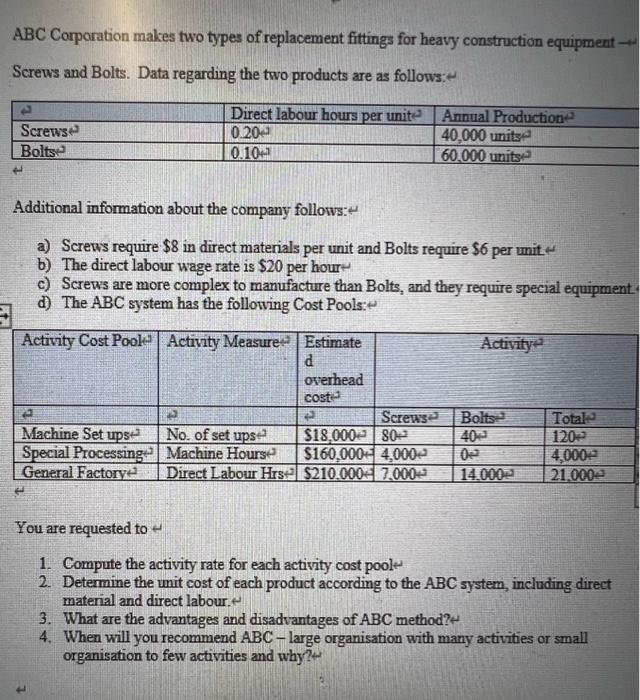

ABC Corporation makes two types of replacement fittings for heavy construction equipment- Screws and Bolts. Data regarding the two products are as follows: Screws

ABC Corporation makes two types of replacement fittings for heavy construction equipment- Screws and Bolts. Data regarding the two products are as follows: Screws Bolts 4 Machine Set upse Special Processing General Factory Additional information about the company follows: a) Screws require $8 in direct materials per unit and Bolts require $6 per unit b) The direct labour wage rate is $20 per hour c) Screws are more complex to manufacture than Bolts, and they require special equipment. d) The ABC system has the following Cost Pools:+ Activity Cost Poole Activity Measure Direct labour hours per unite 0.20 0.10 t 3. 4. No. of set ups Machine Hours Direct Labour Hrs Estimate d overhead cost Screws 80 $18,000 $160,000 4,000 $210.000 7.000 Annual Production 40,000 units 60,000 units 4 Activity Bolts 40 14.000 You are requested to 1. Compute the activity rate for each activity cost poole 2. Determine the unit cost of each product according to the ABC system, including direct material and direct labour. Totale 120 4,000 21.000 What are the advantages and disadvantages of ABC method? When will you recommend ABC-large organisation with many activities or small organisation to few activities and why?

Step by Step Solution

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

1 Compute the activity rate for each activity cost pool Screws Machine Set Up 18000 80 set ups 225 per set up Special Processing 160000 4000 machine h...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started