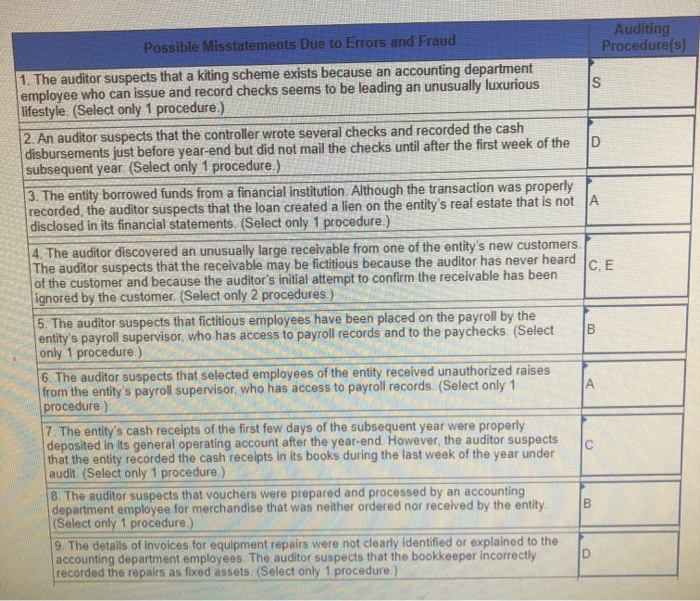

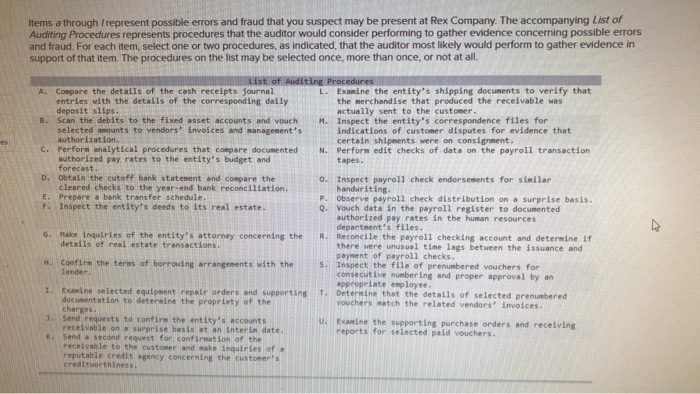

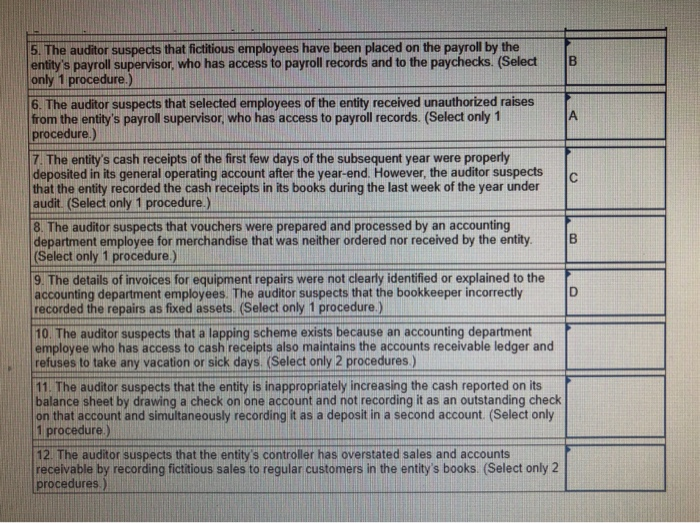

Possible Misstatements Due to Errors and Fraud Auditing Procedure(s) 1. The auditor suspects that a kiting scheme exists because an accounting department employee who can issue and record checks seems to be leading an unusually luxurious lifestyle. (Select only 1 procedure.) 2. An auditor suspects that the controller wrote several checks and recorded the cash disbursements just before year-end but did not mail the checks until after the first week of the subsequent year. (Select only 1 procedure.) 3. The entity borrowed funds from a financial institution. Although the transaction was properly recorded, the auditor suspects that the loan created a lien on the entity's real estate that is not A disclosed in its financial statements. (Select only 1 procedure.) 4. The auditor discovered an unusually large receivable from one of the entity's new customers, The auditor suspects that the receivable may be fictitious because the auditor has never heard ICE of the customer and because the auditor's initial attempt to confirm the receivable has been ignored by the customer. (Select only 2 procedures.) 5. The auditor suspects that fictitious employees have been placed on the payroll by the entity's payroll supervisor, who has access to payroll records and to the paychecks. (Select only 1 procedure. kan en 6. The auditor suspects that selected employees of the entity received unauthorized raises from the entity's payroll supervisor, who has access to payroll records. (Select only 1 procedure) 17. The entity's cash receipts of the first few days of the subsequent year were properly deposited in its general operating account after the year-end. However, the auditor suspects that the entity recorded the cash receipts in its books during the last week of the year under audit (Select only 1 procedure.) 8. The auditor suspects that vouchers were prepared and processed by an accounting department employee for merchandise that was neither ordered nor received by the entity (Select only 1 procedure.) 9. The details of invoices for equipment repairs were not clearly identified or explained to the accounting department employees. The auditor suspects that the bookkeeper incorrectly recorded the repairs as fixed assets. (Select only 1 procedure) Items a through /represent possible errors and fraud that you suspect may be present at Rex Company. The accompanying List of Auditing Procedures represents procedures that the auditor would consider performing to gather evidence concerning possible errors and fraud. For each item, select one or two procedures, as indicated that the auditor most likely would perform to gather evidence in support of that item. The procedures on the list may be selected once, more than once, or not at all. List of Auditing Procedures A. Compare the details of the cash receipts journal Examine the entity's shipping documents to verify that entries with the details of the corresponding daily the merchandise that produced the receivable was deposit slips. actually sent to the customer. B. Scan the debits to the fixed asset accounts and vouch M. Inspect the entity's correspondence files for selected amounts to vendors invoices and management's indications of customer disputes for evidence that authorization. certain shipments were on consignment. C. Perform analytical procedures that compare documented N. Perform edit checks of data on the payroll transaction authorized pay rates to the entity's budget and tapes. forecast. D. Obtain the cutoff bank statement and compare the o. Inspect payroll check endorsements for similar cleared checks to the year-end bank reconciliation handwriting. E. Prepare a bank transfer schedule. Observe payroll check distribution on a surprise basis. F. Inspect the entity's deeds to its real estate. Q. Vouch data in the payroll register to documented authorized pay rates in the human resources department's files. G. Make inquiries of the entity's attorney concerning the R. Reconcile the payroll checking account and determine if details of real estate transactions there were unusual time lags between the issuance and payment of payroll checks. H. Confirm the terms of borrowing arrangements with the 5. Inspect the file of prenumbered vouchers for consecutive numbering and proper approval by an appropriate employee. Examine selected equipoent repair orders and supporting T. Determine that the details of selected prenumbered documentation to determine the property of the vouchers watch the related vendors invoices. charges. Send requests to confine the entity's accounts U. Examine the supporting purchase orders and receiving receivable on surprise basis at an intern date. reports for selected paid vouchers. Send second request for confirmation of the receivable to the customer and make inquiries of a reputable credit agency concerning the customer's creditworthiness 5. The auditor suspects that fictitious employees have been placed on the payroll by the entity's payroll supervisor, who has access to payroll records and to the paychecks. (Select only 1 procedure.) 6. The auditor suspects that selected employees of the entity received unauthorized raises from the entity's payroll supervisor, who has access to payroll records. (Select only 1 procedure.) 7. The entity's cash receipts of the first few days of the subsequent year were properly deposited in its general operating account after the year-end. However, the auditor suspects that the entity recorded the cash receipts in its books during the last week of the year under audit. (Select only 1 procedure.) 8. The auditor suspects that vouchers were prepared and processed by an accounting department employee for merchandise that was neither ordered nor received by the entity (Select only 1 procedure.) 9. The details of invoices for equipment repairs were not clearly identified or explained to the accounting department employees. The auditor suspects that the bookkeeper incorrectly recorded the repairs as fixed assets. (Select only 1 procedure.) 10. The auditor suspects that a lapping scheme exists because an accounting department employee who has access to cash receipts also maintains the accounts receivable ledger and refuses to take any vacation or sick days. (Select only 2 procedures.) 11. The auditor suspects that the entity is inappropriately increasing the cash reported on its balance sheet by drawing a check on one account and not recording it as an outstanding check on that account and simultaneously recording it as a deposit in a second account. (Select only 1 procedure.) 12. The auditor suspects that the entity's controller has overstated sales and accounts receivable by recording fictitious sales to regular customers in the entity's books. (Select only 2 procedures.)