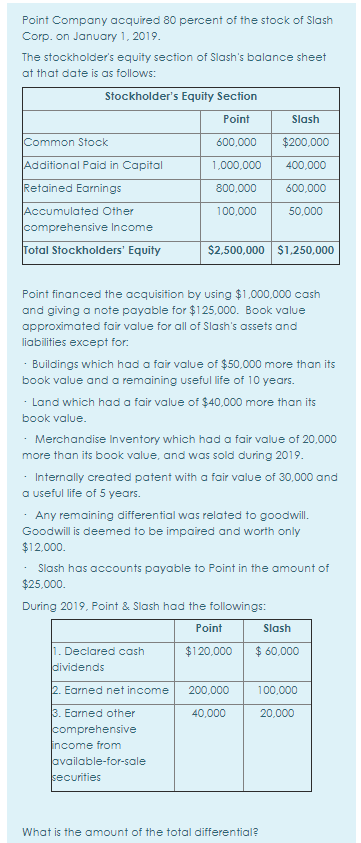

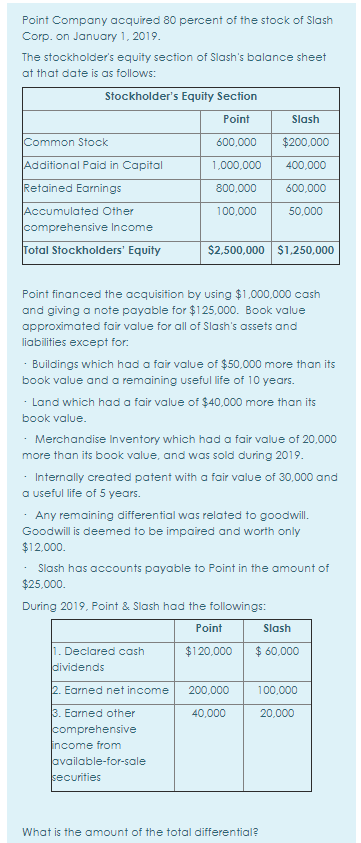

Point Company acquired 80 percent of the stock of Slash Corp. on January 1, 2019. The stockholder's equity section of Slash's balance sheet at that date is as follows: Stockholder's Equity Section Point Slash $200,000 600,000 1,000,000 400,000 600,000 Common Stock Additional Paid in Capital Retained Earnings Accumulated Other comprehensive Income Total Stockholders' Equity 800,000 100,000 50,000 $2,500,000 $1,250,000 Point financed the acquisition by using $1,000,000 cash and giving a note payable for $125,000. Book value approximated fair value for all of Slash's assets and liabilities except for - Buildings which had a fair value of $50,000 more than its book value and a remaining useful life of 10 years. - Land which had a fair value of $40,000 more than its book value. Merchandise Inventory which had a fair value of 20,000 more than its book value, and was sold during 2019. Internally created patent with a fair value of 30,000 and a useful life of 5 years. Any remaining differential was related to goodwill. Goodwill is deemed to be impaired and worth only $12,000 Slash has accounts payable to point in the amount of $25.000 During 2019. Point & Slash had the followings: Point Slash 1. Declared cash $120,000 $ 60,000 cividends 200,000 100,000 40,000 20.000 2. Earned net income 3. Earned other comprehensive income from available-for-sale securities What is the amount of the total differential Point Company acquired 80 percent of the stock of Slash Corp. on January 1, 2019. The stockholder's equity section of Slash's balance sheet at that date is as follows: Stockholder's Equity Section Point Slash $200,000 600,000 1,000,000 400,000 600,000 Common Stock Additional Paid in Capital Retained Earnings Accumulated Other comprehensive Income Total Stockholders' Equity 800,000 100,000 50,000 $2,500,000 $1,250,000 Point financed the acquisition by using $1,000,000 cash and giving a note payable for $125,000. Book value approximated fair value for all of Slash's assets and liabilities except for - Buildings which had a fair value of $50,000 more than its book value and a remaining useful life of 10 years. - Land which had a fair value of $40,000 more than its book value. Merchandise Inventory which had a fair value of 20,000 more than its book value, and was sold during 2019. Internally created patent with a fair value of 30,000 and a useful life of 5 years. Any remaining differential was related to goodwill. Goodwill is deemed to be impaired and worth only $12,000 Slash has accounts payable to point in the amount of $25.000 During 2019. Point & Slash had the followings: Point Slash 1. Declared cash $120,000 $ 60,000 cividends 200,000 100,000 40,000 20.000 2. Earned net income 3. Earned other comprehensive income from available-for-sale securities What is the amount of the total differential