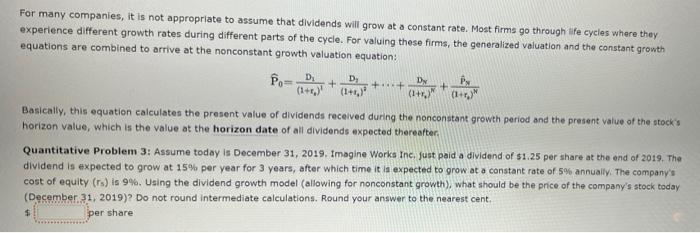

Por ++ For many companies, it is not appropriate to assume that dividends will grow at a constant rate. Most firms go through life cycles where they experience different growth rates during different parts of the cycle. For valuing these firms, the generalized valuation and the constant growth equations are combined to arrive at the nonconstant growth valuation equation: D + D. DN PN (1+) (14.) + (1+ (1+r) Basically, this equation calculates the present value of dividends received during the nonconstant growth period and the present value of the stock's horizon value, which is the value at the horizon date of all dividends expected thereafter, Quantitative Problem 3: Assume today is December 31, 2019. Imagine Works Inc. just paid a dividend of $1.25 per share at the end of 2019. The dividend is expected to grow at 15% per year for 3 years, after which time it is expected to grow at a constant rate of 5% annually. The company's cost of equity (s) is 9%. Using the dividend growth model (allowing for nonconstant growth), what should be the price of the company's stock today (December 31, 2019)? Do not round Intermediate calculations. Round your answer to the nearest cent. $ per share Por ++ For many companies, it is not appropriate to assume that dividends will grow at a constant rate. Most firms go through life cycles where they experience different growth rates during different parts of the cycle. For valuing these firms, the generalized valuation and the constant growth equations are combined to arrive at the nonconstant growth valuation equation: D + D. DN PN (1+) (14.) + (1+ (1+r) Basically, this equation calculates the present value of dividends received during the nonconstant growth period and the present value of the stock's horizon value, which is the value at the horizon date of all dividends expected thereafter, Quantitative Problem 3: Assume today is December 31, 2019. Imagine Works Inc. just paid a dividend of $1.25 per share at the end of 2019. The dividend is expected to grow at 15% per year for 3 years, after which time it is expected to grow at a constant rate of 5% annually. The company's cost of equity (s) is 9%. Using the dividend growth model (allowing for nonconstant growth), what should be the price of the company's stock today (December 31, 2019)? Do not round Intermediate calculations. Round your answer to the nearest cent. $ per share