Question

PLZ PLZ HELP ASAP Donald Baker was recently made redundant from the Orchard plc where he worked for over 30 years as a marketing manager.

PLZ PLZ HELP ASAP

Donald Baker was recently made redundant from the Orchard plc where he worked for over 30 years as a marketing manager. He is now determined to set up his own business with the 140,000 redundancy pay. He wants to start a dating agency for professionals who he believes do not have time to find partners in traditional ways. Donalds two children, Emma & Jeff have also shown interest in their dads business idea and will invest 25,000 each. The HSBC bank has also agreed to provide him with a 150,000 ten-year interest-only business loan at 7% per year. This means Donald will only pay the bank the interest on the loan on a monthly basis during the five-year period. The loan will have to be repaid in full at the end of the 5th year.

Donald is unsure as to whether the business should be in the form of a sole trader, partnership, or a limited company.

Donalds initial assessment of the number of members likely to join his dating website is 1,380 in the first year. However, through aggressive advertising and word of mouth, he expects the membership to increase by 50% in the following year and then grow by around 10% each year for the following three years. His plans are to develop the dating site into a successful business in five years, and then sell it for lots of money and emigrate to sunny Spain for an enjoyable retirement.

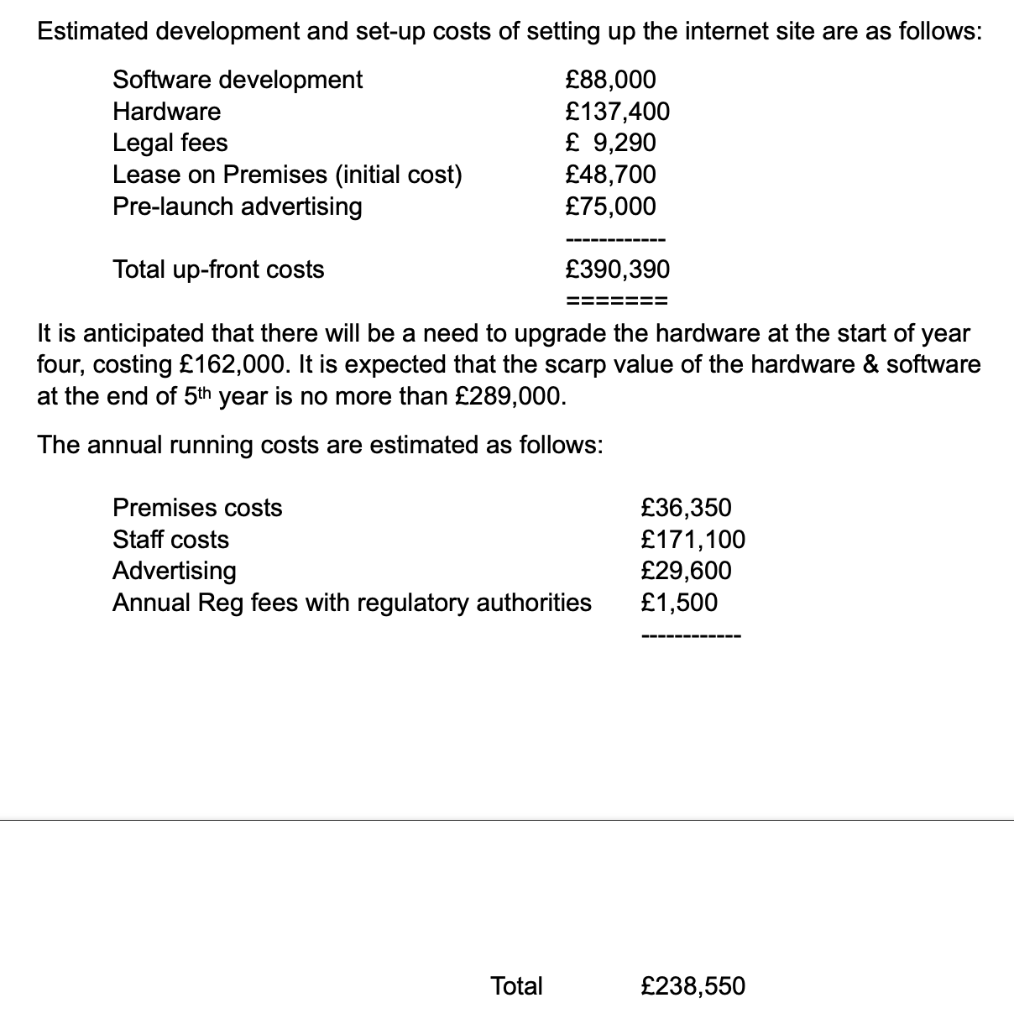

The following information is relevant:

The annual subscription fee in the first year is 240, and is set to increase by 5% per year in each of the following four years

Additional information:

a) The annual premises costs occur evenly throughout the year and are paid for in the following month. These costs are expected to increase by 3.2% per year.

b) The staff costs occur evenly throughout the year and are paid for in the month they occur. These costs are expected to increase by 2.6% per year

c) The advertising costs are expected to increase by 15% per year. In each year, 20% of the advertising budget is spent in January, 15% in March, 15% in May, 25% in July, 10% in September and the remaining budget in November. These costs are paid for in the month following the expenditure.

d) The cost of capital is 10%.

e) Ignore all taxation implications

The bank has agreed to provide a five-year fixed-rate interest-only loan of 150,000 at an annual rate of 9% at the start of the year.

You may assume that both Emma & Jeff will invest 25,000 each into the business in whatever structure it takes.

Plz answer all:

-

- Produce a cash budget for the first year of the business. (You may assume that demand will occur evenly throughout the year.)

-

- Suggest how cash shortages in any month can be dealt with

- Calculate the following for the first year only of the business:

-

- Profit for the year

- BEP

- Margin of safet

- Assuming this is a five-year project and ignoring all taxation implications, Calculate the following

-

- The payback period

- The accounting rate of return

- The net present value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started