Answered step by step

Verified Expert Solution

Question

1 Approved Answer

plzzzz solve someone fast Q-1. Star Motors Ltd. is a Bengaluru based motor bike manufacturing company. It currently manufactures and markets 100cc and 250cc engine

plzzzz solve someone fast

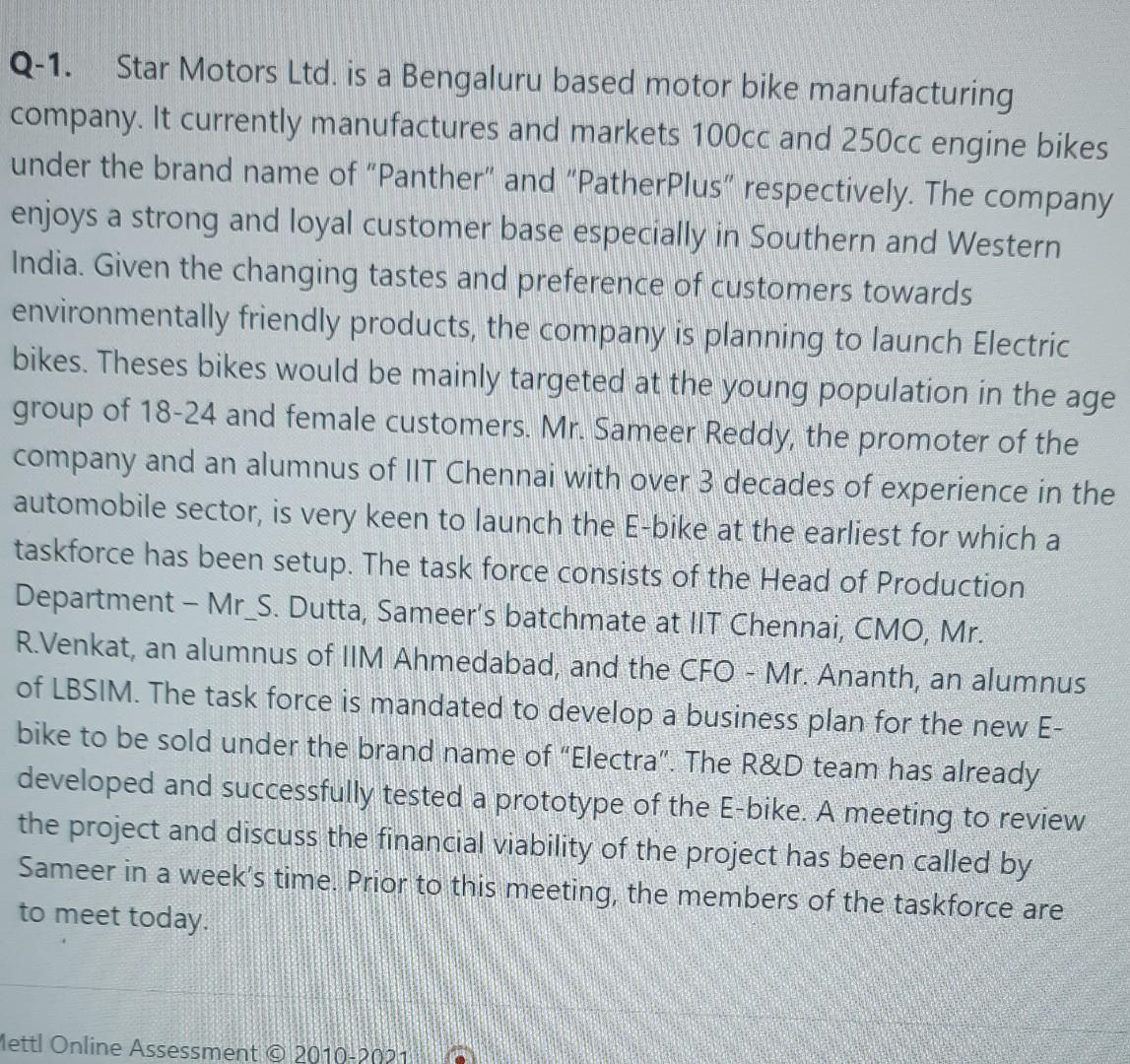

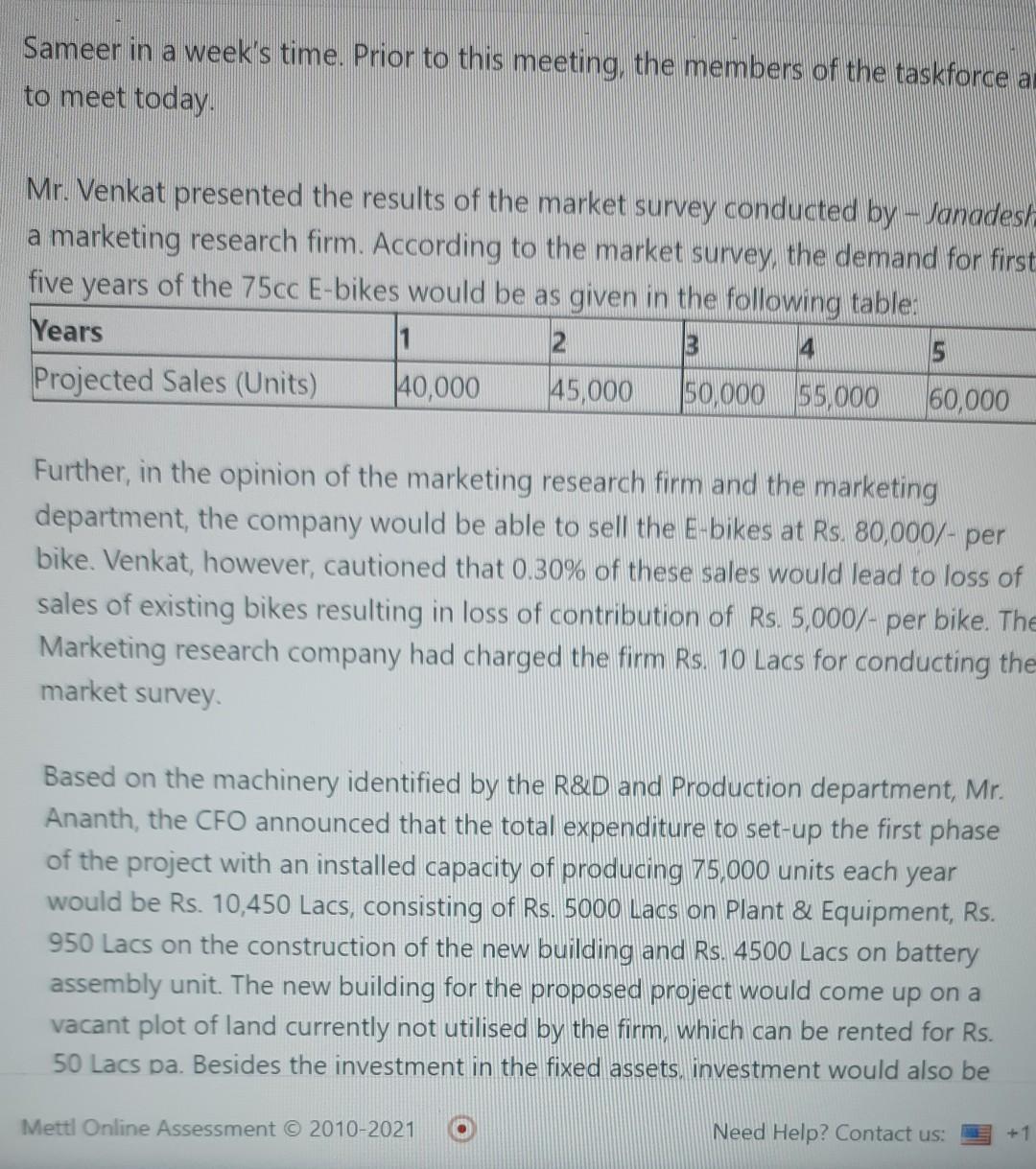

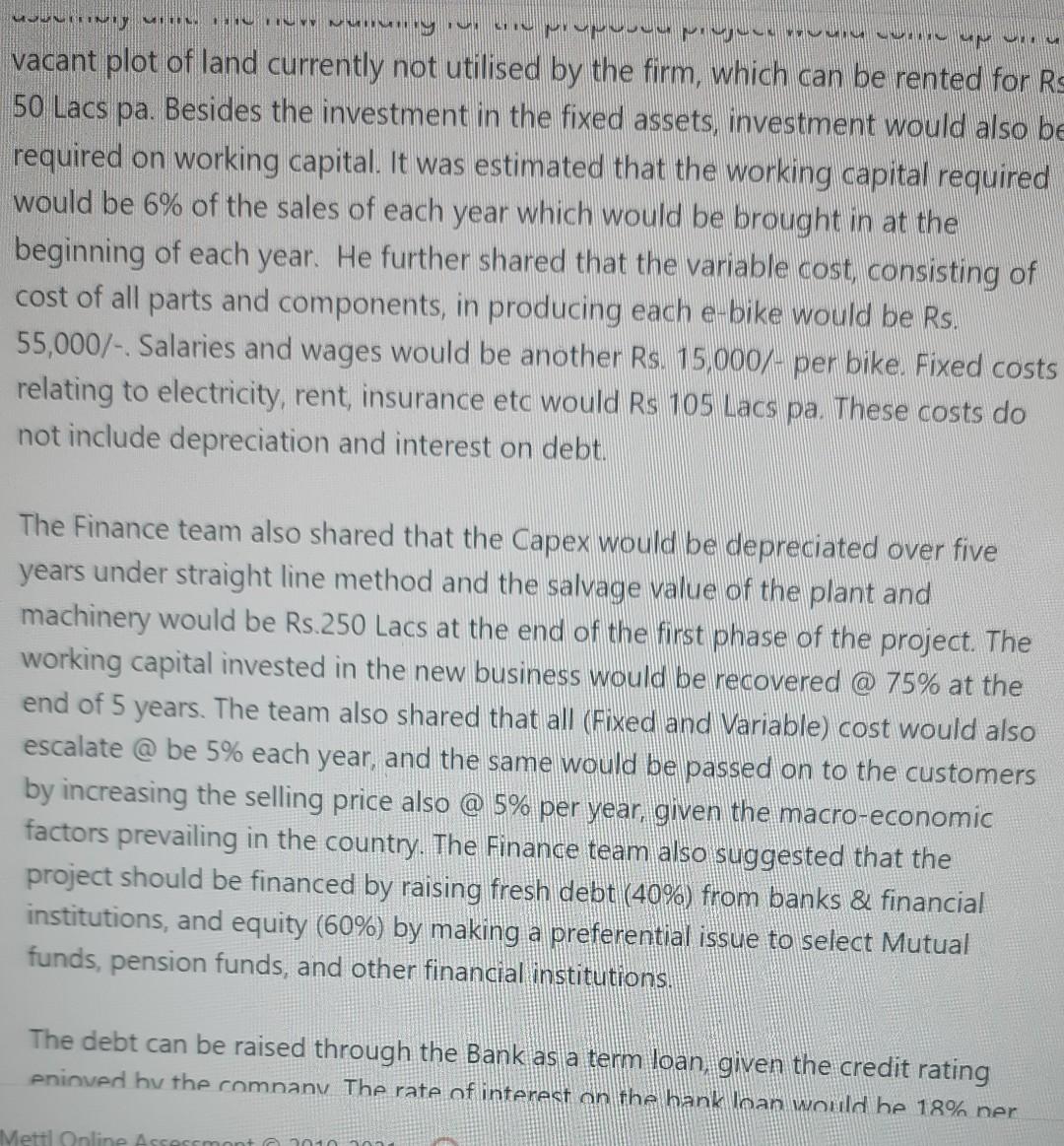

Q-1. Star Motors Ltd. is a Bengaluru based motor bike manufacturing company. It currently manufactures and markets 100cc and 250cc engine bikes under the brand name of "Panther" and "PatherPlus respectively. The company enjoys a strong and loyal customer base especially in Southern and Western India. Given the changing tastes and preference of customers towards environmentally friendly products, the company is planning to launch Electric bikes. Theses bikes would be mainly targeted at the young population in the age group of 18-24 and female customers. Mr. Sameer Reddy, the promoter of the company and an alumnus of IIT Chennai with over 3 decades of experience in the automobile sector, is very keen to launch the E-bike at the earliest for which a taskforce has been setup. The task force consists of the Head of Production Department - Mr_S. Dutta, Sameer's batchmate at IIT Chennai, CMO, Mr. R.Venkat, an alumnus of IIM Ahmedabad, and the CFO - Mr. Ananth, an alumnus of LBSIM. The task force is mandated to develop a business plan for the new E- bike to be sold under the brand name of "Electra. The R&D team has already developed and successfully tested a prototype of the E-bike. A meeting to review the project and discuss the financial viability of the project has been called by Sameer in a week's time. Prior to this meeting, the members of the taskforce are to meet today. Mettl Online Assessment 2010-2021 a Sameer in a week's time. Prior to this meeting the members of the taskforce a to meet today Mr. Venkat presented the results of the market survey conducted by -Janades/ a marketing research firm. According to the market survey, the demand for first five years of the 75cc E-bikes would be as given in the following table Years 11 2 3 4 5 Projected Sales (Units) 40,000 45,000 50,000 $5,000 60,000 Further, in the opinion of the marketing research firm and the marketing department, the company would be able to sell the E-bikes at Rs. 80,000/- per bike. Venkat, however, cautioned that 0.30% of these sales would lead to loss of sales of existing bikes resulting in loss of contribution of Rs. 5,000/- per bike. The Marketing research company had charged the firm Rs. 10 Lacs for conducting the market survey Based on the machinery identified by the R&D and Production department, Mr. Ananth, the CFO announced that the total expenditure to set-up the first phase of the project with an installed capacity of producing 75.000 units each year would be Rs. 10,450 Lacs, consisting of Rs. 5000 Lacs on Plant & Equipment, Rs. 950 Lacs on the construction of the new building and Rs. 4500 Lacs on battery assembly unit. The new building for the proposed project would come up on a vacant plot of land currently not utilised by the firm, which can be rented for Rs. 50 Lacs pa. Besides the investment in the fixed assets investment would also be Mettl Online Assessment 2010-2021 Need Help? Contact us: MMMMM Y MUMMUM vacant plot of land currently not utilised by the firm, which can be rented for Rs 50 Lacs pa. Besides the investment in the fixed assets, investment would also be required on working capital. It was estimated that the working capital required would be 6% of the sales of each year which would be brought in at the beginning of each year. He further shared that the variable cost consisting of cost of all parts and components, in producing each e-bike would be Rs. 55,000/-. Salaries and wages would be another Rs. 15,000/- per bike Fixed costs relating to electricity, rent, insurance etc would Rs 105 Lacs pa These costs do not include depreciation and interest on debt. The Finance team also shared that the Capex would be depreciated over five years under straight line method and the salvage value of the plant and machinery would be Rs.250 Lacs at the end of the first phase of the project. The working capital invested in the new business would be recovered @ 75% at the end of 5 years. The team also shared that all (Fixed and Variable) cost would also escalate @ be 5% each year, and the same would be passed on to the customers by increasing the selling price also @ 5% per year, given the macro-economic factors prevailing in the country. The Finance team also suggested that the project should be financed by raising fresh debt (40%) from banks & financial institutions, and equity (60%) by making a preferential issue to select Mutual funds, pension funds, and other financial institutions, The debt can be raised through the Bank as a term loan, given the credit rating enioved by the comnany. The rate of interest on the bank loan would be 18% ner Mettl Online Assessment 2010 20 end of 5 years. The team also shared that all (Fixed and Variable) cost would escalate @ be 5% each year, and the same would be passed on to the custon by increasing the selling price also @ 5% per year, given the macro-economic factors prevailing in the country. The Finance team also suggested that the project should be financed by raising fresh debt (40%) from banks & financial institutions, and equity (60%) by making a preferential issue to select Mutual funds, pension funds, and other financial institutions. The debt can be raised through the Bank as a term loan given the credit rating enjoyed by the company. The rate of interest on the bank loan would be 18% pe annum. The current market price of Star Motors equity share is Rs 200/-. The company has a beta of 1.98 and the risk-free return prevailing in the country presently is 5.0%. and the market return based on the last year performance is around 14%. The marginal rate of tax faced by the firm is 30%. a You are an analyst with company assisting the CFO. He has asked you to prepare the financial projections and assess the financial viability of the project so that it may be presented at the next meeting with Mr. Reddy, next week. (20 marks) (CO-2 & 3) Metti Online Assessment 2010-2021 Need Help? Contact usStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started