Question

PLZ PLZ HELP ASAP Asif and Zeenat have lived and worked in the UK for the past 2 years. They have returned home to Melbourne,

PLZ PLZ HELP ASAP

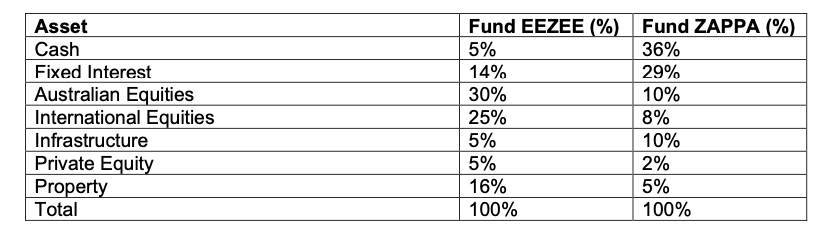

Asif and Zeenat have lived and worked in the UK for the past 2 years. They have returned home to Melbourne, after a very successful working project in the UK and have been fortunate in securing full-time employment in Melbourne. They are looking to start a family and have decided that each of them will invest in separate managed funds in their single names. They have different risk profiles (Asif is conservative; Zeenat is focused on high growth) and are investing for the long-term with the focus on building up their wealth to set themselves up for retirement. The strategic approaches of two managed funds are shown below:

REQUIRED:

-

a) Briefly describe two (2) characteristics of each fund. In your answer include a brief discussion relating to risk and return, including the characteristics of the 4 asset classes.

-

b) Briefly describe in which of the funds, Asif and Zeenat, would be likely to invest, and what type of returns they would be seeking to achieve.

-

c) Which fund is likely to perform better in the current COVID-19 recession that causes high levels of volatility in global markets? What is the reason for this difference in performance?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started