Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Porter's Mortar maintains a debt-equity ratio of 0.65 and has a tax rate of 32 percent. The company has 25,000 shares of stock outstanding with

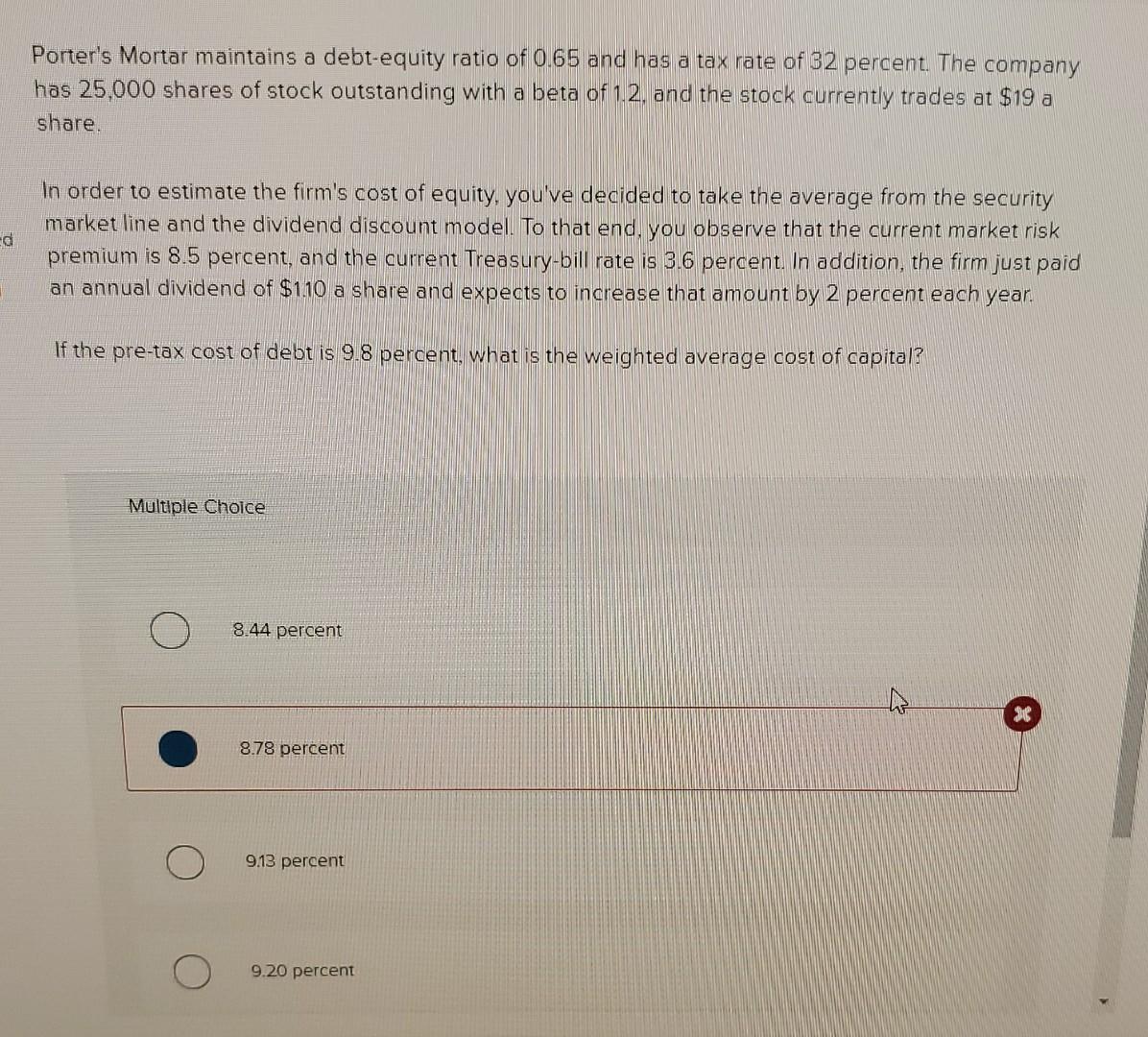

Porter's Mortar maintains a debt-equity ratio of 0.65 and has a tax rate of 32 percent. The company has 25,000 shares of stock outstanding with a beta of 12, and the stock currently trades at $19 a share. In order to estimate the firm's cost of equity, you've decided to take the average from the security market line and the dividend discount model. To that end, you observe that the current market risk premium is 8.5 percent, and the current Treasury-bill rate is 3.6 percent. In addition, the firm just paid an annual dividend of $110 a share and expects to increase that amount by 2 percent each year. If the pre-tax cost of debt is 9.8 percent, what is the weighted average cost of capital? Multiple Choice 8.44 percent 8.78 percent 9.13 percent 9.20 percent

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started