Pool Corporation, Inc., reported in its recent annual report that In 2010, our industry experienced some price deflation.... In 2011, our industry experienced more

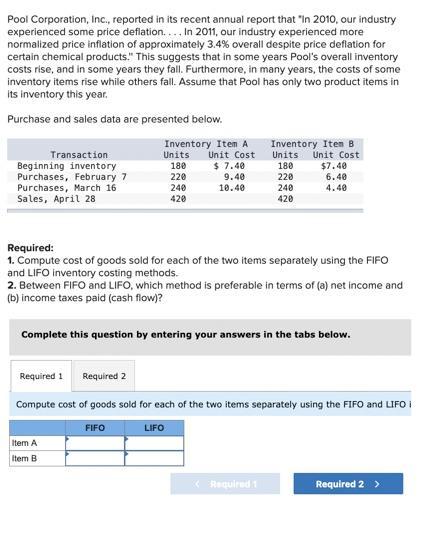

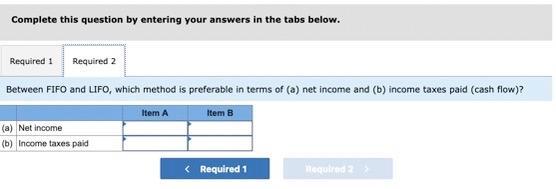

Pool Corporation, Inc., reported in its recent annual report that "In 2010, our industry experienced some price deflation.... In 2011, our industry experienced more normalized price inflation of approximately 3.4% overall despite price deflation for certain chemical products." This suggests that in some years Pool's overall inventory costs rise, and in some years they fall. Furthermore, in many years, the costs of some inventory items rise while others fall. Assume that Pool has only two product items in its inventory this year. Purchase and sales data are presented below. Transaction Beginning inventory Purchases, February 7 Purchases, March 16 Sales, April 28 Required 1 Inventory Item A Units Unit Cost 180 $ 7.40 220 9.40 240 10.40 420 Required: 1. Compute cost of goods sold for each of the two items separately using the FIFO and LIFO inventory costing methods. 2. Between FIFO and LIFO, which method is preferable in terms of (a) net income and (b) income taxes paid (cash flow)? Required 2 Item A Item B Complete this question by entering your answers in the tabs below. Inventory Item B Units Unit Cost FIFO 180 220 240 420 $7.40 6.40 4.40 Compute cost of goods sold for each of the two items separately using the FIFO and LIFO i LIFO < < Required 1 Required 2 > Complete this question by entering your answers in the tabs below. Required 1 Required 2 Between FIFO and LIFO, which method is preferable in terms of (a) net income and (b) income taxes paid (cash flow)? Item A Item B (a) Net income (b) Income taxes paid < Required 1 Required 2 >

Step by Step Solution

3.49 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started