plz i need help by checking my work and do the journal entry for all of them. all the information where found from yahoo finance

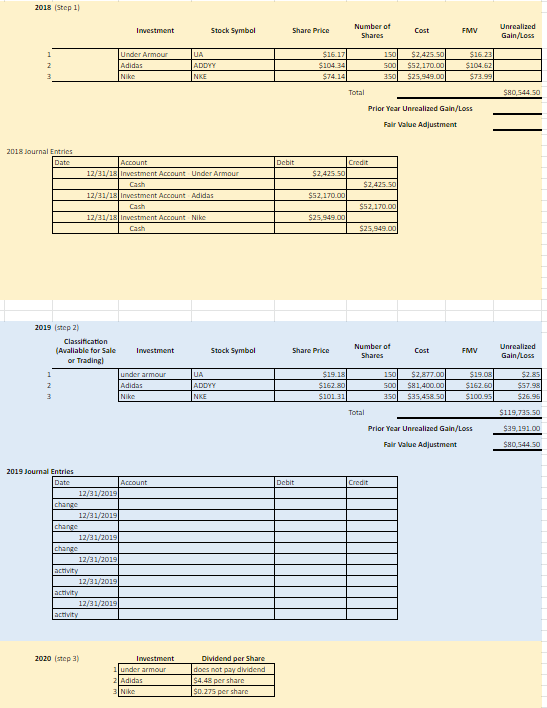

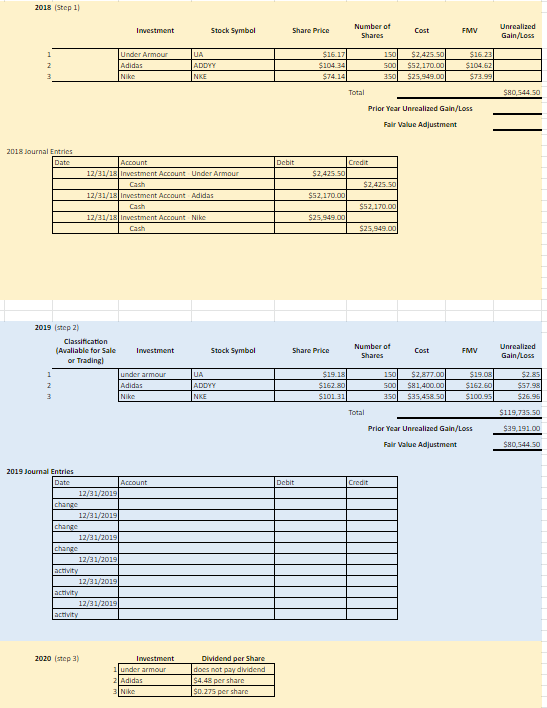

- Pick out 3 publicly traded companies and look up the stock price as of December 31, 2018. Include the number of stocks purchased, has to be greater than 100, less than 1000.

- The stock prices at December 31, 2018 is the purchase price for your portfolio

- Create a portfolio summary: Stock Name, Cost, FMV,

- Make up a company name

- Record the journal Entry to record the purchase of your equity investments

- Record the change in fair market value by looking up the portfolio prices as of December 31, 2019.

- Remake the companys portfolio summary

- Record the journal entry to record the change in fair market value

- Record the journal Entry to record the 2019 activity

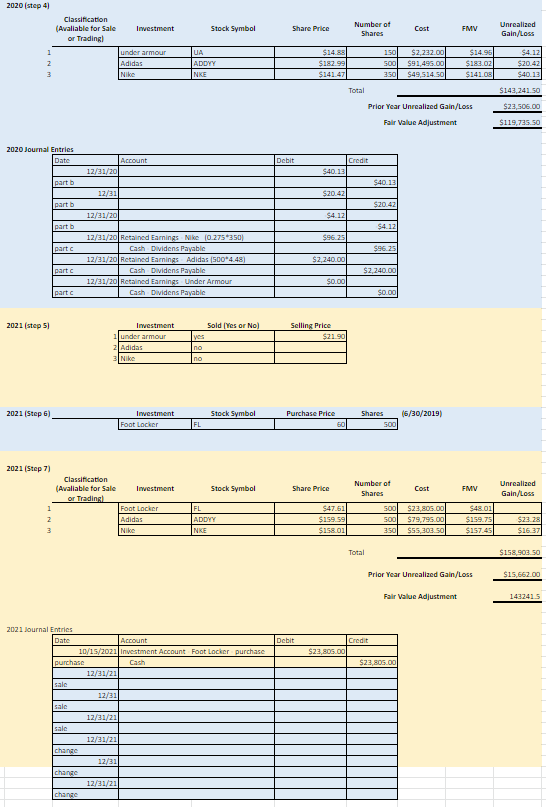

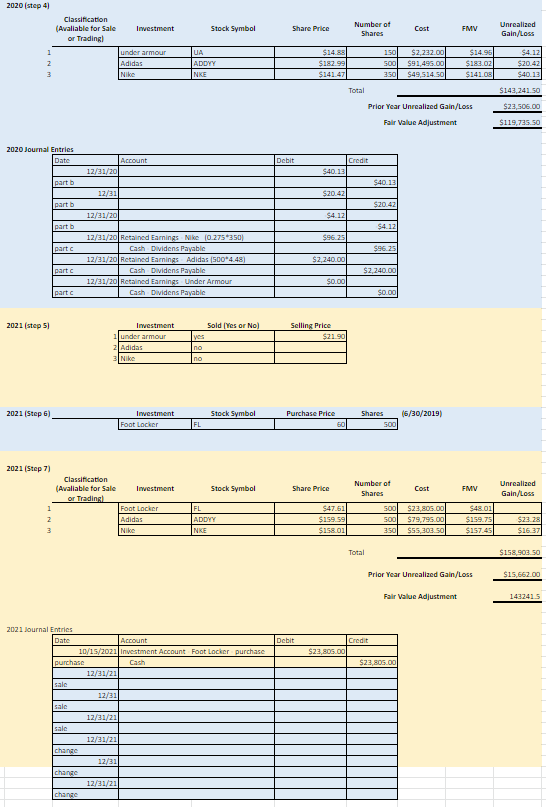

- Declare a dividend for each company in the portfolio to be paid in 2020

- Indicate next to each stock the dividend per share (anything from $.50 per share up to $10 per share)

- Record the change in fair value market for December 31, 2020

- Remake the companys portfolio summary

- Record the journal entry to record the change in fair market value

- Record the journal entry for the dividend indicated in step 3.

- Indicate one stock that will be sold and indicate the selling price (you can make up the selling price per unit) note all stocks of that investment will be sold. This stock will be sold in 2021

- Add one stock to the portfolio by looking up the fair market value as of 6/30/2021, assume you purchased 500 stocks. This needs to be a new company not 1 of the three originally purchased in step 1.

- Record the change in fair value market for October 15, 2021

-

- Remake the companys portfolio summary

- Record the journal entries required to record the 2021 activity, including purchase, sale and change in fair market value

8. Indicate what would be included in the Companys balance sheet/income statement for each year.

2018 (Step 11 Investment Stock Symbol Share Price Number of Shares Cost FMV Unrealized Gain/Loss Under Armour Adidas Nike UA ADDYY NKE $16.17 150 $2,425.50 $16.23 $104 34 500 $52,170.00 $104.62 $74.14 350 $25.949.00 $73.99 Total Prior Year Unrealized Gain/Loss Fair Value Adjustment $80,544.50 2018 Journal Entries Date Debit Credit $2.4259 $2.425.50 Account 12/31/18 Investment Account Under Armour Cash 12/31/18 Investment Account Adidas Cash 12/31/18 Investment Account Nike $S2 170.00 SS2, 170.00 $25.949.00 $25.949.00 2019 step 2) Classification (Avaliable for Sale or Trading) Investment Stock Symbol Share Price Number of Shares Cost FIMV Unrealized Gain/Loss 2 under armour Adidas Nike UA ADDYY NKE $19.18 $162.80 150 SOO 350 $2.877.00 $81,400.00 $35,458.50 $19.05 $162.60 $100.95 $285 $57.98 $26.96 3 $1013 Total $119,735.50 $39, 191.00 Prior Year Unrealized Gain/Loss Fair Value Adjustment $80,544.50 Debit Credit 2019 Journal Entries Date Account 12/31/2019 change 12/31/2019 change 12/31/2019 change 12/31/2019 activity 12/31/2019 activity 12/31/2019 activity 2020 step 2) Investment under armour 2 Adidas 3 Nike Dividend per Share does not pay dividend $4.48 per share $0.275 per share 2020 (step 4) Stock Symbol Share Price Number of Shares Cost FMV Unrealized Gain/Loss Classification (Avaliable for Sale Investment or Trading under armour Adidas Nike 2 3 UA ADDYY NKE $14.88 $182.99 $141.47 150 500 350 $2.232.001 $91,495.00 $49,514.50 $14.95 $183.02 $141.05 $4.12 $20.42 $40.15 Total $143, 241.50 $23,506.00 Prior Year Unrealized Gain/Loss Fair Value Adjustment $119,735.50 2020 Journal Entries Date Debit Credit Account 12/31/20 $40.13 part $40.13 12/31 $20.42 part b $20.42 12/31/20 $4.12 part $4.12 $96.25 partc $96.25 $2,240.00 partc 12/31/20 Retained Earnings Nike (0.275 350) Cash Dividens Payable 12/31/20 Retained Earnings Adidas (500*4.48) Cash Dividens Payable 12/31/20 Retained Earnings Under Armour Cash Dividens Payable $2,240.00 $0.00 part $0.00 2021 (step 51 Selling Price $21.90 Investment under armour 2 Adidas Nike Sold (Yes or No) yes no no 2021 (Step 6) Investment Foot Locker Stock Symbol Purchase price Shares SOO 15/30/2019) FL 2021 (Step 7) Stock Symbol Share Price Number of Shares Cost FIMV Unrealized Gain/Loss 1 2 Classification (Avaliable for Sale Investment or Trading Foot Locker Adidas Nike FL ADDYY NKE $47.61 $159.59 $158 01 500 SOO 350 $23.805.00 $79,795.00 $55,303 50 $48.01 $159.75 $157,451 $23.28 3 $16.37 Total $158903 50 Prior Year Unrealized Gain/Loss $15,662.00 Fair Value Adjustment 1432415 Debit Credit $23,805.00 $23.805.00 2021 Journal Entries Date Account 10/15/2021 Investment Account Foot Locker purchase purchase Cash 12/31/21 sale 12/31 sale 12/31/21 sale 12/31/21 change 12/31 change 12/31/21 change 2018 (Step 11 Investment Stock Symbol Share Price Number of Shares Cost FMV Unrealized Gain/Loss Under Armour Adidas Nike UA ADDYY NKE $16.17 150 $2,425.50 $16.23 $104 34 500 $52,170.00 $104.62 $74.14 350 $25.949.00 $73.99 Total Prior Year Unrealized Gain/Loss Fair Value Adjustment $80,544.50 2018 Journal Entries Date Debit Credit $2.4259 $2.425.50 Account 12/31/18 Investment Account Under Armour Cash 12/31/18 Investment Account Adidas Cash 12/31/18 Investment Account Nike $S2 170.00 SS2, 170.00 $25.949.00 $25.949.00 2019 step 2) Classification (Avaliable for Sale or Trading) Investment Stock Symbol Share Price Number of Shares Cost FIMV Unrealized Gain/Loss 2 under armour Adidas Nike UA ADDYY NKE $19.18 $162.80 150 SOO 350 $2.877.00 $81,400.00 $35,458.50 $19.05 $162.60 $100.95 $285 $57.98 $26.96 3 $1013 Total $119,735.50 $39, 191.00 Prior Year Unrealized Gain/Loss Fair Value Adjustment $80,544.50 Debit Credit 2019 Journal Entries Date Account 12/31/2019 change 12/31/2019 change 12/31/2019 change 12/31/2019 activity 12/31/2019 activity 12/31/2019 activity 2020 step 2) Investment under armour 2 Adidas 3 Nike Dividend per Share does not pay dividend $4.48 per share $0.275 per share 2020 (step 4) Stock Symbol Share Price Number of Shares Cost FMV Unrealized Gain/Loss Classification (Avaliable for Sale Investment or Trading under armour Adidas Nike 2 3 UA ADDYY NKE $14.88 $182.99 $141.47 150 500 350 $2.232.001 $91,495.00 $49,514.50 $14.95 $183.02 $141.05 $4.12 $20.42 $40.15 Total $143, 241.50 $23,506.00 Prior Year Unrealized Gain/Loss Fair Value Adjustment $119,735.50 2020 Journal Entries Date Debit Credit Account 12/31/20 $40.13 part $40.13 12/31 $20.42 part b $20.42 12/31/20 $4.12 part $4.12 $96.25 partc $96.25 $2,240.00 partc 12/31/20 Retained Earnings Nike (0.275 350) Cash Dividens Payable 12/31/20 Retained Earnings Adidas (500*4.48) Cash Dividens Payable 12/31/20 Retained Earnings Under Armour Cash Dividens Payable $2,240.00 $0.00 part $0.00 2021 (step 51 Selling Price $21.90 Investment under armour 2 Adidas Nike Sold (Yes or No) yes no no 2021 (Step 6) Investment Foot Locker Stock Symbol Purchase price Shares SOO 15/30/2019) FL 2021 (Step 7) Stock Symbol Share Price Number of Shares Cost FIMV Unrealized Gain/Loss 1 2 Classification (Avaliable for Sale Investment or Trading Foot Locker Adidas Nike FL ADDYY NKE $47.61 $159.59 $158 01 500 SOO 350 $23.805.00 $79,795.00 $55,303 50 $48.01 $159.75 $157,451 $23.28 3 $16.37 Total $158903 50 Prior Year Unrealized Gain/Loss $15,662.00 Fair Value Adjustment 1432415 Debit Credit $23,805.00 $23.805.00 2021 Journal Entries Date Account 10/15/2021 Investment Account Foot Locker purchase purchase Cash 12/31/21 sale 12/31 sale 12/31/21 sale 12/31/21 change 12/31 change 12/31/21 change