Question

Poluo Trading bought a vehicle during the 2019 financial year for R195 000 (excluding VAT). On 31 January 2021, the business sold this vehicle

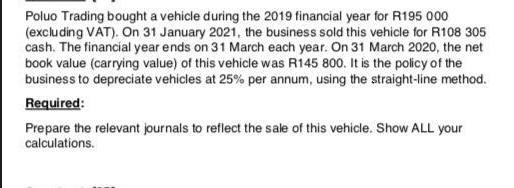

Poluo Trading bought a vehicle during the 2019 financial year for R195 000 (excluding VAT). On 31 January 2021, the business sold this vehicle for R108 305 cash. The financial year ends on 31 March each year. On 31 March 2020, the net book value (carrying value) of this vehicle was R145 800. It is the policy of the business to depreciate vehicles at 25% per annum, using the straight-line method. Required: Prepare the relevant journals to reflect the sale of this vehicle. Show ALL your calculations.

Step by Step Solution

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

The first step is to calculate the accumulated depreciation on the vehicle as of the date of sa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting for Decision Makers

Authors: Peter Atrill, Eddie McLaney

6th Edition

273763451, 273763458, 978-0273763451

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App