Question

Atlantic Manufacturing is considering a new investment project that will last for four years. The delivered and installed cost of the machine needed for the

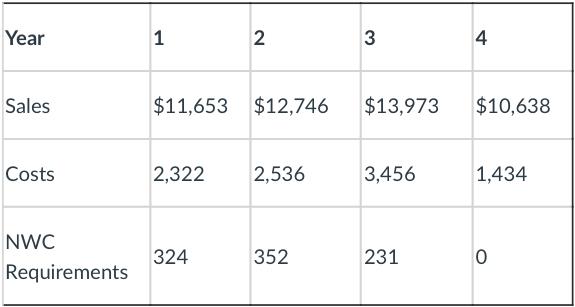

Atlantic Manufacturing is considering a new investment project that will last for four years. The delivered and installed cost of the machine needed for the project is $23,957 and it will be depreciated according to the three-year MACRS schedule. The project also requires an initial increase in net working capital of $300. Financial projections for sales and costs are in the table below. In addition, since sales are expected to fluctuate, NWC requirements will also fluctuate. The $0 requirement for NWC at the end of year 4 means that all NWC is recovered by the end of the project. The corporate tax rate is 35% and the required return on the project is 12%.

What is the project's NPV?

Year Sales Costs NWC Requirements 1 $11,653 $12,746 2,322 2 324 2,536 352 3 $13,973 3,456 231 4 $10,638 1,434 0

Step by Step Solution

3.53 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

FIRST CALCULATING DEPRECIATION BOOK VALUE DEPRECIATION BOOK VALUE FORMULA COST DEPRECI...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started