Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Portfolio theory.. Please assist with Question 1 and 2 Question 1 Assume that the risk-free asset offers a return of 5% and that the market

Portfolio theory.. Please assist with Question 1 and 2

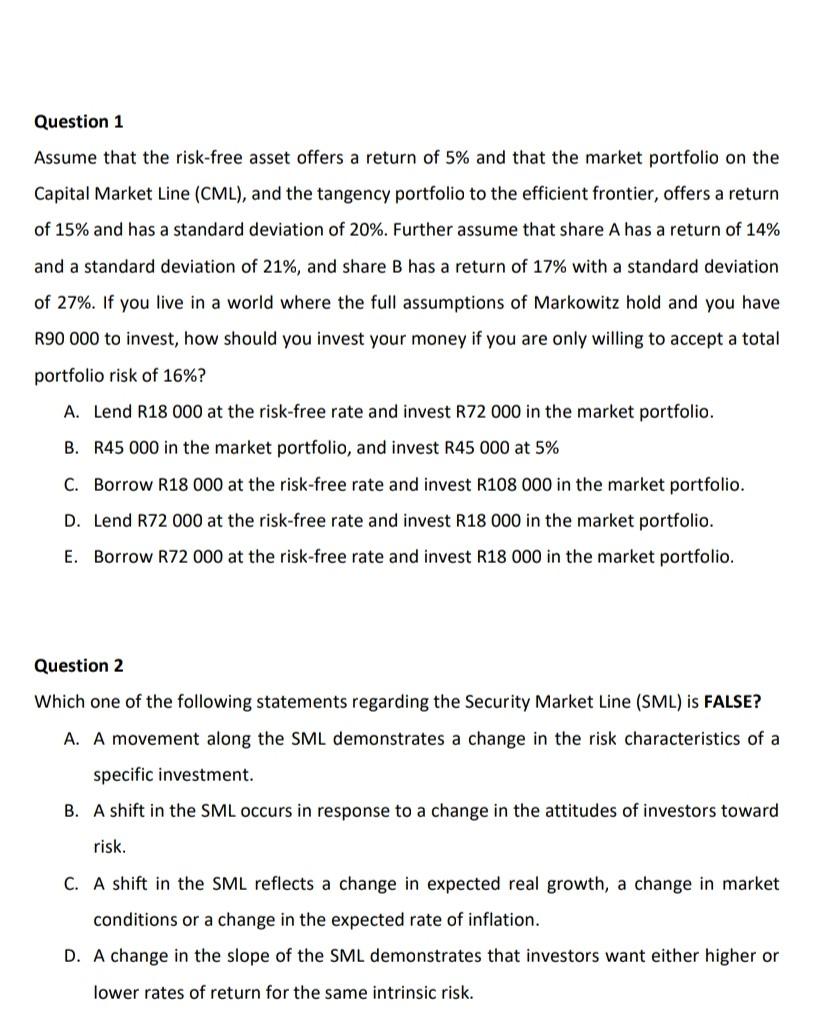

Question 1 Assume that the risk-free asset offers a return of 5% and that the market portfolio on the Capital Market Line (CML), and the tangency portfolio to the efficient frontier, offers a return of 15% and has a standard deviation of 20%. Further assume that share A has a return of 14% and a standard deviation of 21%, and share B has a return of 17% with a standard deviation of 27%. If you live in a world where the full assumptions of Markowitz hold and you have R90 000 to invest, how should you invest your money if you are only willing to accept a total portfolio risk of 16%? A. Lend R18 000 at the risk-free rate and invest R72 000 in the market portfolio. B. R45 000 in the market portfolio, and invest R45 000 at 5% C. Borrow R18 000 at the risk-free rate and invest R108 000 in the market portfolio. D. Lend R72 000 at the risk-free rate and invest R18 000 in the market portfolio. E. Borrow R72 000 at the risk-free rate and invest R18 000 in the market portfolio. Question 2 Which one of the following statements regarding the Security Market Line (SML) is FALSE? A. A movement along the SML demonstrates a change in the risk characteristics of a specific investment. B. A shift in the SML occurs in response to a change in the attitudes of investors toward risk. C. A shift in the SML reflects a change in expected real growth, a change in market conditions or a change in the expected rate of inflation. D. A change in the slope of the SML demonstrates that investors want either higher or lower rates of return for the same intrinsic riskStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started