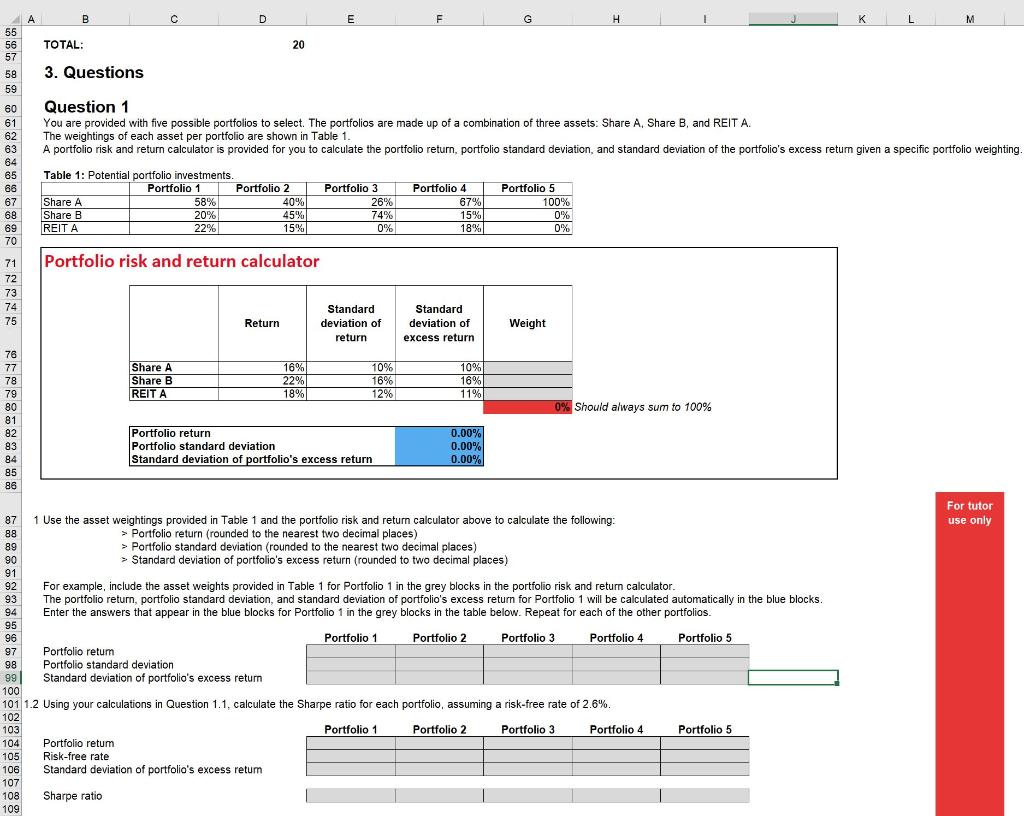

Question

POR FAVOR LLENE TODAS LAS CELULAS GRISES EN BLANCO CON LAS RESPUESTAS NUMRICAS. COMO; peso, el rendimiento de la cartera, la desviacin estndar de la

POR FAVOR LLENE TODAS LAS CELULAS GRISES EN BLANCO CON LAS RESPUESTAS NUMRICAS. COMO; peso, el rendimiento de la cartera, la desviacin estndar de la cartera y la desviacin estndar del exceso de rendimiento de la cartera, etc. para LAS 5 carteras.

Utilice las ponderaciones de activos proporcionadas en la Tabla 1 y la calculadora de riesgo y rendimiento de la cartera anterior para calcular lo siguiente:

Rentabilidad de la cartera (redondeada a los dos decimales ms cercanos)

Desviacin estndar de la cartera (redondeada a los dos decimales ms cercanos)

Desviacin estndar del exceso de rentabilidad de la cartera (redondeado a dos decimales)

Por ejemplo, incluya las ponderaciones de activos proporcionadas en la Tabla 1 para la Cartera 1 en los bloques grises de la calculadora de riesgo y rendimiento de la cartera. El rendimiento de la cartera, la desviacin estndar de la cartera y la desviacin estndar del exceso de rendimiento de la cartera para la Cartera 1 se calcularn automticamente en los bloques azules. Ingrese las respuestas que aparecen en los bloques azules del Portafolio 1 en los bloques grises de la siguiente tabla. Repita para cada una de las otras carteras.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started