Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Plz Journalize and post the closing entries. This is a multi step problem and some adjustments were made as you could tell. i have attached

Plz Journalize and post the closing entries. This is a multi step problem and some adjustments were made as you could tell. i have attached some statmenets for your convinience.

you only have to journallize and post closing entries. i know i uploaded a lot of pictures but those are just for a reference. please see the last two pictures

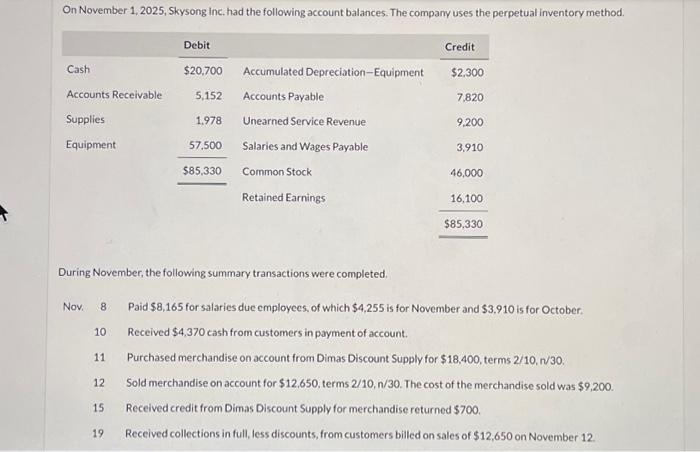

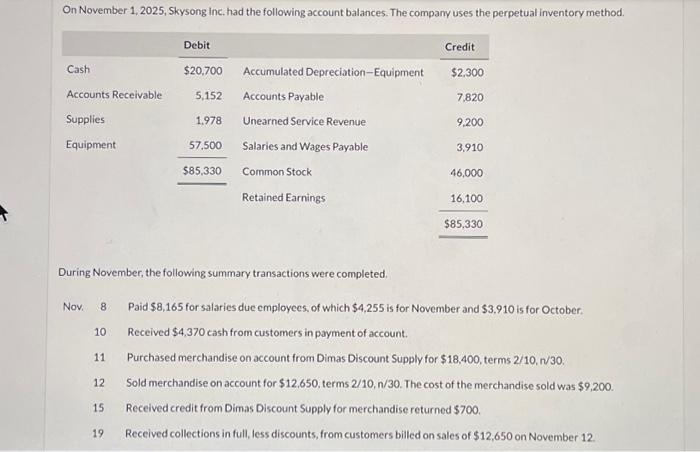

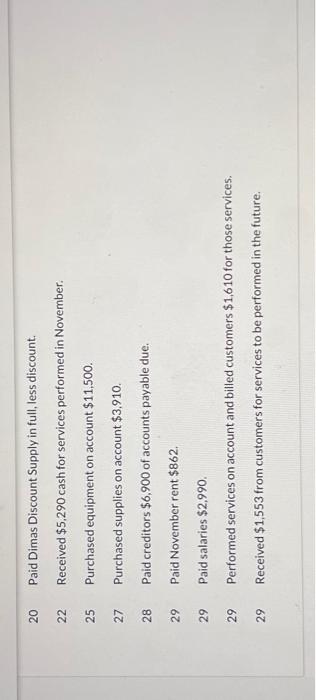

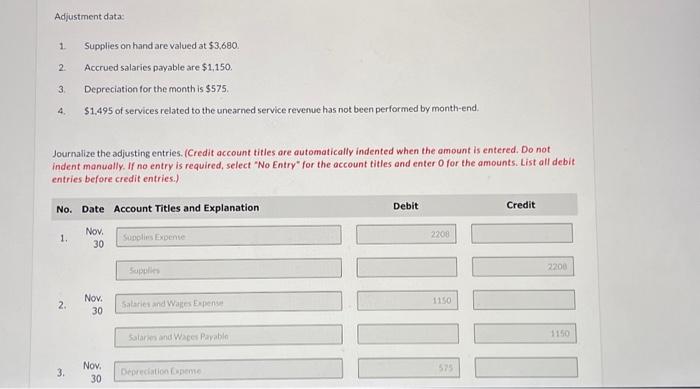

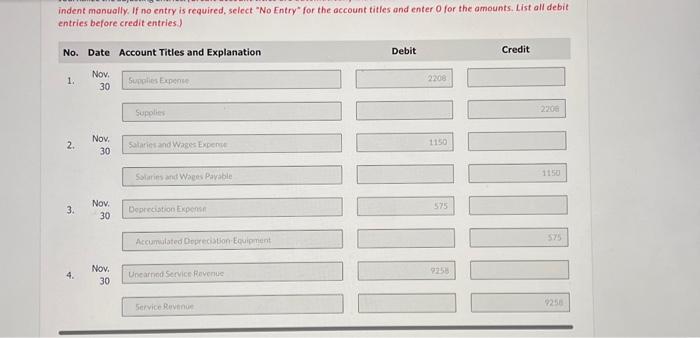

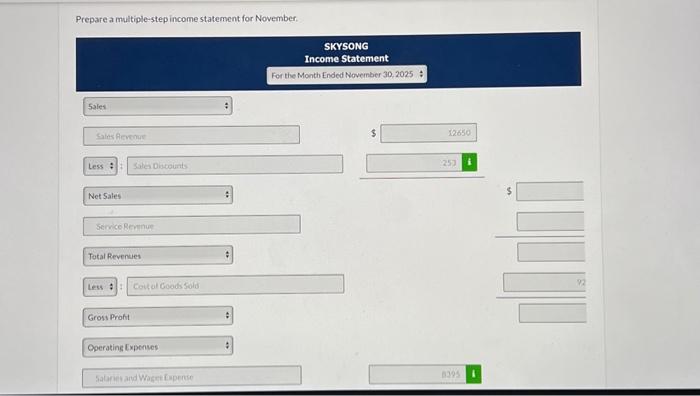

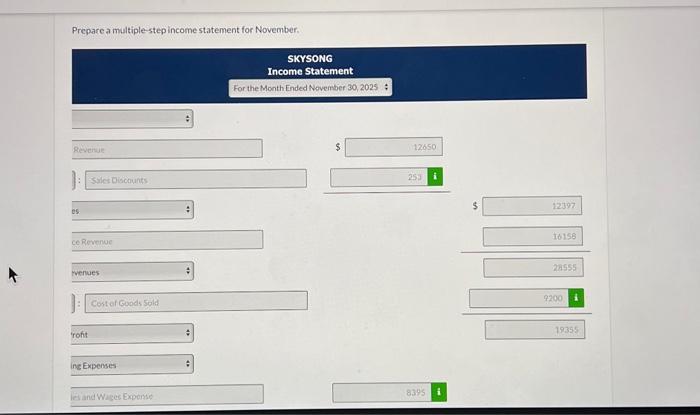

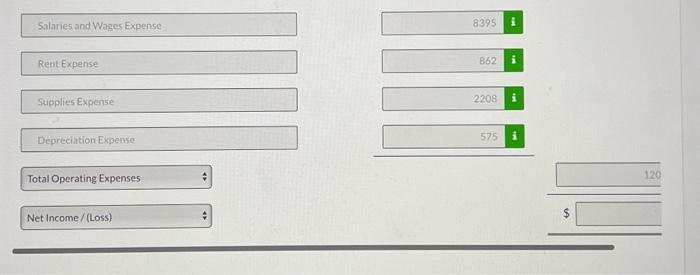

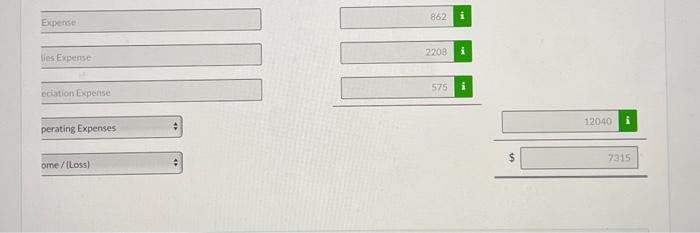

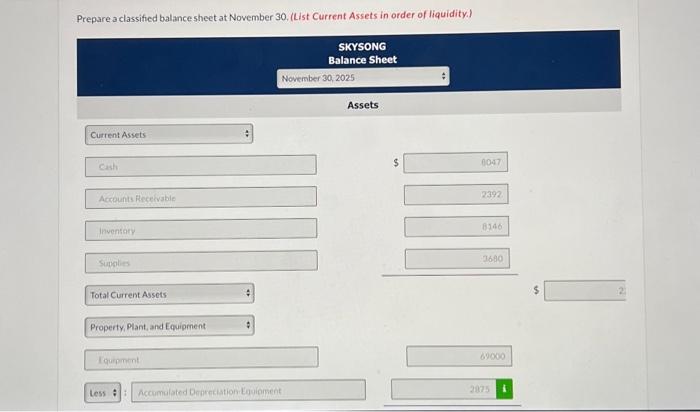

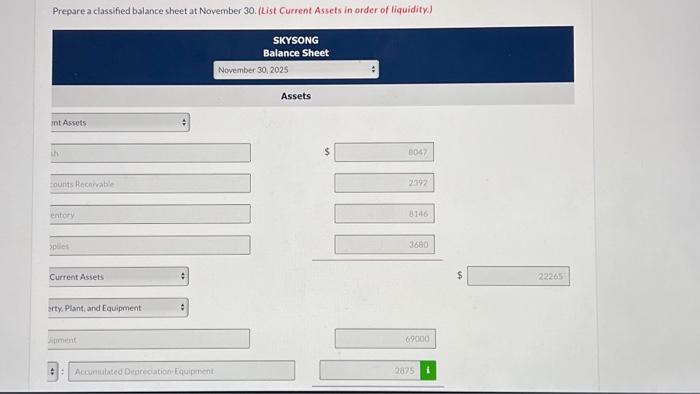

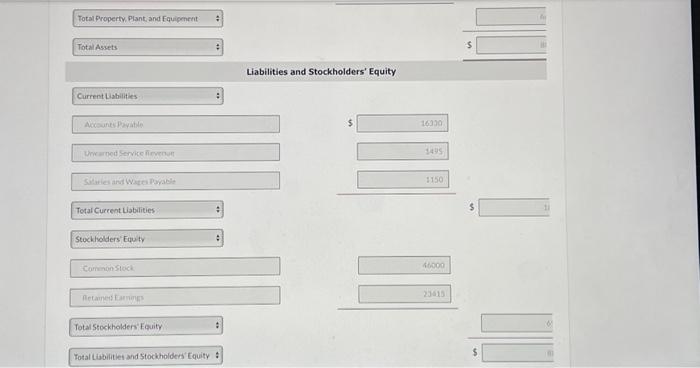

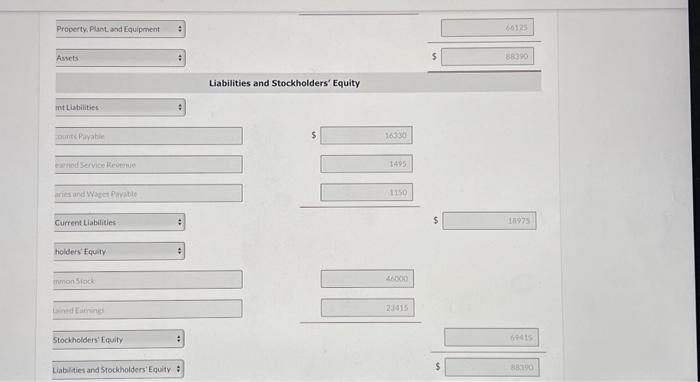

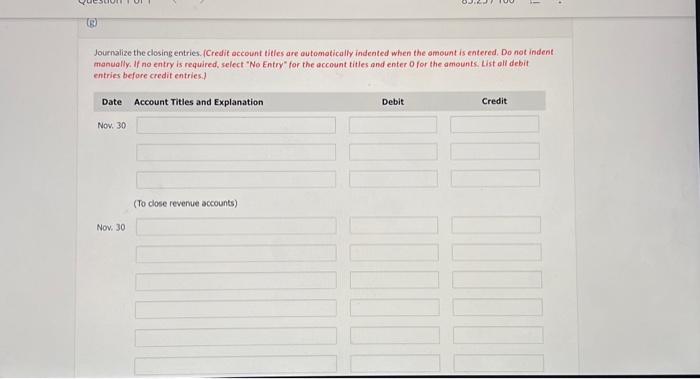

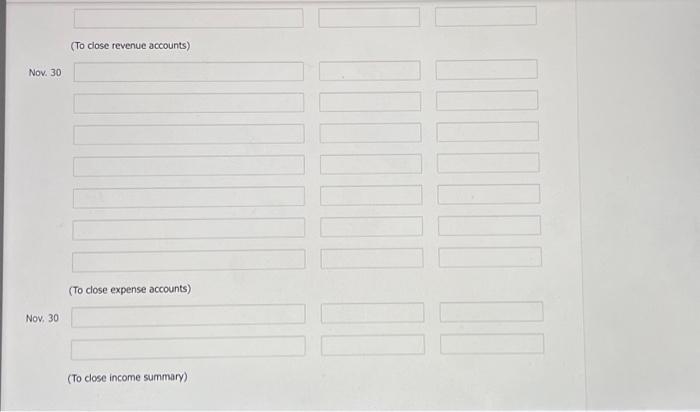

During November, the following summary transactions were completed. Nov. 8 Paid $8,165 for salaries due employecs, of which $4,255 is for November and $3.910 is for October. 10 Received $4,370 cash from customers in payment of account. 11 Purchased merchandise on account from Dimas Discount Supply for $18,400, terms 2/10,n/30. 12 Sold merchandise on account for $12,650, terms 2/10,n/30. The cost of the merchandise sold was $9,200. 15 Received credit from Dimas Discount Supply for merchandise returned $700. 19 Received collections in full, less discounts, from customers billed on sales of $12,650 on November 12 . 20 Paid Dimas Discount Supply in full, less discount. 22 Received $5,290 cash for services performed in November. 25 Purchased equipment on account $11,500. 27 Purchased supplies on account $3,910. 28 Paid creditors $6,900 of accounts payable due. 29 Paid November rent $862. 29 Paid salaries $2,990. 29 Performed services on account and billed customers $1,610 for those services. 29 Received $1,553 from customers for services to be performed in the future. Adjustment data: 1. Supplies on hand are valued at $3,680 2. Accrued salaries payable are $1,150 3. Depreciation for the month is $575. 4. $1,495 of services related to the unearned service revenue has not been performed by month-end. Journalize the adjusting entries. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) Prepare a multiple-step income statement for November. Prepare a multiple-step income statement for November. ing Expense Salaries and Wazes Expense Rent Expense Supplies Expense Depreciation Expense Total Operating Expenses Net income / (Loss) lies Expense eciation Expense perating Expenses ome / (Loss) $ Prepare a classified balance sheet at November 30 , (List Current Assets in order of liquidity.) Prepare ciassified balance sheet at November 30. (List Current Assets in order of liquidity.) 5 Liabilities and Stockholders' Equity Current Liabinties Mucounte piyation $ Total Cureent Liabilities 5 Stockholders' Equty Tornangicick fetanest Lampers Total Stockholders' Eovity Total Liobilited and Stockholden' Cquity : 5 Stockholder's' Equity. 5 Journalize the closing entries. (Credit account titles are automotically indented when the amount is entered, Do not indent manually, If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.] (To close revenue accounts) Nov. 30 (To close expense accounts) Nov, 30 (To close income summary) During November, the following summary transactions were completed. Nov. 8 Paid $8,165 for salaries due employecs, of which $4,255 is for November and $3.910 is for October. 10 Received $4,370 cash from customers in payment of account. 11 Purchased merchandise on account from Dimas Discount Supply for $18,400, terms 2/10,n/30. 12 Sold merchandise on account for $12,650, terms 2/10,n/30. The cost of the merchandise sold was $9,200. 15 Received credit from Dimas Discount Supply for merchandise returned $700. 19 Received collections in full, less discounts, from customers billed on sales of $12,650 on November 12 . 20 Paid Dimas Discount Supply in full, less discount. 22 Received $5,290 cash for services performed in November. 25 Purchased equipment on account $11,500. 27 Purchased supplies on account $3,910. 28 Paid creditors $6,900 of accounts payable due. 29 Paid November rent $862. 29 Paid salaries $2,990. 29 Performed services on account and billed customers $1,610 for those services. 29 Received $1,553 from customers for services to be performed in the future. Adjustment data: 1. Supplies on hand are valued at $3,680 2. Accrued salaries payable are $1,150 3. Depreciation for the month is $575. 4. $1,495 of services related to the unearned service revenue has not been performed by month-end. Journalize the adjusting entries. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) Prepare a multiple-step income statement for November. Prepare a multiple-step income statement for November. ing Expense Salaries and Wazes Expense Rent Expense Supplies Expense Depreciation Expense Total Operating Expenses Net income / (Loss) lies Expense eciation Expense perating Expenses ome / (Loss) $ Prepare a classified balance sheet at November 30 , (List Current Assets in order of liquidity.) Prepare ciassified balance sheet at November 30. (List Current Assets in order of liquidity.) 5 Liabilities and Stockholders' Equity Current Liabinties Mucounte piyation $ Total Cureent Liabilities 5 Stockholders' Equty Tornangicick fetanest Lampers Total Stockholders' Eovity Total Liobilited and Stockholden' Cquity : 5 Stockholder's' Equity. 5 Journalize the closing entries. (Credit account titles are automotically indented when the amount is entered, Do not indent manually, If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.] (To close revenue accounts) Nov. 30 (To close expense accounts) Nov, 30 (To close income summary) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started