Question

Porch Pirate Protection A study commissioned by Federal Express Canada Corporation (FedEx) that surveyed 1,500 Canadians in September of 2019 found that one in four

Porch Pirate Protection

A study commissioned by Federal Express Canada Corporation (FedEx) that surveyed 1,500 Canadians in September of 2019 found that one in four of those surveyed had had a package stolen and that 70 percent of respondents who shop online worry about package theft1. Porch pirates steal packages left on front porches when the person ordering the goods is not at home. In 2016, Jamie Foil, an experienced pipeline welder, formed Porch Pirate Protection, Inc. (PPP), a fictitious company headquartered in Guelph, Ontario2. PPP sells high quality, welded aluminum boxes designed to thwart porch pirates. While not meteoric, sales have increased steadily each year and in 2020 PPP sold 5,000 units. Jamie wants to continue to grow the business to increase PPPs profitability and to contribute to the local economy. However, the industry is becoming very competitive, and profit margins are getting squeezed.

Jamie had been investigating three ideas PPP for 2021. First, by purchasing a forklift and steel shelving, PPP could double the amount of inventory that could be warehoused in PPPs rented location leased for $3,000 per month. This change would address a problem that occurred several times a year when the local metal fabricator was busy with other customers and could not deliver boxes on time to PPP. Purchasing the forklift and steel shelving would cost approximately $30,000 and would be an alternative to using a supplier other than the one local metal fabricator that PPP has always used. Second, Jamie had talked with a local sign company and its metal fabricator about improving the signage and weatherproofing. While this would increase the cost of the boxes by about 10 percent, it would decrease complaints from customers about rain dripping into the boxes and delivery company drivers failing to use the box and leaving packages on the porch. Finally, Jamie is thinking about introducing a second model of the box, the SeeYou smart model, that would include a motion-sensitive night-vision camera and notify the box owner of deliveries. While this would require that the box be installed with access to power and wifi, Jamie saw that smart boxes sold by competitors were listed for double the current $225 price of his model. How much could a webcam cost? Jamie had seen them online for less than $50.

Diversification and upgrading are difficult because they require capital. If the business does not generate enough cash to fund the changes it is problematic. Jamie is the sole shareholder of Porch Pirate Protection. Jamie had taken an accounting course and wondered if it would be better to borrow more money from friends and family (his only source of long-term financing), borrow more money from the local bank, or sell shares on the Toronto Stock Exchange (TSX). Jamie had visited PPPs bank for initial discussions about an increase in the bank loan. He learned that any increase in the loan would not only require a personal guarantee but would also include covenants, such as a stipulation that the Current Ratio could not fall below 1:1 and that PPP have positive cash flow. Furthermore, Jamie discovered that the bank would require a landlord waiver that the landlord gives up his right of distraint in the event of non-payment of rent or violation of the lease. Jamie had also found the TSX Guide to Listing online (https://www.tsx.com/ebooks/en/2020-guide-to-listing/) but had not checked out the listing requirements yet.

Jamie is not sure where to begin. You took an introductory financial accounting course with Jamie. When Jamie heard that you are now taking a course in financial management, Jamie has asked for your help.

Required:

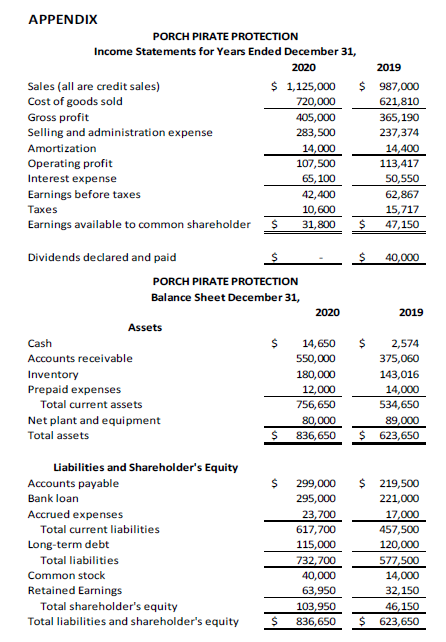

1. Prepare a cash flow statement for 2020. The appendix includes the income statements for the years ending December 31, 2020 and 2019 and the balance sheets for 2019 and 2020. Equipment has not been sold in the past five years. Porch Pirate repaid $5,000 of long-term debt in 2020 and 2019.

2. a) Compute and comment on PPPs 2020 financial ratios relevant to Jamies decisions.

b) Without preparing financial forecasts, comment on how Jamies three ideas are likely to affect profitability, liquidity, and efficiency (asset utilization). State all assumptions clearly.

3. a) Recommend the best option for financing.

b) List other factors that may also impact Jamies decision.

*****PLEASE: include any references you use.

*****PLEASE ANSWER:

Question 3. a) and b).

(I have reposted the question requesting the other questions to be answered)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started