Answered step by step

Verified Expert Solution

Question

1 Approved Answer

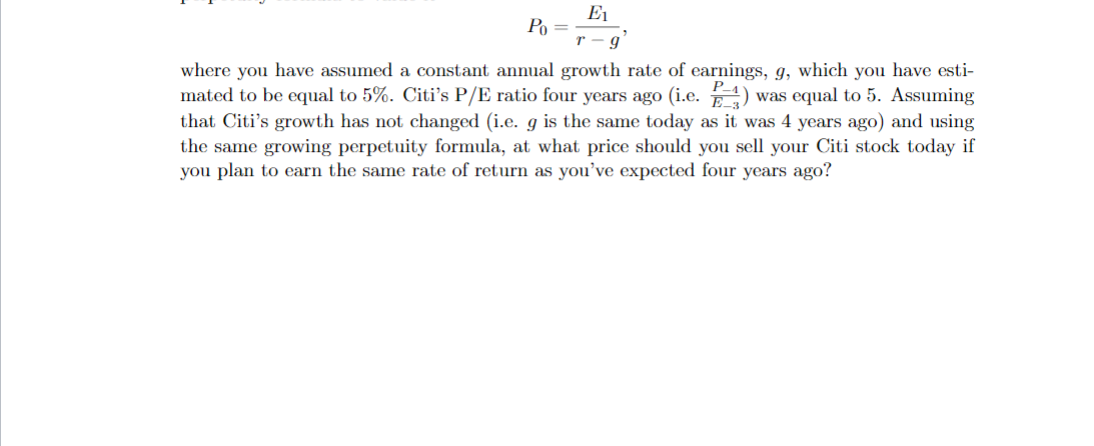

Po= 9 where you have assumed a constant annual growth rate of earnings, g, which you have esti- mated to be equal to 5%.

Po= 9 where you have assumed a constant annual growth rate of earnings, g, which you have esti- mated to be equal to 5%. Citi's P/E ratio four years ago (i.e. P-1) was equal to 5. Assuming that Citi's growth has not changed (i.e. g is the same today as it was 4 years ago) and using the same growing perpetuity formula, at what price should you sell your Citi stock today if you plan to earn the same rate of return as you've expected four years ago?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started