plz teach me how to calculate the CONSULTING SERVICES REVENUE in 2022. can u show me the whole solutions? thx

plz teach me how to calculate the CONSULTING SERVICES REVENUE in 2022. can u show me the whole solutions? thx

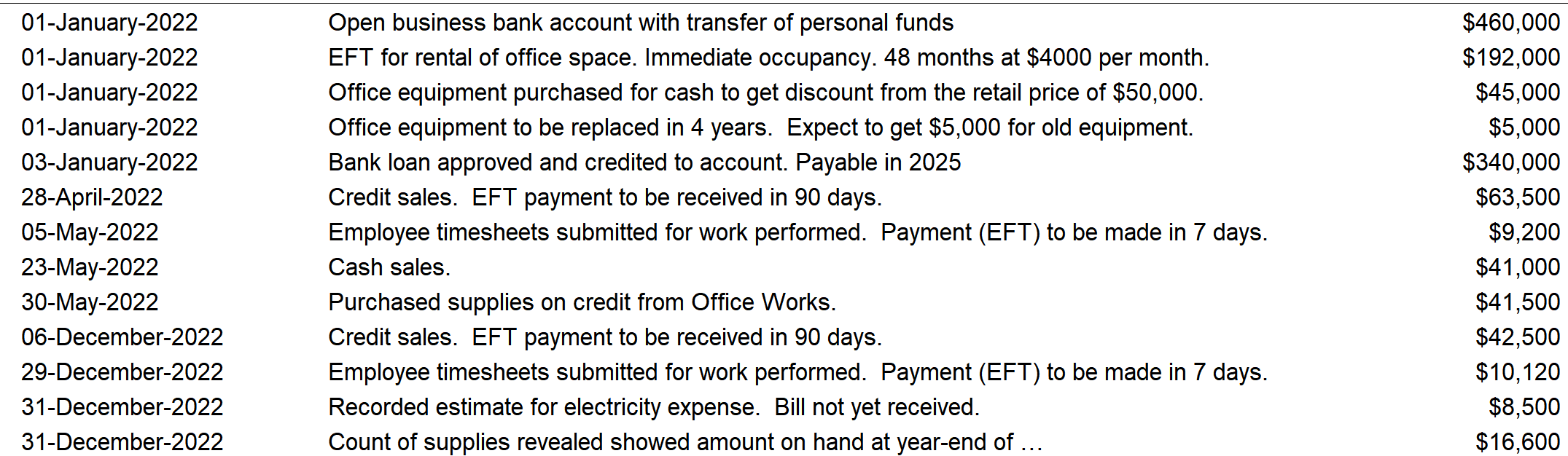

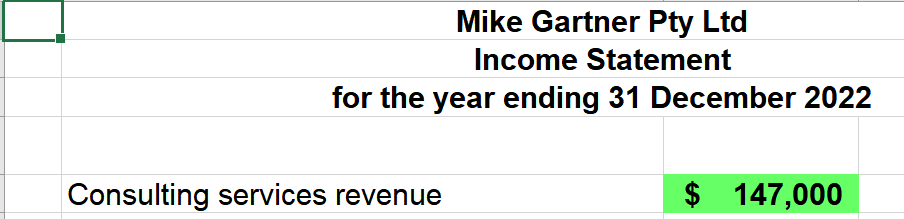

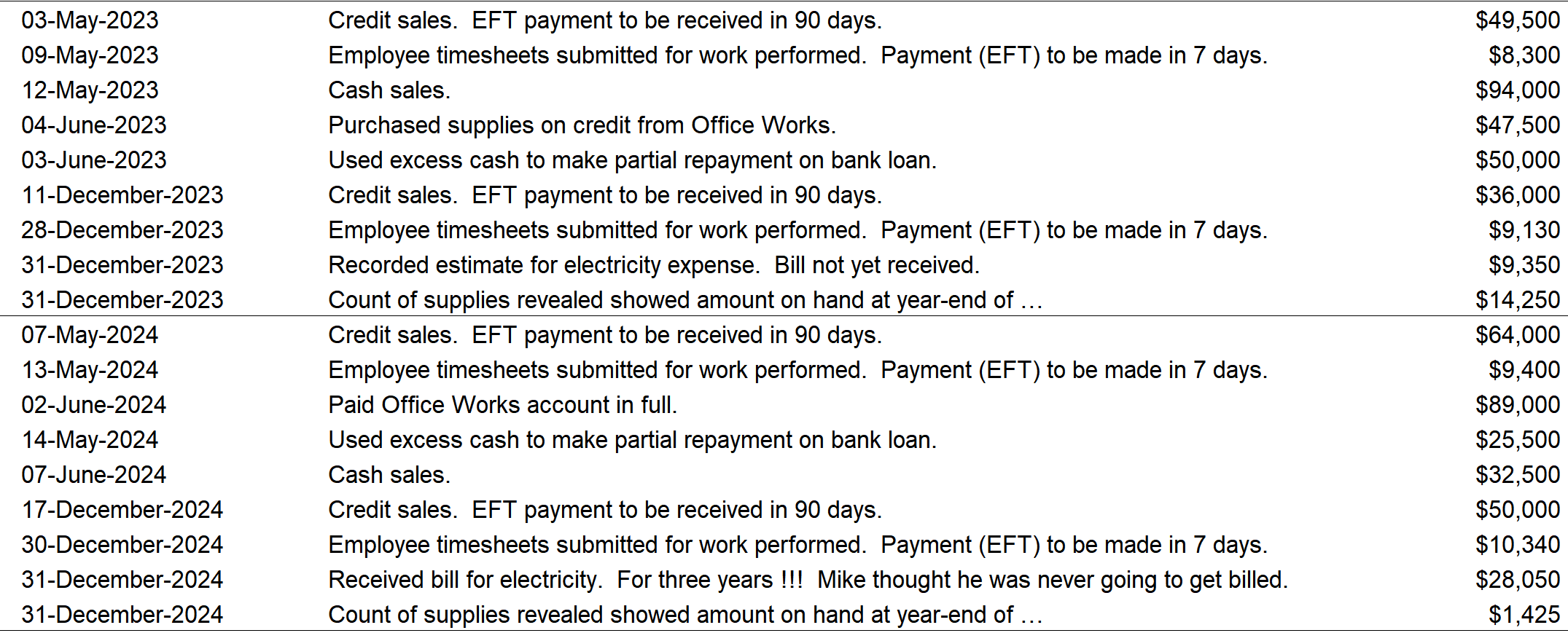

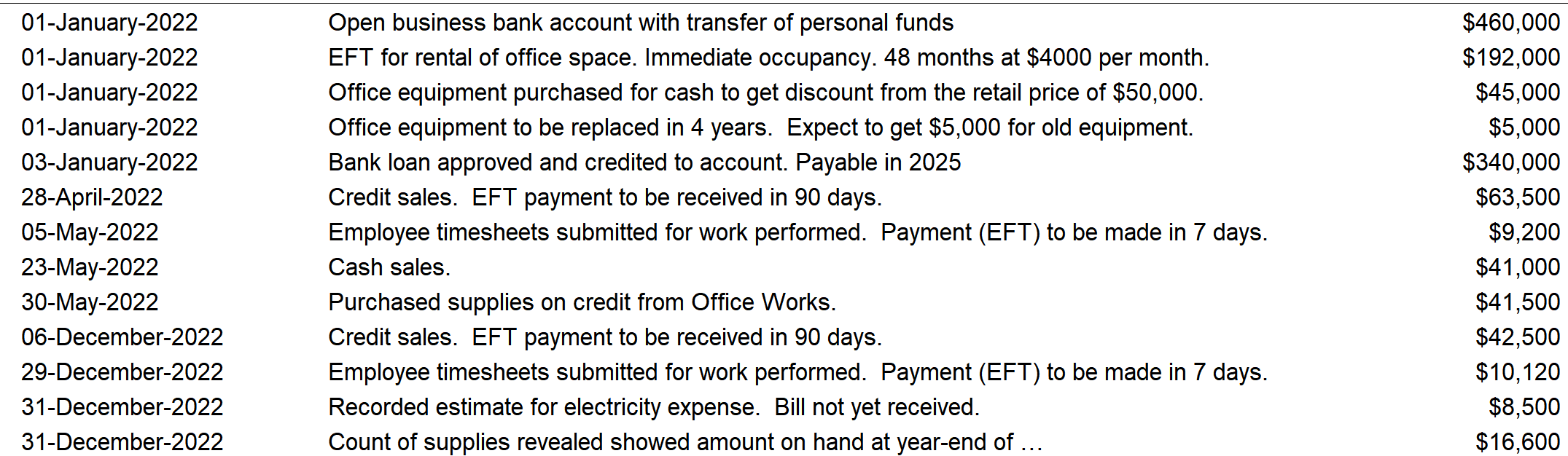

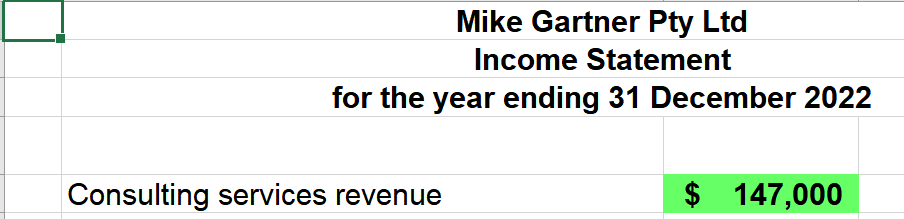

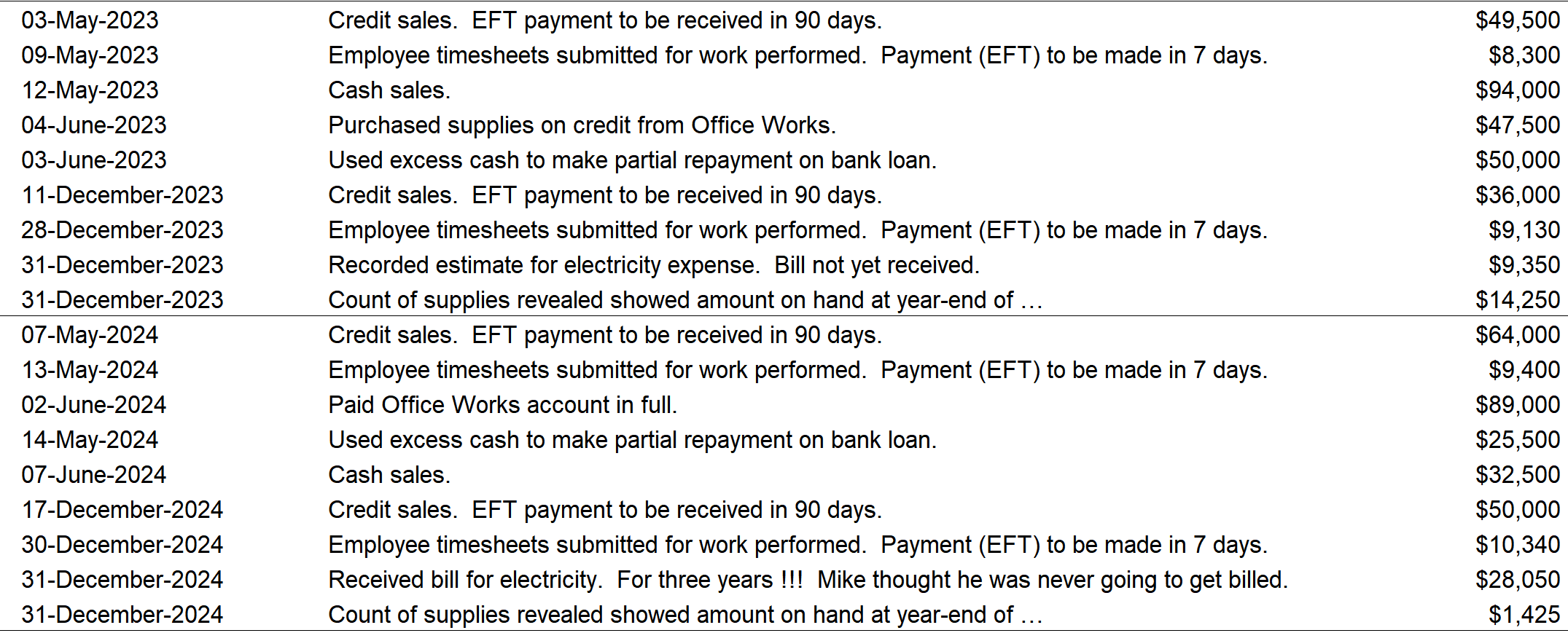

03-May-2023 09-May-2023 12-May-2023 04-June-2023 03-June-2023 11-December-2023 28-December-2023 31-December-2023 31-December-2023 07-May-2024 13-May-2024 02-June-2024 14-May-2024 07-June-2024 17-December-2024 30-December-2024 31-December-2024 31-December-2024 Credit sales. EFT payment to be received in 90 days. Employee timesheets submitted for work performed. Payment (EFT) to be made in 7 days. Cash sales. Purchased supplies on credit from Office Works. Used excess cash to make partial repayment on bank loan. Credit sales. EFT payment to be received in 90 days. Employee timesheets submitted for work performed. Payment (EFT) to be made in 7 days. Recorded estimate for electricity expense. Bill not yet received. Count of supplies revealed showed amount on hand at year-end of ... Credit sales. EFT payment to be received in 90 days Employee timesheets submitted for work performed. Payment (EFT) to be made in 7 days. Paid Office Works account in full. Used excess cash to make partial repayment on bank loan. Cash sales. Credit sales. EFT payment to be received in 90 days. Employee timesheets submitted for work performed. Payment (EFT) to be made in 7 days. Received bill for electricity. For three years !!! Mike thought he was never going to get billed. Count of supplies revealed showed amount on hand at year-end of ... $49,500 $8,300 $94,000 $47,500 $50,000 $36,000 $9,130 $9,350 $14,250 $64,000 $9,400 $89,000 $25,500 $32,500 $50,000 $10,340 $28,050 $1,425 01-January-2022 01-January-2022 01-January-2022 01-January-2022 03-January-2022 28-April-2022 05-May-2022 23-May-2022 30-May-2022 06-December-2022 29-December-2022 31-December-2022 31-December-2022 Open business bank account with transfer of personal funds EFT for rental of office space. Immediate occupancy. 48 months at $4000 per month. Office equipment purchased for cash to get discount from the retail price of $50,000. Office equipment to be replaced in 4 years. Expect to get $5,000 for old equipment. Bank loan approved and credited to account. Payable in 2025 Credit sales. EFT payment to be received in 90 days. Employee timesheets submitted for work performed. Payment (EFT) to be made in 7 days. Cash sales. Purchased supplies on credit from Office Works. Credit sales. EFT payment received in 90 days. Employee timesheets submitted for work performed. Payment (EFT) to be made in 7 days. Recorded estimate for electricity expense. Bill not yet received. Count of supplies revealed showed amount on hand at year-end of ... $460,000 $ 192,000 $45,000 $5,000 $340,000 $63,500 $9,200 $41,000 $41,500 $42,500 $10,120 $8,500 $16,600 Mike Gartner Pty Ltd Income Statement for the year ending 31 December 2022 Consulting services revenue $ 147,000

plz teach me how to calculate the CONSULTING SERVICES REVENUE in 2022. can u show me the whole solutions? thx

plz teach me how to calculate the CONSULTING SERVICES REVENUE in 2022. can u show me the whole solutions? thx