Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Portfoilo management!!!!!! Need the answer urgently and please provide the steps. Estimate the the value per share at the begining of 2023 The following are

Portfoilo management!!!!!!

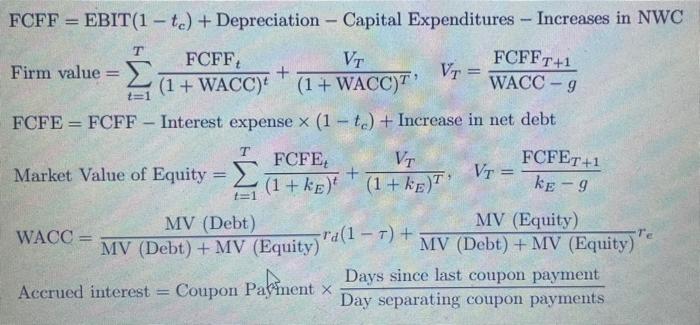

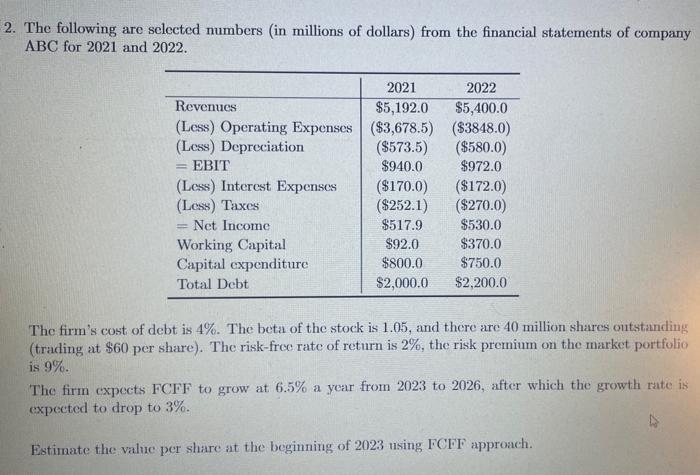

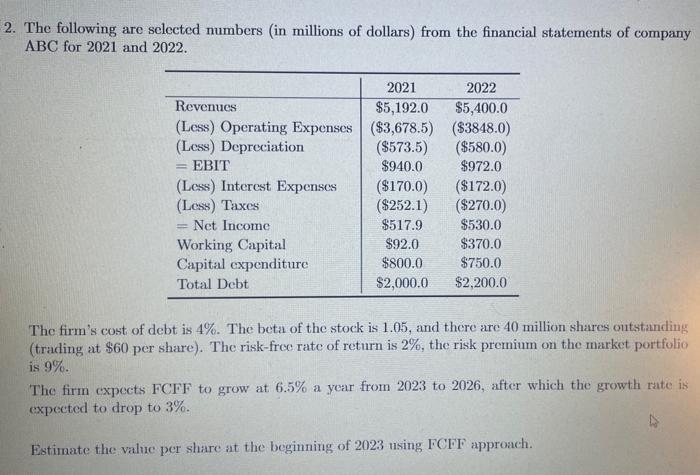

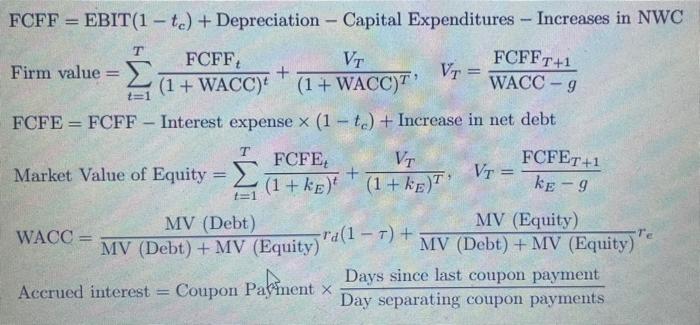

The following are selected numbers (in millions of dollars) from the financial statements of company ABC for 2021 and 2022. The firm's cost of debt is 4%. The beta of the stock is 1.05, and there are 40 million shares outstanding (trading at $60 per share). The risk-free rate of return is 2%, the risk premium on the market portfolio is 9%. The firm expects FCFF to grow at 6.5% a year from 2023 to 2026 , after which the growth rate is expected to drop to 3%. Estimate the value per share at the beginning of 2023 using FCFF approach. FCFF = EBIT (1tc)+ Depreciation - Capital Expenditures - Increases in NWC FCFE=FCFF Interest expense (1tc)+ Increase in net debt MarketValueofEquity=t=1T(1+kE)tFCFEt+(1+kE)TVT,VT=kEgFCFET+1WACC=MV(Debt)+MV(Equity)MV(Debt)rd(1)+MV(Debt)+MV(Equity)MV(Equity)reAccruedinterest=CouponPahmnentDayseparatingcouponpaymentsDayssincelastcouponpayment Need the answer urgently and please provide the steps.

Estimate the the value per share at the begining of 2023

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started