Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Portex Pty Ltd is a manufacturing company based in Australia that exports its product to the U.S. It expects payment on a large shipment

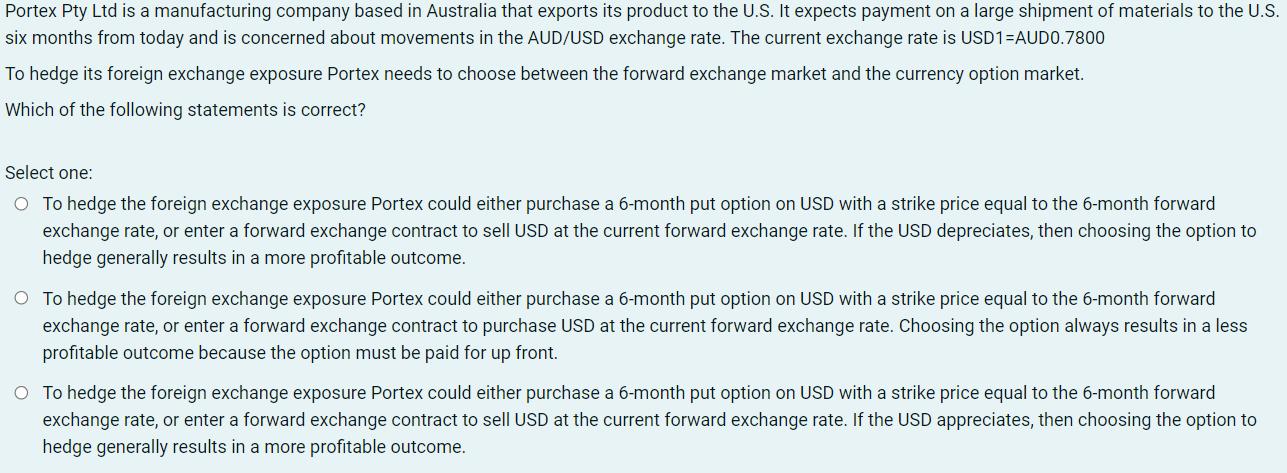

Portex Pty Ltd is a manufacturing company based in Australia that exports its product to the U.S. It expects payment on a large shipment of materials to the U.S. six months from today and is concerned about movements in the AUD/USD exchange rate. The current exchange rate is USD1=AUD0.7800 To hedge its foreign exchange exposure Portex needs to choose between the forward exchange market and the currency option market. Which of the following statements is correct? Select one: O To hedge the foreign exchange exposure Portex could either purchase a 6-month put option on USD with a strike price equal to the 6-month forward exchange rate, or enter a forward exchange contract to sell USD at the current forward exchange rate. If the USD depreciates, then choosing the option to hedge generally results in a more profitable outcome. O To hedge the foreign exchange exposure Portex could either purchase a 6-month put option on USD with a strike price equal to the 6-month forward exchange rate, or enter a forward exchange contract to purchase USD at the current forward exchange rate. Choosing the option always results in a less profitable outcome because the option must be paid for up front. O To hedge the foreign exchange exposure Portex could either purchase a 6-month put option on USD with a strike price equal to the 6-month forward exchange rate, or enter a forward exchange contract to sell USD at the current forward exchange rate. If the USD appreciates, then choosing the option to hedge generally results in a more profitable outcome.

Step by Step Solution

★★★★★

3.36 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below The correct statement is To hedge the f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started