Question

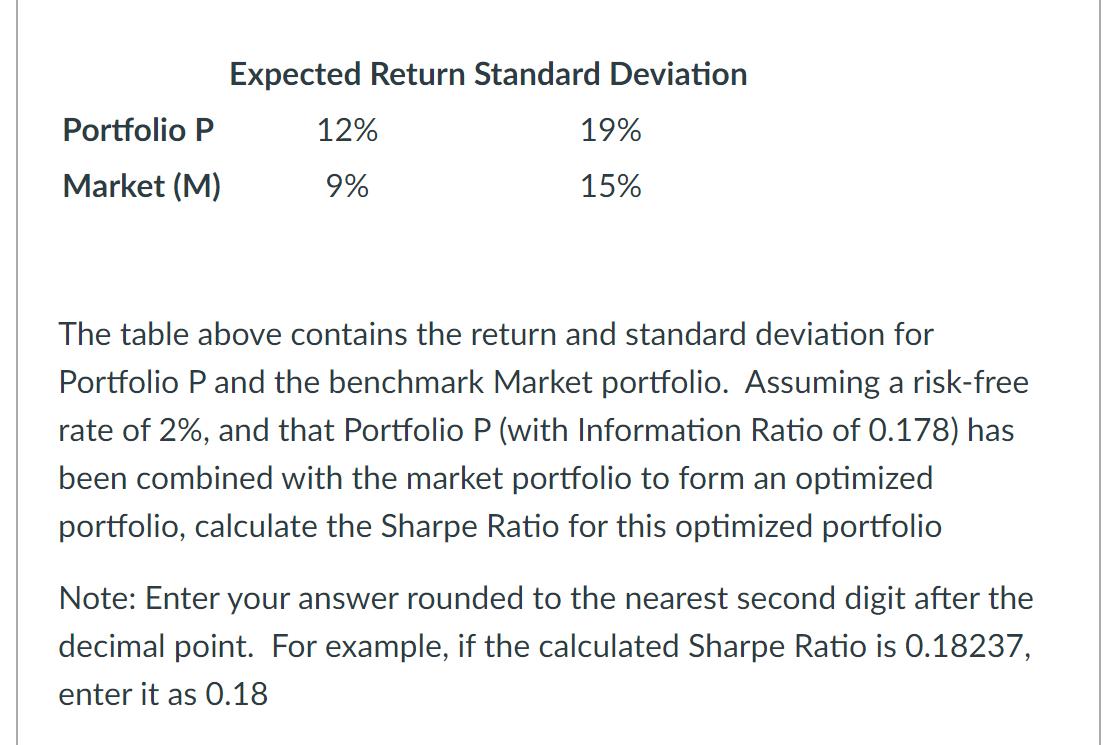

Expected Return Standard Deviation Portfolio P 12% Market (M) 9% 19% 15% The table above contains the return and standard deviation for Portfolio P

Expected Return Standard Deviation Portfolio P 12% Market (M) 9% 19% 15% The table above contains the return and standard deviation for Portfolio P and the benchmark Market portfolio. Assuming a risk-free rate of 2%, and that Portfolio P (with Information Ratio of 0.178) has been combined with the market portfolio to form an optimized portfolio, calculate the Sharpe Ratio for this optimized portfolio Note: Enter your answer rounded to the nearest second digit after the decimal point. For example, if the calculated Sharpe Ratio is 0.18237, enter it as 0.18

Step by Step Solution

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the Sharpe Ratio for the optimized portfolio we need to determine the expected return a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles of Corporate Finance

Authors: Richard Brealey, Stewart Myers, Franklin Allen

13th edition

1260013901, 1260565553, 978-1260013900

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App