Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Polly Corporation owns 80 percent of Sonny Corporation's stock and 90 percent of Daughter Company's stock. The companies file a consolidated tax return each

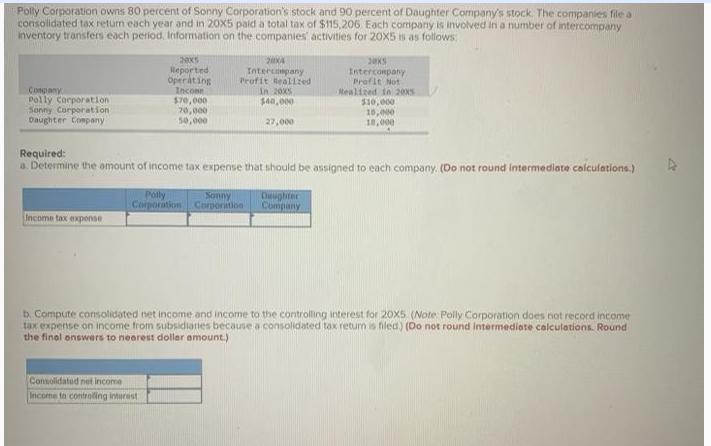

Polly Corporation owns 80 percent of Sonny Corporation's stock and 90 percent of Daughter Company's stock. The companies file a consolidated tax return each year and in 20X5 paid a total tax of $115,206 Each company is involved in a number of intercompany inventory transfers each period. Information on the companies' activities for 20X5 is as follows: Company 20x5 Reported Operating 20x4 Intercompany Profit Realized Incone Polly Corporation $70,000 In 20x5 $40,000 Sonny Corporation 70,000 Daughter Company 50,000 27,000 Required: Intercompany Profit Not Realized in 2005 $10,000 10,000 a. Determine the amount of income tax expense that should be assigned to each company. (Do not round intermediate calculations.) Income tax expense Polly Corporation Sonny Corporation Daughter Company b. Compute consolidated net income and income to the controlling interest for 20X5 (Note: Polly Corporation does not record income tax expense on income from subsidiaries because a consolidated tax return is filed.) (Do not round intermediate calculations. Round the final onswers to nearest dollar amount.) Consolidated net income Income to controlling interest

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a To determine the amount of income tax expense that should be assigned to each company we need to calculate their respective taxable incomes based on ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started