Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Portfolio managers are frequently paid a proportion of the funds under management. Suppose you manage a $110 million equity portfolio offering a dividend yield (P0DIV1)

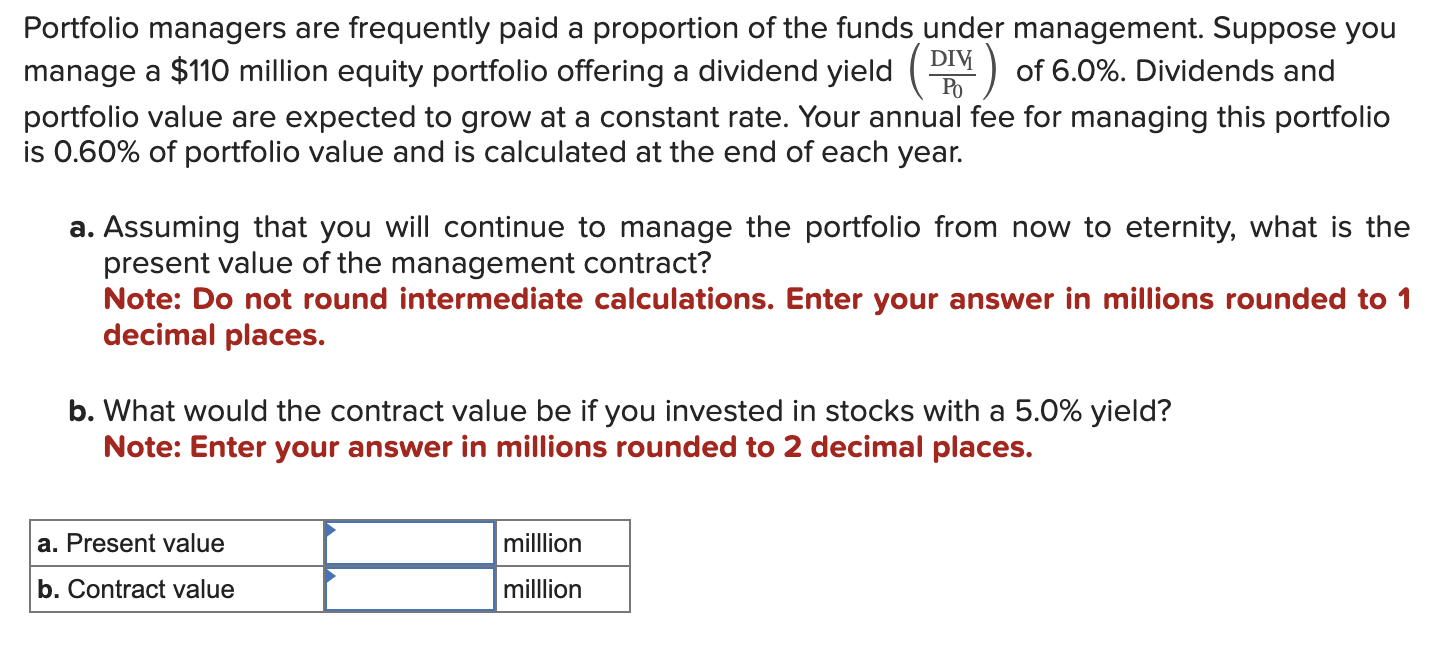

Portfolio managers are frequently paid a proportion of the funds under management. Suppose you manage a $110 million equity portfolio offering a dividend yield (P0DIV1) of 6.0%. Dividends and portfolio value are expected to grow at a constant rate. Your annual fee for managing this portfolio is 0.60% of portfolio value and is calculated at the end of each year. a. Assuming that you will continue to manage the portfolio from now to eternity, what is the present value of the management contract? Note: Do not round intermediate calculations. Enter your answer in millions rounded to 1 decimal places. b. What would the contract value be if you invested in stocks with a 5.0% yield? Note: Enter your answer in millions rounded to 2 decimal places

Portfolio managers are frequently paid a proportion of the funds under management. Suppose you manage a $110 million equity portfolio offering a dividend yield (P0DIV1) of 6.0%. Dividends and portfolio value are expected to grow at a constant rate. Your annual fee for managing this portfolio is 0.60% of portfolio value and is calculated at the end of each year. a. Assuming that you will continue to manage the portfolio from now to eternity, what is the present value of the management contract? Note: Do not round intermediate calculations. Enter your answer in millions rounded to 1 decimal places. b. What would the contract value be if you invested in stocks with a 5.0% yield? Note: Enter your answer in millions rounded to 2 decimal places Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started