points) Linkletter Company (LC) began year 2 with 520,000 shares of common stock outstanding. On March 1, LC issued 168,000 new shares. On June

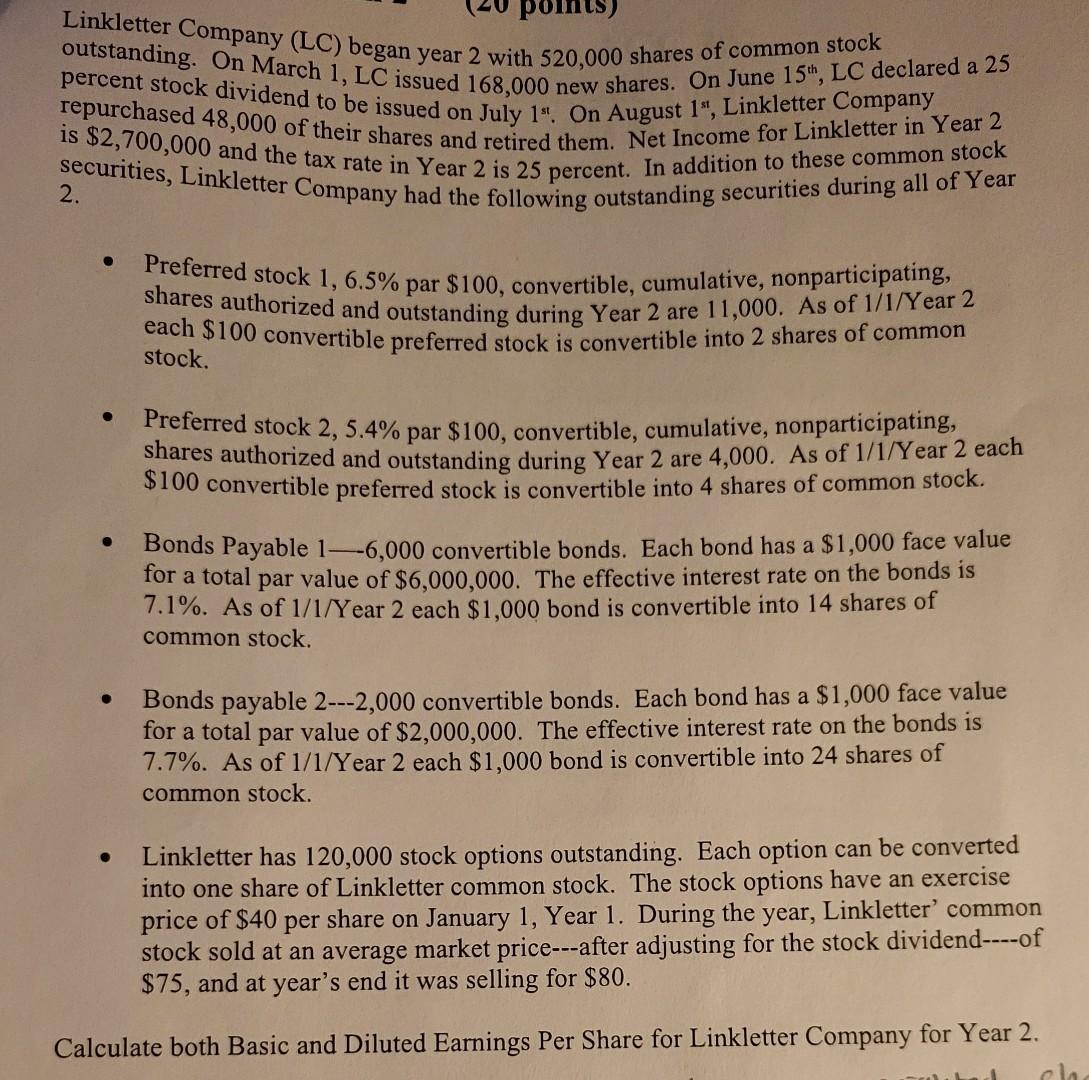

points) Linkletter Company (LC) began year 2 with 520,000 shares of common stock outstanding. On March 1, LC issued 168,000 new shares. On June 15th, LC declared a 25 percent stock dividend to be issued on July 1". On August 1", Linkletter Company is $2,700,000 and the tax rate in Year 2 is 25 percent. In addition to these common stock repurchased 48,000 of their shares and retired them. Net Income for Linkletter in Year 2 securities, Linkletter Company had the following outstanding securities during all of Year 2. . Preferred stock 1, 6.5% par $100, convertible, cumulative, nonparticipating, shares authorized and outstanding during Year 2 are 11,000. As of 1/1/Year 2 each $100 convertible preferred stock is convertible into 2 shares of common stock. Preferred stock 2, 5.4% par $100, convertible, cumulative, nonparticipating, shares authorized and outstanding during Year 2 are 4,000. As of 1/1/Year 2 each $100 convertible preferred stock is convertible into 4 shares of common stock. Bonds Payable 1-6,000 convertible bonds. Each bond has a $1,000 face value for a total par value of $6,000,000. The effective interest rate on the bonds is 7.1%. As of 1/1/Year 2 each $1,000 bond is convertible into 14 shares of common stock. Bonds payable 2---2,000 convertible bonds. Each bond has a $1,000 face value for a total par value of $2,000,000. The effective interest rate on the bonds is 7.7%. As of 1/1/Year 2 each $1,000 bond is convertible into 24 shares of common stock. Linkletter has 120,000 stock options outstanding. Each option can be converted into one share of Linkletter common stock. The stock options have an exercise price of $40 per share on January 1, Year 1. During the year, Linkletter' common stock sold at an average market price---after adjusting for the stock dividend----of $75, and at year's end it was selling for $80. Calculate both Basic and Diluted Earnings Per Share for Linkletter Company for Year 2.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Certainlylets calculate the Basic and Diluted Earnings Per Share EPS for Linkletter Company for Year 2 based on the provided information Understanding the Data Before we dive into the calculationslets ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started