Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLz remember to show your steps Options for Depreciation method: CCA, DB, SOYD, SL, DDB Depreciation rate : 20%, 30%, 33%, 40%, 10%, N/A Your

PLz remember to show your steps

Options for

Depreciation method:

CCA, DB, SOYD, SL, DDB

Depreciation rate :

20%, 30%, 33%, 40%, 10%, N/A

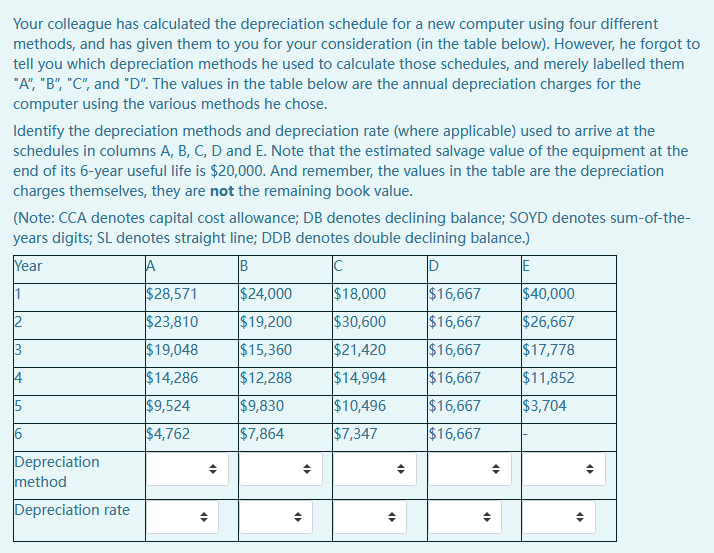

Your colleague has calculated the depreciation schedule for a new computer using four different methods, and has given them to you for your consideration (in the table below). However, he forgot to tell you which depreciation methods he used to calculate those schedules, and merely labelled them "A", "B", "C", and "D". The values in the table below are the annual depreciation charges for the computer using the various methods he chose. Identify the depreciation methods and depreciation rate (where applicable) used to arrive at the schedules in columns A, B, C, D and E. Note that the estimated salvage value of the equipment at the end of its 6-year useful life is $20,000. And remember, the values in the table are the depreciation charges themselves, they are not the remaining book value. (Note: CCA denotes capital cost allowance; DB denotes declining balance; SOYD denotes sum-of-the- years digits; SL denotes straight line; DDB denotes double declining balance.) Year A B Ic D JE 1 $28,571 $24,000 $18,000 $16,667 $40,000 2 $23,810 $19,200 $30,600 $16,667 $26,667 3 $19,048 $15,360 $21,420 $16,667 $17,778 $14,286 $12,288 $14,994 $16,667 $11,852 15 $9,524 $9,830 $10,496 $16,667 $3,704 $4,762 $7,864 $7,347 $16,667 Depreciation method 4 Depreciation rateStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started