plz show work and formula used thanks. i need help with the parts i got worng 15 and 16

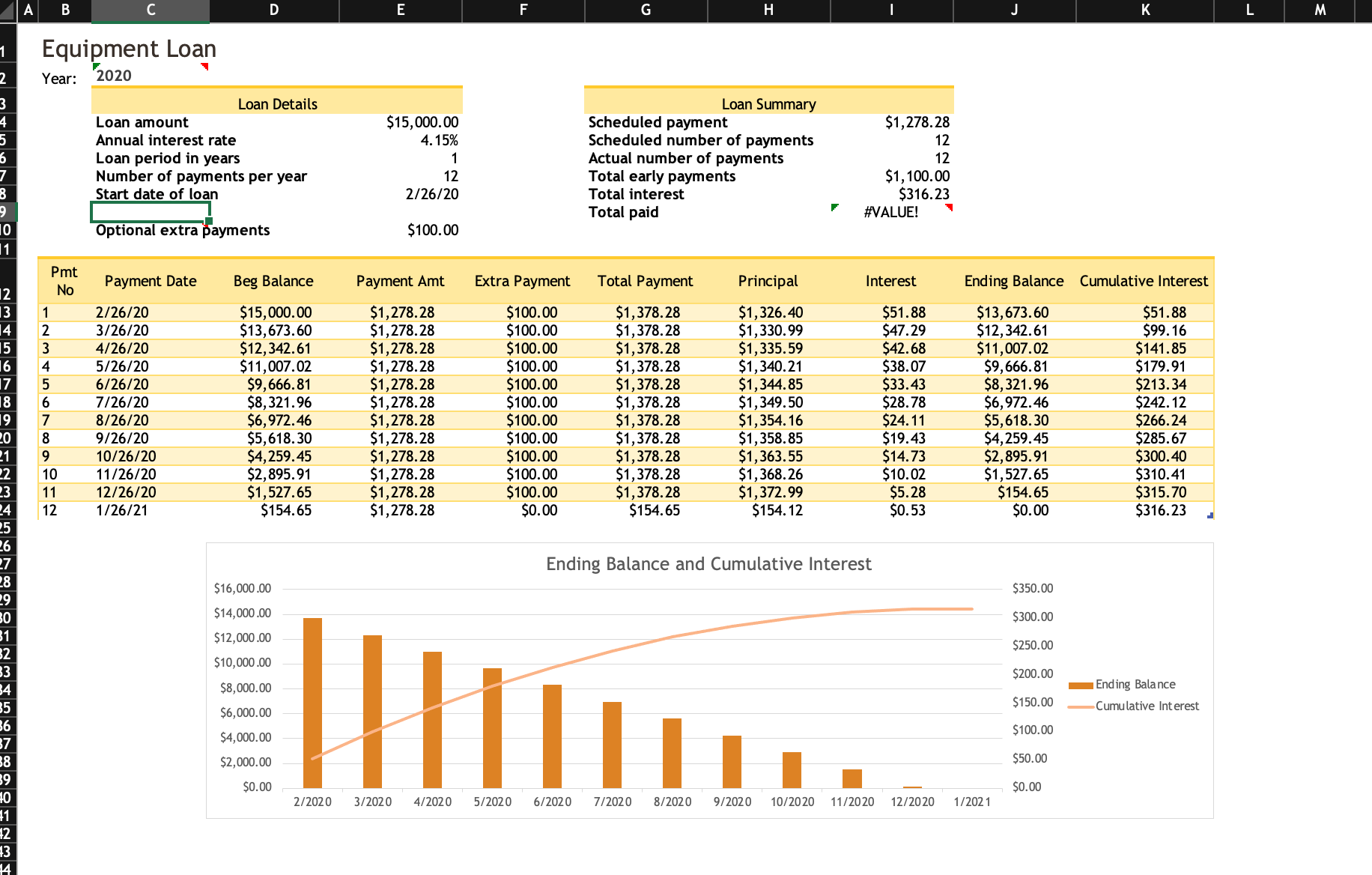

0/7 15. Go to the Equipment Loan worksheet, which contains details about a loan the company used for computer network equipment. The worksheet contains two errors. Make sure Excel is set to check all types of errors, and then resolve the ones on the Equipment Loan worksheet as follows: a. Display the possible errors and solutions for cell C2, and then select convert to number. b. Trace the precedents to the formula in cell 19, which should multiply the scheduled payment amount by the number of scheduled payments. Correct the error. X Update a value in a cell. In the Equipment Loan worksheet, value in cell C2 should be corrected so that it contains the value 2020. 0/7 X Enter a formula in a cell. In the Equipment Loan worksheet, the formula in cell 19 should multiply the scheduled payment amount by the number of scheduled payments. 16. Draw attention to the optional extra payments in the range C10:E10 by adding a thick outside border using the Orange, Accent 3 shape outline color. X Add a border to a range. In the Equipment Loan worksheet, the range C10:E10 should be formatted using the Thick Outside Borders border option. A B C D E F G H K L M 1 Equipment Loan 2 Year: 2020 3 4 5 6 7 3 9 10 11 Loan Details Loan amount Annual interest rate Loan period in years Number of payments per year Start date of loan $15,000.00 4.15% 1 12 2/26/20 Loan Summary Scheduled payment Scheduled number of payments Actual number of payments Total early payments Total interest Total paid $1,278.28 12 12 $1,100.00 $316.23 1 #VALUE! Optional extra payments $100.00 Pmt No Payment Date Beg Balance Payment Amt Extra Payment Total Payment Principal Interest Ending Balance Cumulative Interest 12 13 14 15 16 17 18 19 20 21 1 2 3 4 5 6 7 8 9 10 11 12 2/26/20 3/26/20 4/26/20 5/26/20 6/26/20 7/26/20 8/26/20 9/26/20 10/26/20 11/26/20 12/26/20 1/26/21 $15,000.00 $13,673.60 $12,342.61 $11,007.02 $9,666.81 $8,321.96 $6,972.46 $5,618.30 $4,259.45 $2,895.91 $1,527.65 $154.65 $1,278.28 $1,278.28 $1,278.28 $1,278.28 $1,278.28 $1,278.28 $1,278.28 $1,278.28 $1,278.28 $1,278.28 $1,278.28 $1,278.28 $100.00 $100.00 $100.00 $100.00 $100.00 $100.00 $100.00 $100.00 $100.00 $100.00 $100.00 $0.00 $1,378.28 $1,378.28 $1,378.28 $1,378.28 $1,378.28 $1,378.28 $1,378.28 $1,378.28 $1,378.28 $1,378.28 $1,378.28 $154.65 $1,326.40 $1,330.99 $1,335.59 $1,340.21 $1,344.85 $1,349.50 $1,354.16 $1,358.85 $1,363.55 $1,368.26 $1,372.99 $154.12 $51.88 $47.29 $42.68 $38.07 $33.43 $28.78 $24.11 $19.43 $14.73 $10.02 $5.28 $0.53 $13,673.60 $12,342.61 $11,007.02 $9,666.81 $8,321.96 $6,972.46 $5,618.30 $4,259.45 $2,895.91 $1,527.65 $154.65 $0.00 $51.88 $99.16 $141.85 $179.91 $213.34 $242.12 $266.24 $285.67 $300.40 $310.41 $315.70 $316.23 Ending Balance and Cumulative Interest $350.00 $16,000.00 $14,000.00 $300.00 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 8 39 $12,000.00 $10,000.00 $250.00 $200.00 $8,000.00 Ending Balance $150.00 Cumulative Interest $100.00 $6,000.00 $4,000.00 $2,000.00 $50.00 $0.00 $0.00 2/2020 3/2020 4/2020 5/2020 6/2020 7/2020 8/2020 9/2020 10/2020 11/2020 12/2020 1/2021 NEE 3 14 0/7 15. Go to the Equipment Loan worksheet, which contains details about a loan the company used for computer network equipment. The worksheet contains two errors. Make sure Excel is set to check all types of errors, and then resolve the ones on the Equipment Loan worksheet as follows: a. Display the possible errors and solutions for cell C2, and then select convert to number. b. Trace the precedents to the formula in cell 19, which should multiply the scheduled payment amount by the number of scheduled payments. Correct the error. X Update a value in a cell. In the Equipment Loan worksheet, value in cell C2 should be corrected so that it contains the value 2020. 0/7 X Enter a formula in a cell. In the Equipment Loan worksheet, the formula in cell 19 should multiply the scheduled payment amount by the number of scheduled payments. 16. Draw attention to the optional extra payments in the range C10:E10 by adding a thick outside border using the Orange, Accent 3 shape outline color. X Add a border to a range. In the Equipment Loan worksheet, the range C10:E10 should be formatted using the Thick Outside Borders border option. A B C D E F G H K L M 1 Equipment Loan 2 Year: 2020 3 4 5 6 7 3 9 10 11 Loan Details Loan amount Annual interest rate Loan period in years Number of payments per year Start date of loan $15,000.00 4.15% 1 12 2/26/20 Loan Summary Scheduled payment Scheduled number of payments Actual number of payments Total early payments Total interest Total paid $1,278.28 12 12 $1,100.00 $316.23 1 #VALUE! Optional extra payments $100.00 Pmt No Payment Date Beg Balance Payment Amt Extra Payment Total Payment Principal Interest Ending Balance Cumulative Interest 12 13 14 15 16 17 18 19 20 21 1 2 3 4 5 6 7 8 9 10 11 12 2/26/20 3/26/20 4/26/20 5/26/20 6/26/20 7/26/20 8/26/20 9/26/20 10/26/20 11/26/20 12/26/20 1/26/21 $15,000.00 $13,673.60 $12,342.61 $11,007.02 $9,666.81 $8,321.96 $6,972.46 $5,618.30 $4,259.45 $2,895.91 $1,527.65 $154.65 $1,278.28 $1,278.28 $1,278.28 $1,278.28 $1,278.28 $1,278.28 $1,278.28 $1,278.28 $1,278.28 $1,278.28 $1,278.28 $1,278.28 $100.00 $100.00 $100.00 $100.00 $100.00 $100.00 $100.00 $100.00 $100.00 $100.00 $100.00 $0.00 $1,378.28 $1,378.28 $1,378.28 $1,378.28 $1,378.28 $1,378.28 $1,378.28 $1,378.28 $1,378.28 $1,378.28 $1,378.28 $154.65 $1,326.40 $1,330.99 $1,335.59 $1,340.21 $1,344.85 $1,349.50 $1,354.16 $1,358.85 $1,363.55 $1,368.26 $1,372.99 $154.12 $51.88 $47.29 $42.68 $38.07 $33.43 $28.78 $24.11 $19.43 $14.73 $10.02 $5.28 $0.53 $13,673.60 $12,342.61 $11,007.02 $9,666.81 $8,321.96 $6,972.46 $5,618.30 $4,259.45 $2,895.91 $1,527.65 $154.65 $0.00 $51.88 $99.16 $141.85 $179.91 $213.34 $242.12 $266.24 $285.67 $300.40 $310.41 $315.70 $316.23 Ending Balance and Cumulative Interest $350.00 $16,000.00 $14,000.00 $300.00 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 8 39 $12,000.00 $10,000.00 $250.00 $200.00 $8,000.00 Ending Balance $150.00 Cumulative Interest $100.00 $6,000.00 $4,000.00 $2,000.00 $50.00 $0.00 $0.00 2/2020 3/2020 4/2020 5/2020 6/2020 7/2020 8/2020 9/2020 10/2020 11/2020 12/2020 1/2021 NEE 3 14