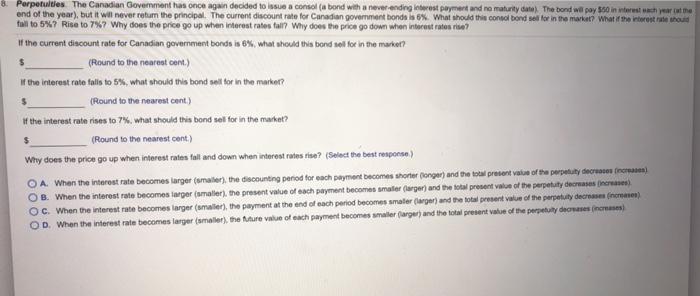

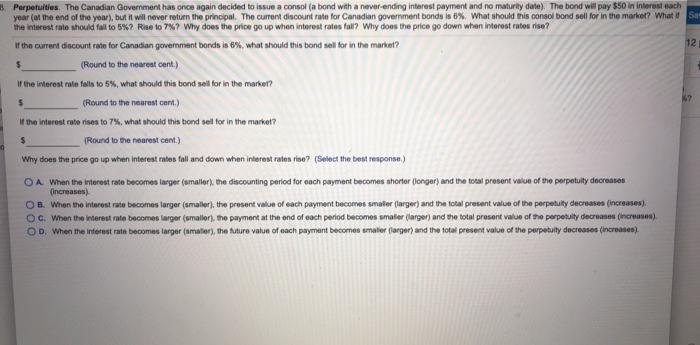

& Porpetultles The Canadian Government has once again decided to issue a consol (a bond with a never-ending interest payment and no maturity date) The bond we pay $50 interest each year the end of the year), but it will never retum the principal. The current discount rate for Canadian government bonde is 6%. What should this consolbond so for in the markal? What if the interest rate should fall to 5%? Rise to 7%? Why does the price go up when interest rates fall? Why does the price go down when interest rates rise? of the current discount rate for Canadian government bonds is 6%, what should this band so foe in the market? (Round to the nearest cont.) If the interest rate fails to 5%, what should this bond sell for in the marker? (Round to the nearest cent) If the interest rate rises to 7%, what should this bond sel for in the market? (Round to the nearest cont.) Why does the price go up when interest rates tall and down when interest rates rise? (Select the best response) OA. When the interest rate becomes targer (smaller), the discounting perod for each payment becomes shorter onger) and the total present value of the perpetuty decrease for) OB. When the interest rate becomes arger (smaller the present value of each payment becomes smaller (larger) and the total present value of the perpetuty decreases increases) OC. When the interest rate becomes larger (smaller), the payment at the end of each period becomes smaller larger) and the total present value of the perpetuly decrease increases) OD. When the interest rate becomes larger (smaller), the future value of each payment becomes smaller (arger) and the total present value of the perpetua doneses) Perpetuities. The Canadian Government has once again decided to issue a consol (a bond with a never-ending interest payment and no maturity date). The bond will pay $50 in interest each year (at the end of the year), but it will never return the principal. The current discount rate for Canadian government bonds is 8% What should this consolbond sell for in the market? What Sa the interest rate should fail to 5%2 Rise to 7%? Why does the price go up when interest rates fal? Why does the price go down when interest rates rise? 12 if the current discount rate for Canadian government bonds is 6%, what should this bond sell for in the market? (Round to the nearest cent.) If the interest rain falls to 5%, what should this bond sell for in the market? (Round to the neurast cent.) the interest rato rises to 7%, what should this bond set for in the market? Round to the nearest cent.) Why does the price go up when Interest rates tall and down when interest rates rise? (Select the best response) OA When the interest rate becomes larger (smaller the discounting period for each payment becomes shorter (longer) and the total present value of the perpetulty decreases increases) Os. When the interest rate becomes larger (smaller), the present value of each payment becomes smaller (larger) and the total present value of the perpetulty decreases increases). OC. When the interest rate becomes larger (smaller the payment at the end of each period becomes smaller (larger) and the total prosent value of the perpetuty decreases (incrusan). D. When the interest rate becomes targer (male), the future value of each payment becomes smaller (larger) and the total present value of the perpetully decreases (incrones)