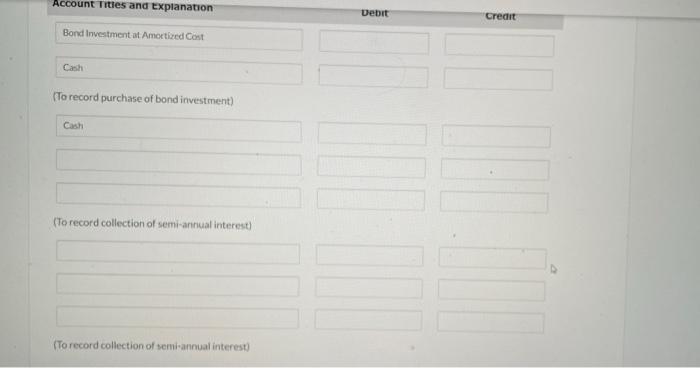

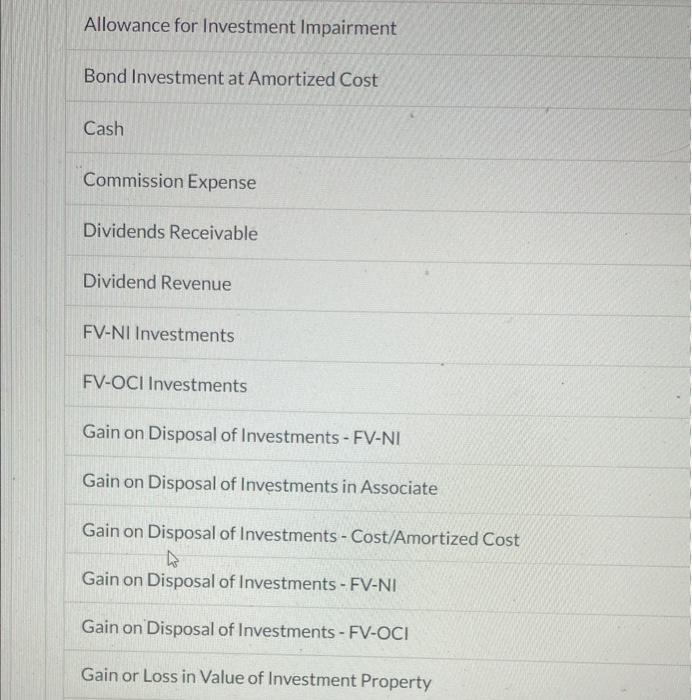

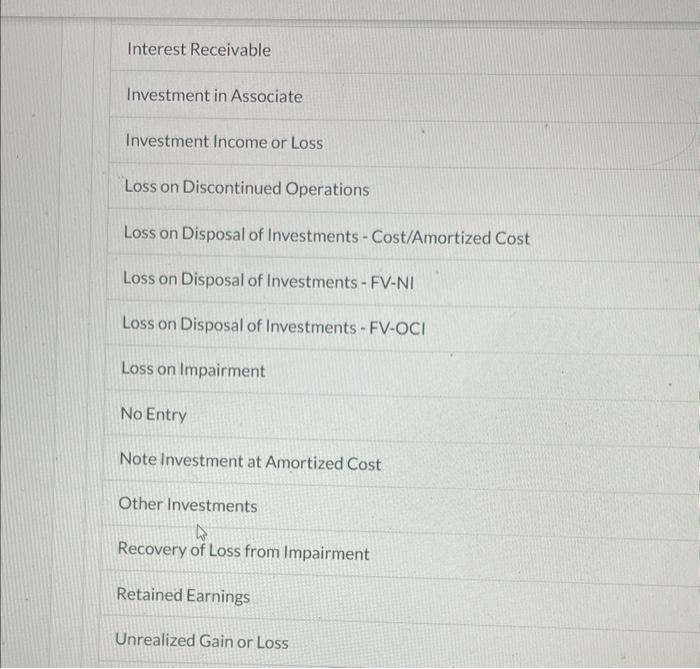

Grouper Corporation purchased $60.800 of 4-year, 7% bonds of Hu inc, for $58,753 to yield an 8% return. It classified the purchase as an amortized cost method investment. The bonds pay interest semi-annually. Assuming Grouper applies ASPE and has chosen the straight-line method of discount amortization, prepare the same three entries requested above. (Credit account titles are automatically indented when the omount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries. Round answers to 0 decimal places, eg 5,275.) Account Iities and Explanation Debit Creait Bond Investment at Amortized Cost (To record purchase of bond investment) (To record collection of semi-arinual interest) (To record collection of semi+annual interest) Allowance for Investment Impairment Bond Investment at Amortized Cost Cash Commission Expense Dividends Receivable Dividend Revenue FV-NI Investments FV-OCl Investments Gain on Disposal of Investments - FV-NI Gain on Disposal of Investments in Associate Gain on Disposal of Investments - Cost/Amortized Cost Gain on Disposal of Investments - FV-NI Gain on Disposal of Investments - FV-OCI Gain or Loss in Value of Investment Property Interest Receivable Investment in Associate Investment Income or Loss Loss on Discontinued Operations Loss on Disposal of Investments - Cost/Amortized Cost Loss on Disposal of Investments - FV-NI Loss on Disposal of Investments - FV-OCI Loss on Impairment No Entry Note Investment at Amortized Cost Other Investments Recovery of Loss from Impairment Retained Earnings Unrealized Gain or Loss

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started