Answered step by step

Verified Expert Solution

Question

1 Approved Answer

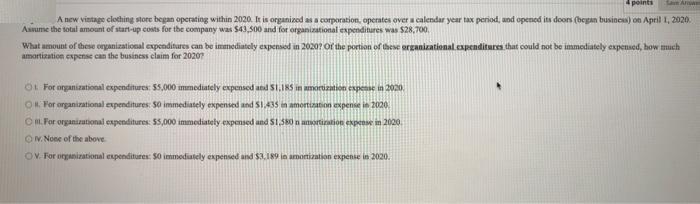

points Sa Ara A new vintage clothing store began opcrating within 2020. It is organized as a corporation, operates over a calendar year tax

points Sa Ara A new vintage clothing store began opcrating within 2020. It is organized as a corporation, operates over a calendar year tax period, and opened its doors (began busines) on April 1, 2020. Assume the total amount of start-up costs for the company was S43,500 and for organizational expenditures was $28,700. What amount of these onganizational expenditures can be immediately expensed in 2020? Of the portion of these organizational.cxpendituren that could not be immediately expensed, how much amortization expense can the business claim for 20207 OL For organizational expenditures: S5,000 immediately expensed and S1,18 in amorization espesse in 2020. OK For organizational expenditures: S0 immediately expensed and S1,435 in amortization expense in 2020 OL. For organizational expenditures: S5,000 immediately expensed and S1,580 n amortiration expense in 2020. ON. None of the above ON. For organizational expenditures: S0 immediately expensed and $3.189 in amortization expense in 2020.

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

D None of the above Organization Expenses means legal accounting and other expenses incurred in conn...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started