Answered step by step

Verified Expert Solution

Question

1 Approved Answer

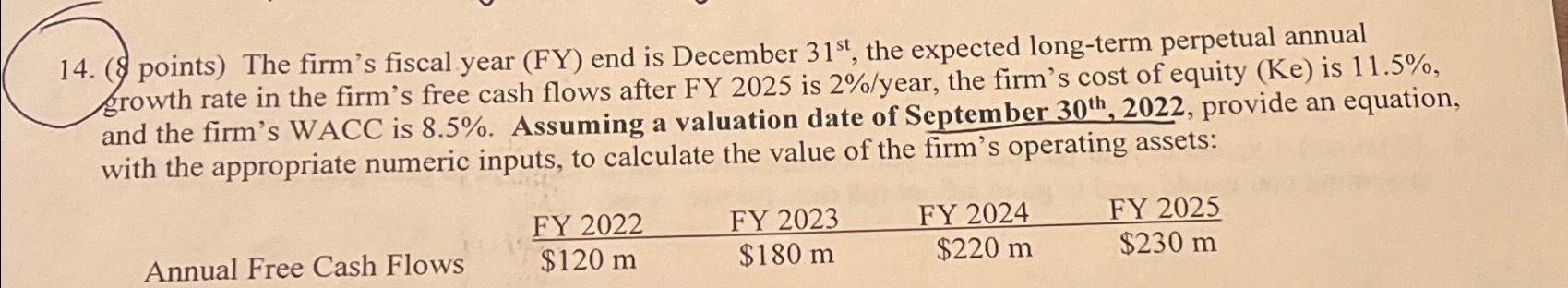

( points ) The firm's fiscal year ( FY ) end is December 3 1 s t , the expected long - term perpetual annual

points The firm's fiscal year FY end is December the expected longterm perpetual annual growth rate in the firm's free cash flows after FY is year the firm's cost of equity Ke is and the firm's WACC is Assuming a valuation date of September provide an equation, with the appropriate numeric inputs, to calculate the value of the firm's operating assets:

Annual Free Cash Flows

tableFY FY FY FY $$$$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started