Answered step by step

Verified Expert Solution

Question

1 Approved Answer

plz help me with balance sheet and read the question carefully Part 2 of 3 Points: 13 13 of 15 The bookkeeper of Ort Services

plz help me with balance sheet and read the question carefully

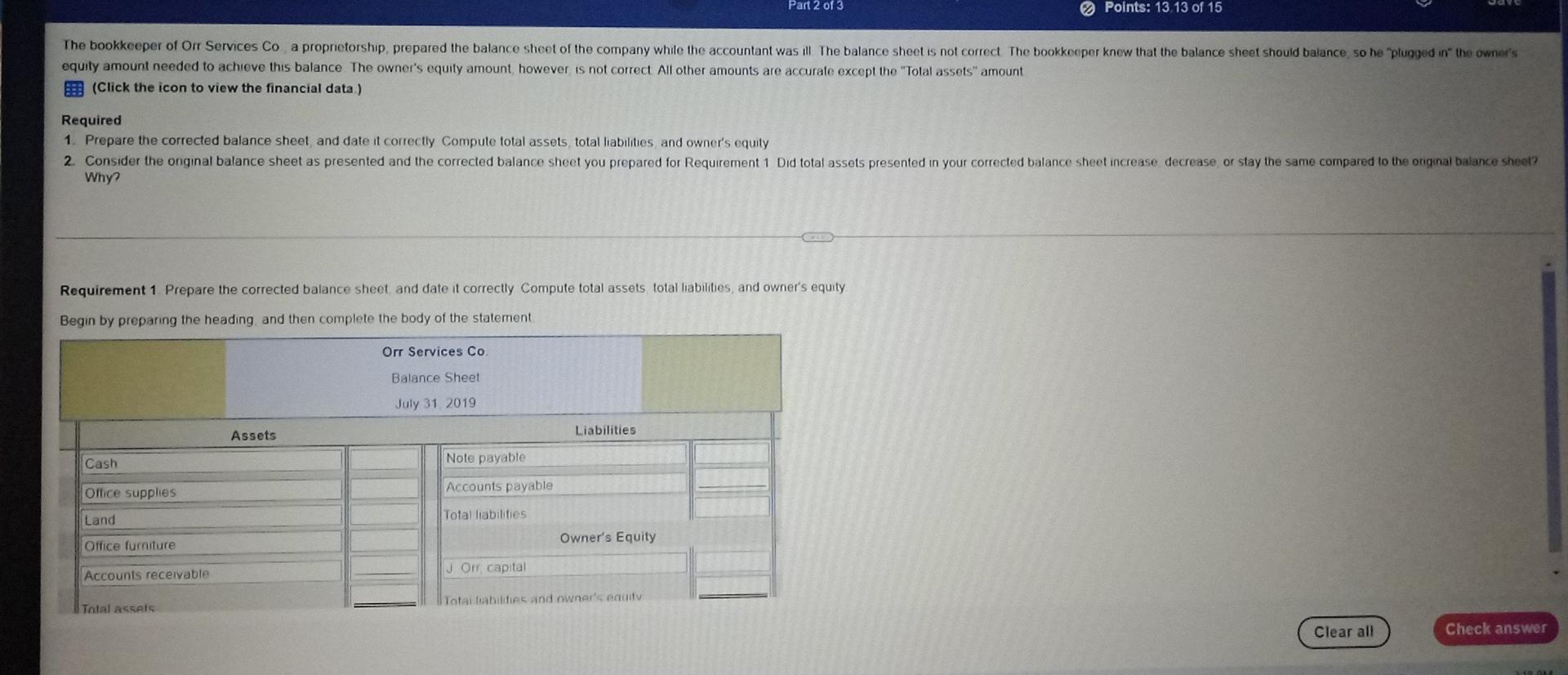

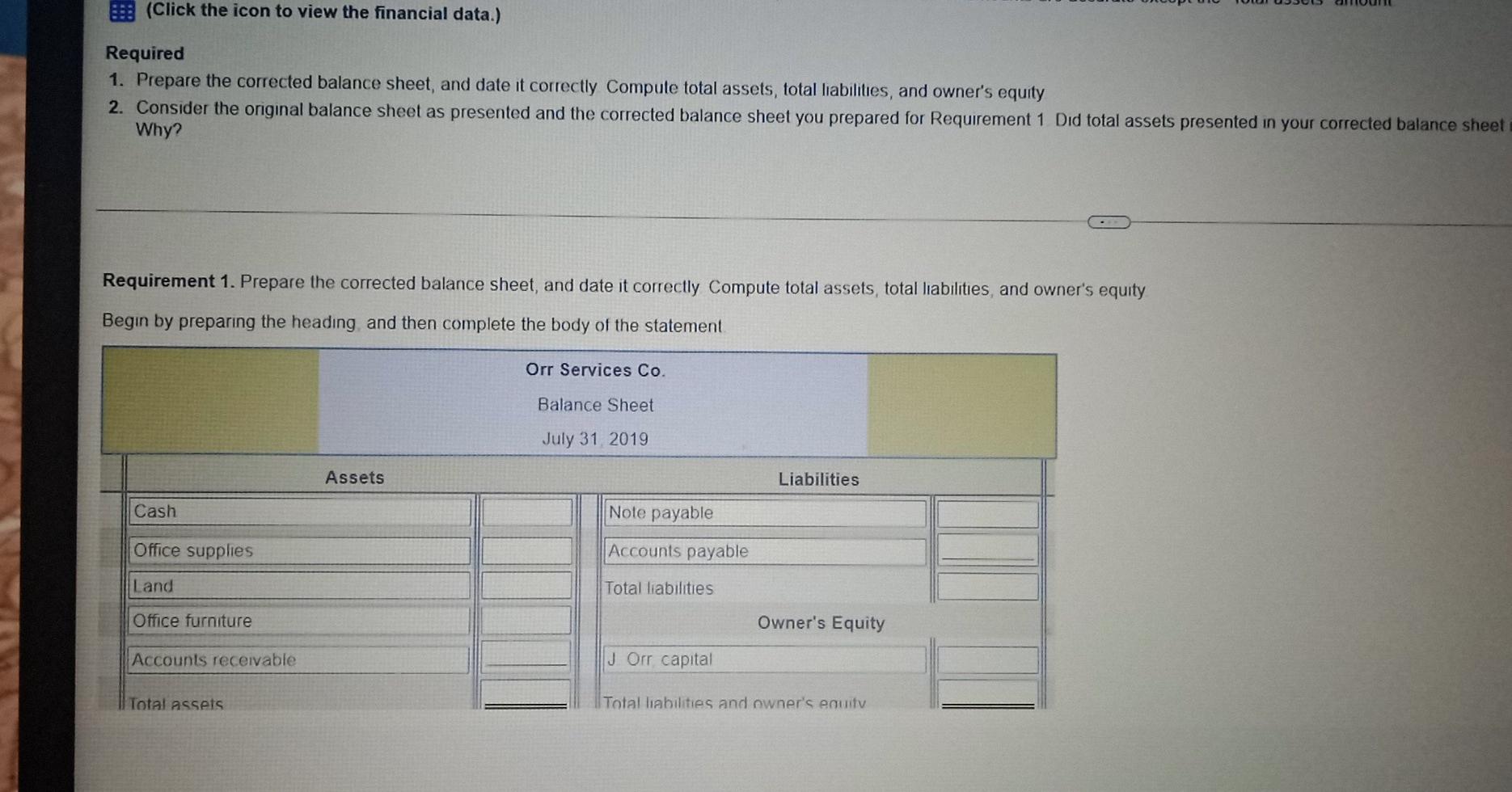

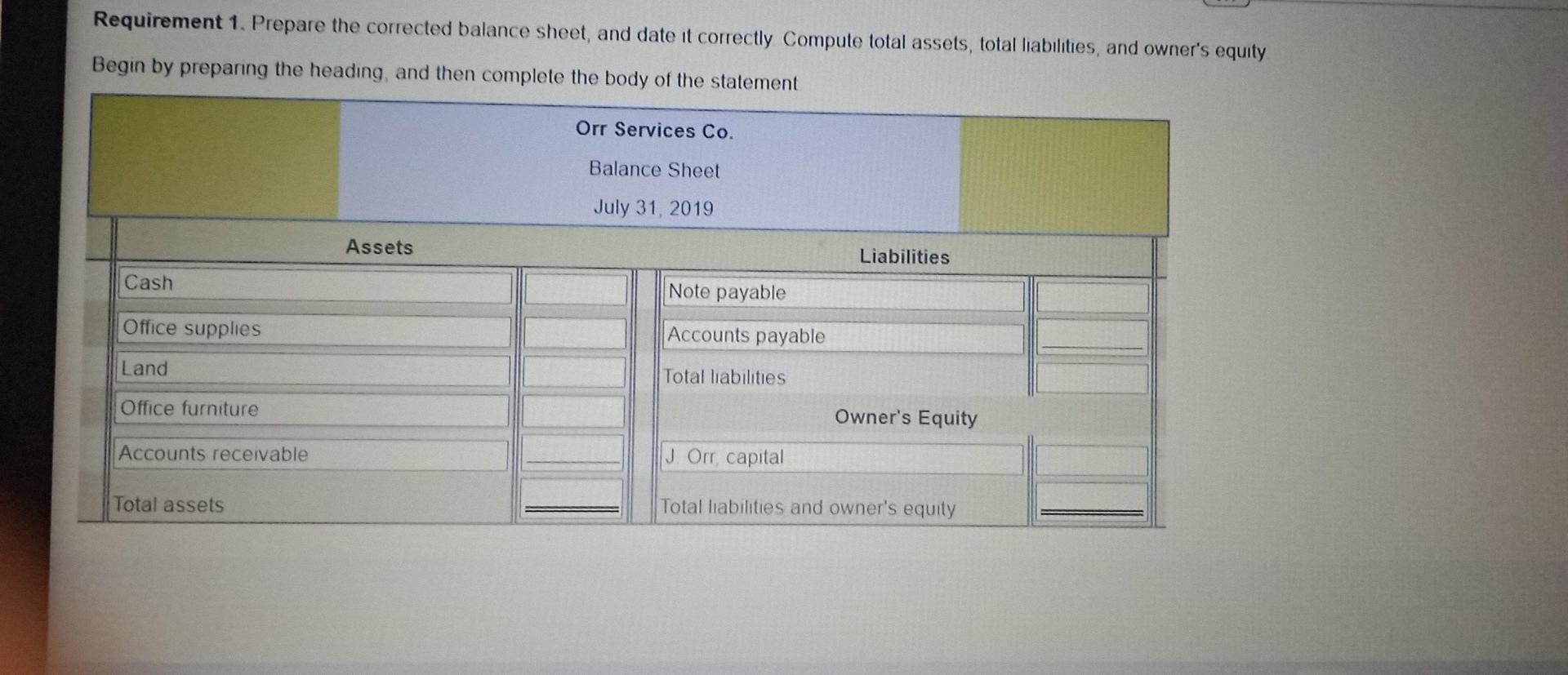

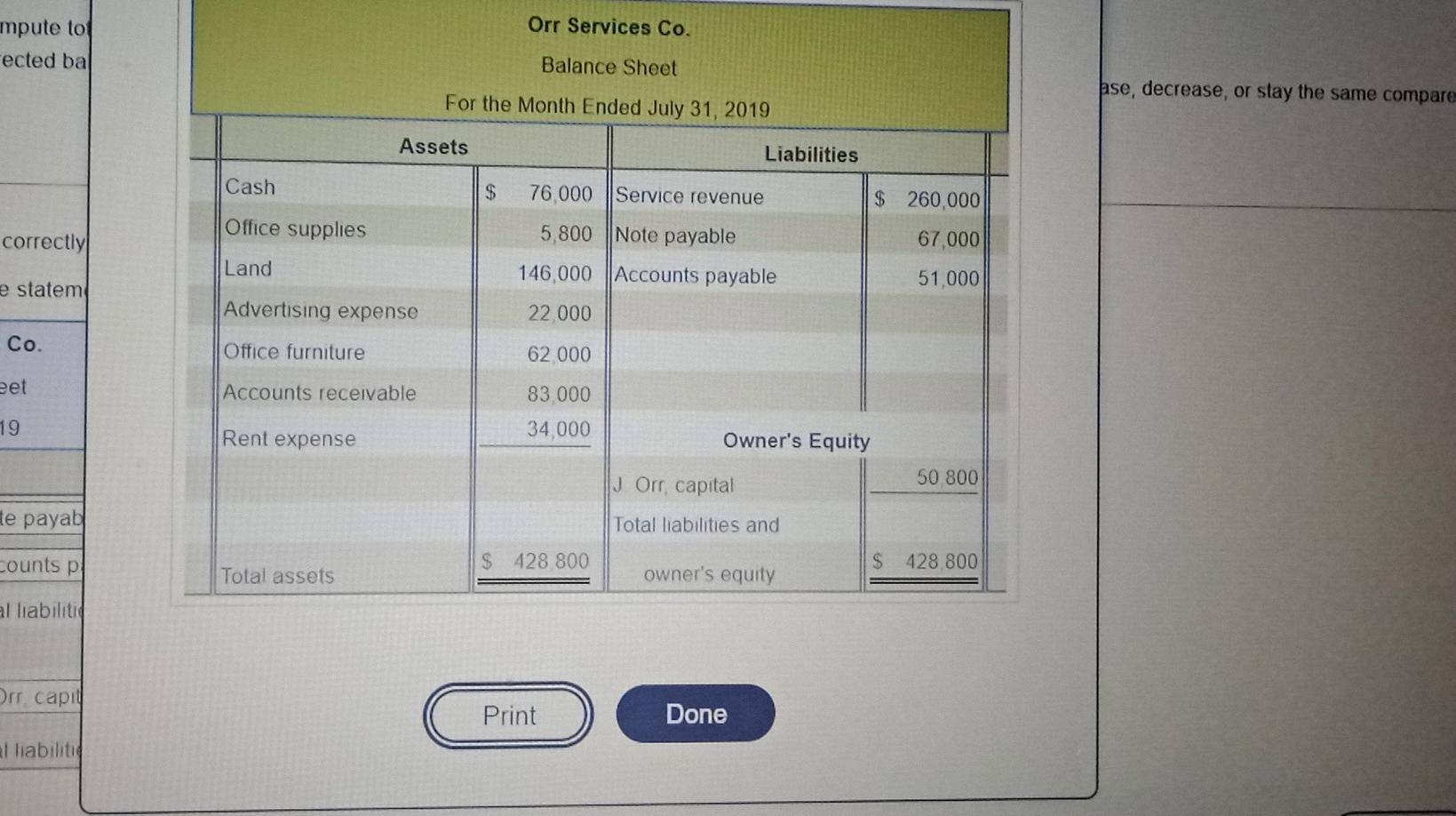

Part 2 of 3 Points: 13 13 of 15 The bookkeeper of Ort Services Co a propnetorship, prepared the balance sheet of the company while the accountant was ill The balance sheet is not correct The bookkooper knew that the balance sheet should balance so he plugged in the owner's equity amount needed to achieve this balance. The owner's equity amount however is not correct All other amounts are accurate except the "Total assets" amount ES: (Click the icon to view the financial data) Required 1. Prepare the corrected balance sheet and date it correctly Compute total assets total liabilities and owner's equity 2. Consider the onginal balance sheet as presented and the corrected balance sheet you prepared for Requirement 1 Did total assets presented in your corrected balance sheet increase decrease or stay the same compared to the original balance sheet? Why? Requirement 1 Prepare the corrected balance sheet and date it correctly Compute total assets total liabilities, and owner's equity Begin by preparing the heading and then complete the body of the statement Orr Services Co Balance Sheet July 31 2019 Assets Liabilities Cash Nole payable Office supplies Accounts payable Land Total liabilities Owner's Equity Office furniture J Orr capital Accounts receivable Total abilities and owner's edut Total ASSAIS Clear all Check answer 10 (Click the icon to view the financial data.) Required 1. Prepare the corrected balance sheet, and date it correctly Compute total assets, total liabilities, and owner's equity 2. Consider the original balance sheet as presented and the corrected balance sheet you prepared for Requirement 1 Did total assets presented in your corrected balance sheet Why? Requirement 1. Prepare the corrected balance sheet, and date it correctly Compute total assets, total liabilities, and owner's equity Begin by preparing the heading and then complete the body of the statement Orr Services Co. Balance Sheet July 31 2019 Assets Liabilities Cash Note payable Office supplies Accounts payable Land Total liabilities Office furniture Owner's Equity Accounts receivable J Orr capital Total assets Total liabilities and owner's equity Requirement 1. Prepare the corrected balance sheet, and date it correctly Compute total assets, total liabilities, and owner's equity Begin by preparing the heading, and then complete the body of the statement Orr Services Co. Balance Sheet July 31, 2019 Assets Liabilities Cash Note payable Office supplies Accounts payable Land Total liabilities Office furniture Owner's Equity Accounts receivable J Orr, capital Total assets Total liabilities and owner's equity Orr Services Co. mpute to rected ba Balance Sheet se, decrease, or stay the same compare For the Month Ended July 31, 2019 Assets Liabilities Cash $ 76 000 Service revenue Office supplies $ 260,000 67,000 correctly 5,800 Note payable Land 146,000 Accounts payable 51,000 e statem Advertising expense 22 000 Co. Office furniture 62 000 eet Accounts receivable 83 000 34.000 19 Rent expense Owner's Equity J Orr, capital 50 800 te payab Total liabilities and counts p $ 428 800 $ 428 800 Total assets owner's equity al liabilitie Orr capil Print Done Il liabilitieStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started