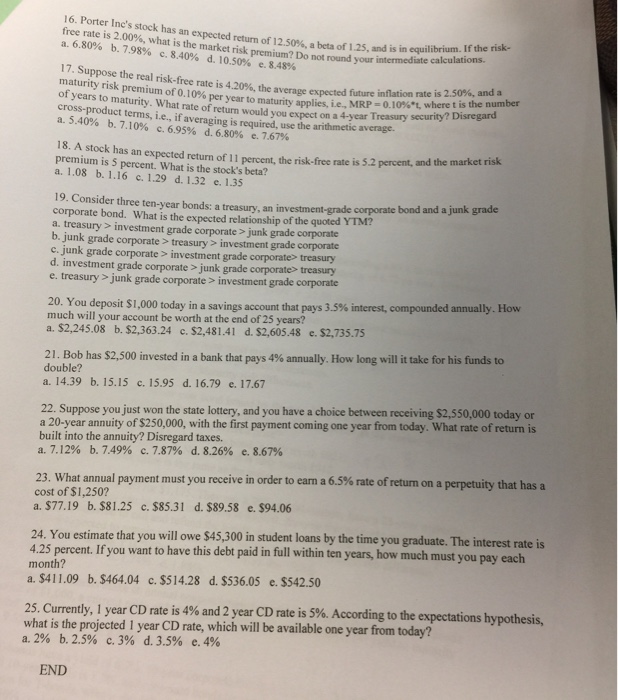

Porter Inc's stock has a expected return of 12.50%, a beta of 1.25, and is in equilibrium. If the risk-free rate is 2.00%, what is the market risk premium? Do not round your intermediate calculations. a. 6.80% b. 7.98% c. 8.40% d. 10.50% e. 8.48% Suppose the real risk-free is 4.20%, the average expected future inflation rate is 2.50%, and a maturity risk premium of 0.10% per year to maturity applies, i.e., MRP = 0.10% t, where t is the number of years to maturity. What rate of return would you expect on a 4-year Treasury security? Disregard cross-product terms, i.e., if averaging is required, use the arithmetic average. a. 5.40% b. 7.10% c. 6.95% d. 6.80% e. 7.67% A stock has an expected return of 11 percent, the risk-free rate is 5.2 percent, and the market risk premium is 5 percent. What is the stock's beta? a. 1.08 b. 1.16 c. 1.29 d. 1.32 e. 1.35 Consider three ten-year bonds: a treasury, an investment-grade corporate bond and a junk grade corporate bond. What is the expected relationship of the quoted YTM? a. treasury > investment grade corporate > junk grade corporate b. junk grade corporate > treasury > investment grade corporate c. junk grade corporate > investment grade corporate> treasury> d. investment grade corporate > junk grade corporate> treasury e. treasury > junk grade corporate > investment grade corporate You deposit $1,000 today in a savings account that pays 3.5% interest, compounded annually. How much will your account be worth at the end of 25 years? a. $2.245.08 b. $2, 363.24 c. $2.481.41 d. $2.605.48 e. $2.735.75 Bob has $2.500 invested in a bank that pays 4% annually. How long will it take for his funds to double? a. 14.39 b. 15.15 c. 15.95 d. 16.79 e. 17.67 Suppose you just won the state lottery, and you have a choice between receiving $2, 550,000 today or a 20-year annuity of $250,000, with the first payment coming one year from today. What rate of return is built into the annuity? Disregard taxes. a. 7.12% b. 7.49% c. 7.87% d. 8.26% e. 8.67% What annual payment must you receive in order to earn a 6.5% rate of return on a perpetuity that has a cost of $1, 250? a. $77.19 b. $81.25 c. $85.31 d. $89.58 e. $94.06 You estimate that you will owe $45, 300 in student loans by the time you graduate. The interest rate is 4.25 percent. If you want to have this debt paid in full within ten years, how much must you pay each month? a. $411.09 b. $464.04 c. $514.28 d. $536.05 e. $542.50 Currently, 1 year CD rate is 4% and 2 yrar CD rate is 5%. According to the expectations hypothesis, what is the projected 1 year CD rate, which will be available one year from today? a. 2% b. 2.5% c.3% d. 3.5% e.4%