Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Poonawassy Sound (Pty) Ltd (PS) was established three years ago to manufacture electronic components for home musical and hi-fi systems. At the end of

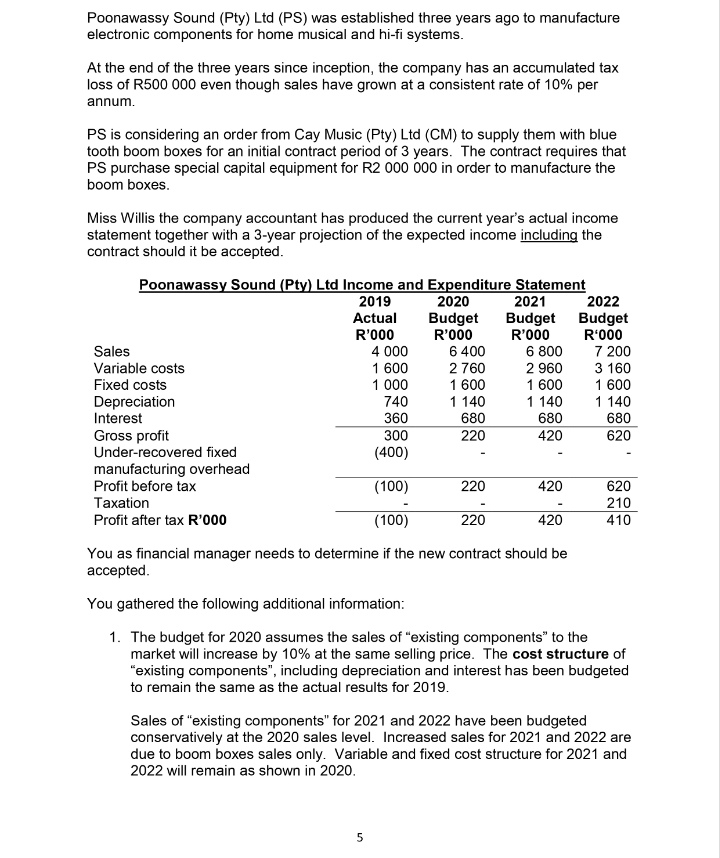

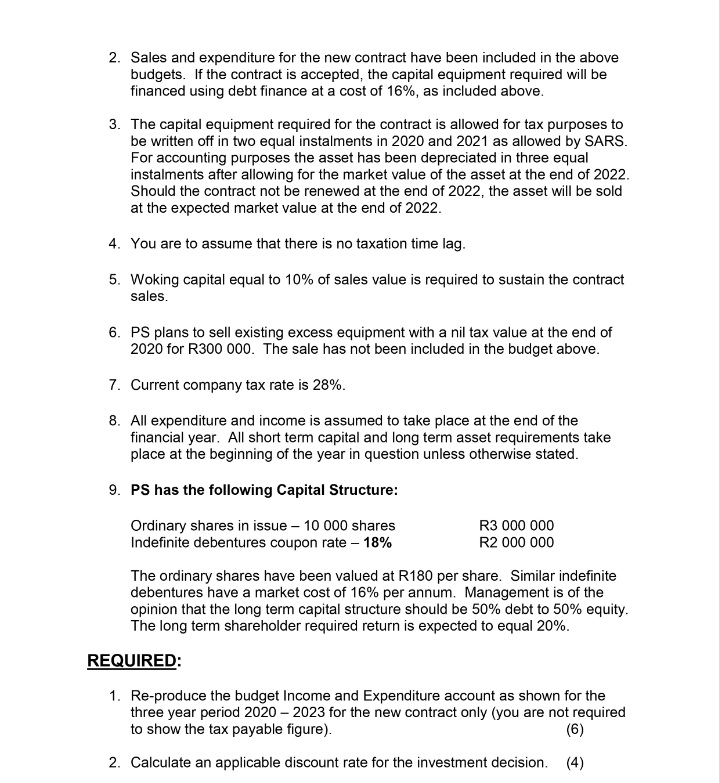

Poonawassy Sound (Pty) Ltd (PS) was established three years ago to manufacture electronic components for home musical and hi-fi systems. At the end of the three years since inception, the company has an accumulated tax loss of R500 000 even though sales have grown at a consistent rate of 10% per annum. PS is considering an order from Cay Music (Pty) Ltd (CM) to supply them with blue tooth boom boxes for an initial contract period of 3 years. The contract requires that PS purchase special capital equipment for R2 000 000 in order to manufacture the boom boxes. Miss Willis the company accountant has produced the current year's actual income statement together with a 3-year projection of the expected income including the contract should it be accepted. Poonawassy Sound (Pty) Ltd Income and Expenditure Statement 2019 Actual R'000 Sales Variable costs Fixed costs Depreciation Interest Gross profit Under-recovered fixed manufacturing overhead Profit before tax Taxation Profit after tax R'000 4 000 1 600 1 000 2020 Budget R'000 6 400 2 760 1 600 1 140 5 740 360 300 (400) (100) 420 (100) 220 420 You as financial manager needs to determine if the new contract should be accepted. 680 220 2021 2022 Budget Budget R'000 R'000 220 6 800 2 960 1 600 1 140 680 420 7 200 3 160 1 600 1 140 680 620 620 210 410 You gathered the following additional information: 1. The budget for 2020 assumes the sales of "existing components" to the market will increase by 10% at the same selling price. The cost structure of "existing components", including depreciation and interest has been budgeted to remain the same as the actual results for 2019. Sales of "existing components" for 2021 and 2022 have been budgeted conservatively at the 2020 sales level. Increased sales for 2021 and 2022 are due to boom boxes sales only. Variable and fixed cost structure for 2021 and 2022 will remain as shown in 2020. 2. Sales and expenditure for the new contract have been included in the above budgets. If the contract is accepted, the capital equipment required will be financed using debt finance at a cost of 16%, as included above. 3. The capital equipment required for the contract is allowed for tax purposes to be written off in two equal instalments in 2020 and 2021 as allowed by SARS. For accounting purposes the asset has been depreciated in three equal instalments after allowing for the market value of the asset at the end of 2022. Should the contract not be renewed at the end of 2022, the asset will be sold at the expected market value at the end of 2022. 4. You are to assume that there is no taxation time lag. 5. Woking capital equal to 10% of sales value is required to sustain the contract sales. 6. PS plans to sell existing excess equipment with a nil tax value at the end of 2020 for R300 000. The sale has not been included in the budget above. 7. Current company tax rate is 28%. 8. All expenditure and income is assumed to take place at the end of the financial year. All short term capital and long term asset requirements take place at the beginning of the year in question unless otherwise stated. 9. PS has the following Capital Structure: Ordinary shares in issue - 10 000 shares Indefinite debentures coupon rate - 18% R3 000 000 R2 000 000 The ordinary shares have been valued at R180 per share. Similar indefinite debentures have a market cost of 16% per annum. Management is of the opinion that the long term capital structure should be 50% debt to 50% equity. The long term shareholder required return is expected to equal 20%. REQUIRED: 1. Re-produce the budget Income and Expenditure account as shown for the three year period 2020-2023 for the new contract only (you are not required to show the tax payable figure). (6) 2. Calculate an applicable discount rate for the investment decision. (4)

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 Poonawassy Sound Pty Ltd Income and Expenditure Statement 2020 Budget R000 2021 Budget 2022 202...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started