Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PMT - 4135 N - 5*12=60 I/Y - 10%/12=.83 What am i doing wrong ? One of your tenants has five years remaining on a

PMT - 4135

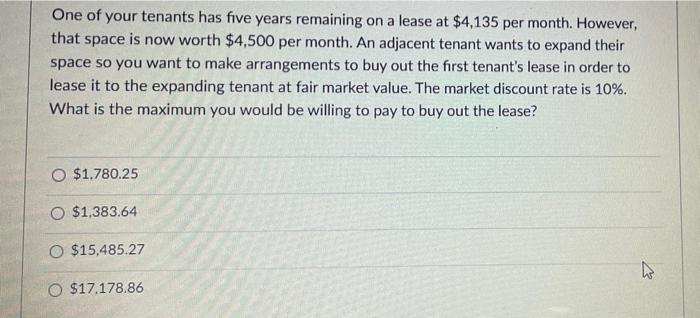

One of your tenants has five years remaining on a lease at $4,135 per month. However, that space is now worth $4,500 per month. An adjacent tenant wants to expand their space so you want to make arrangements to buy out the first tenant's lease in order to lease it to the expanding tenant at fair market value. The market discount rate is 10%. What is the maximum you would be willing to pay to buy out the lease? O $1.780.25 O $1,383.64 O $15,485.27 O $17.178.86 N - 5*12=60

I/Y - 10%/12=.83

What am i doing wrong ?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started