Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pocus, Inc., reports warranty expense when related products are sold. For tax purposes, the warraniy costs are deductible as incurred. At the end of

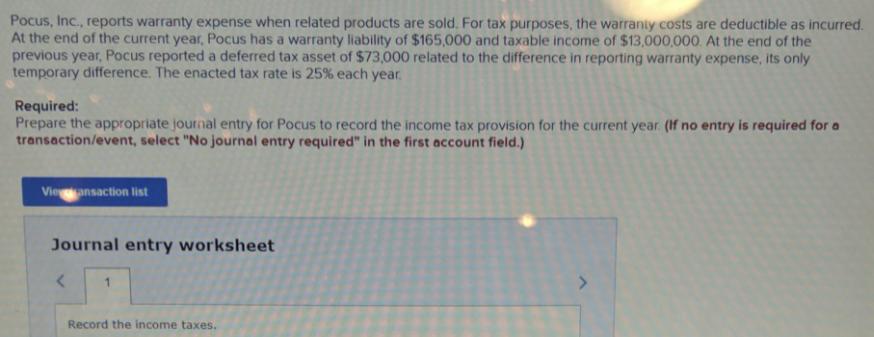

Pocus, Inc., reports warranty expense when related products are sold. For tax purposes, the warraniy costs are deductible as incurred. At the end of the current year, Pocus has a warranty liability of $165,000 and taxable income of $13,000,000. At the end of the previous year, Pocus reported a deferred tax asset of $73,000 related to the difference in reporting warranty expense, its only temporary difference. The enacted tax rate is 25% each year. Required: Prepare the appropriate journal entry for Pocus to record the income tax provision for the current year (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Vieansaction list Journal entry worksheet Record the income taxes.

Step by Step Solution

★★★★★

3.26 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Ansuer Date Transaction Gereral Juymal D...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started