Answered step by step

Verified Expert Solution

Question

1 Approved Answer

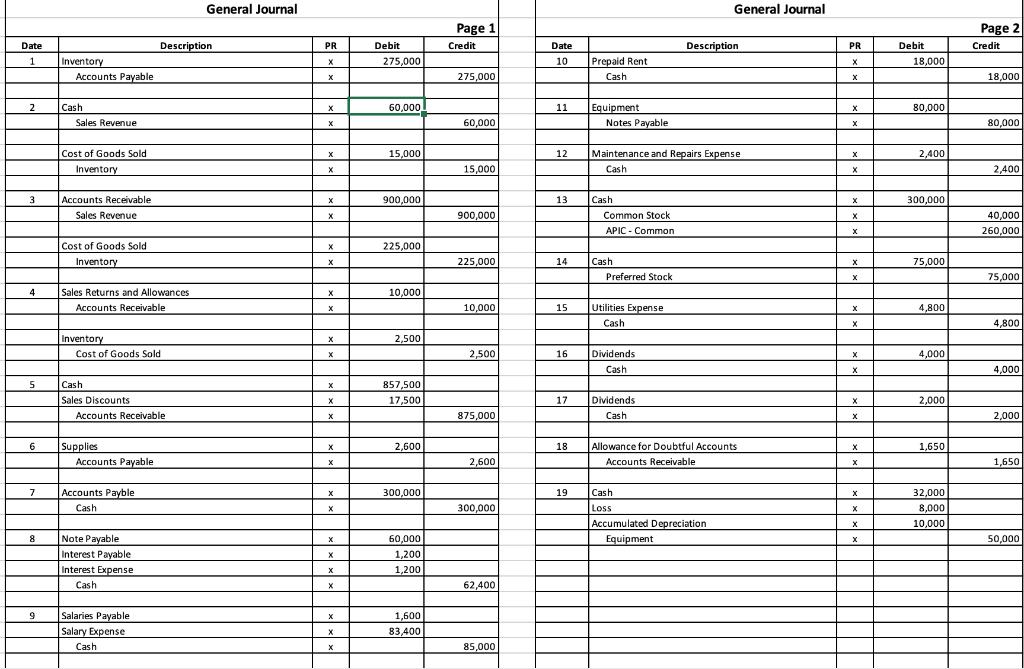

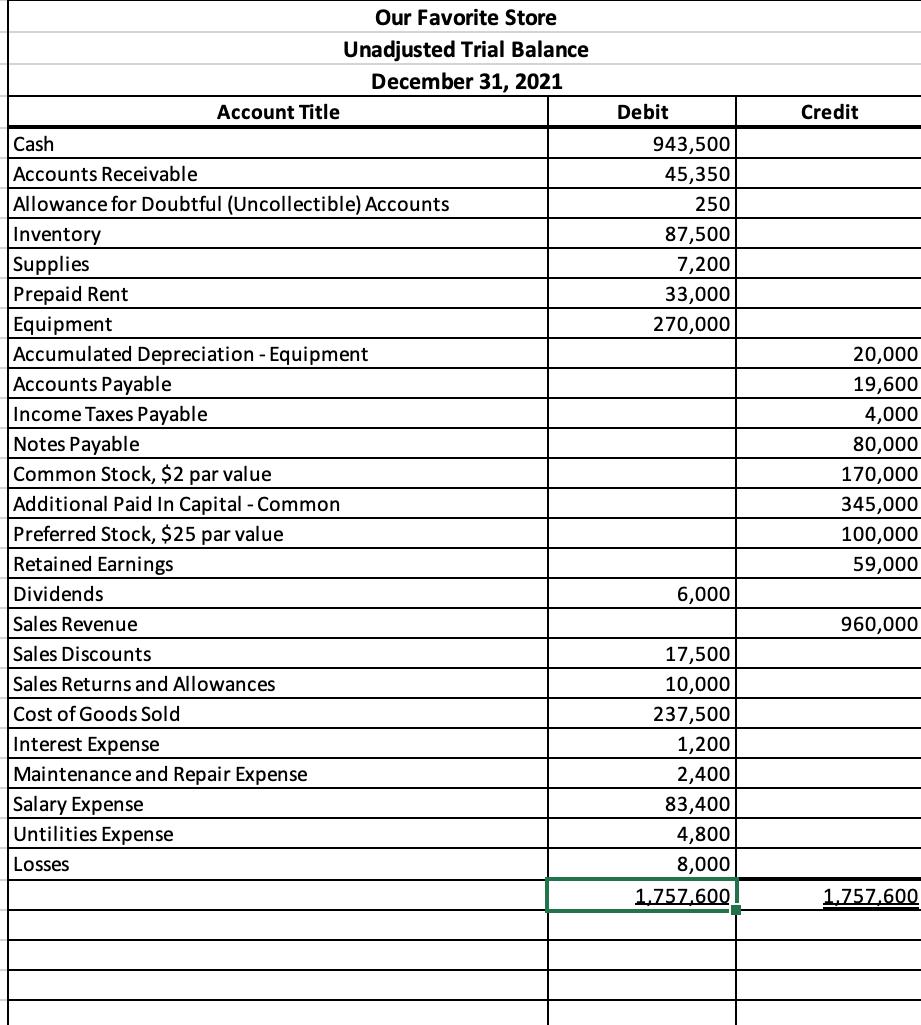

Post the adjusting entries for Our Favorite Store in the Adjusted Trial Balance Included are the adjusting entries needed to be made, along with the

Post the adjusting entries for Our Favorite Store in the Adjusted Trial Balance

Included are the adjusting entries needed to be made, along with the General Journal from the original unadjusted entries, and the unadjusted trial balance.

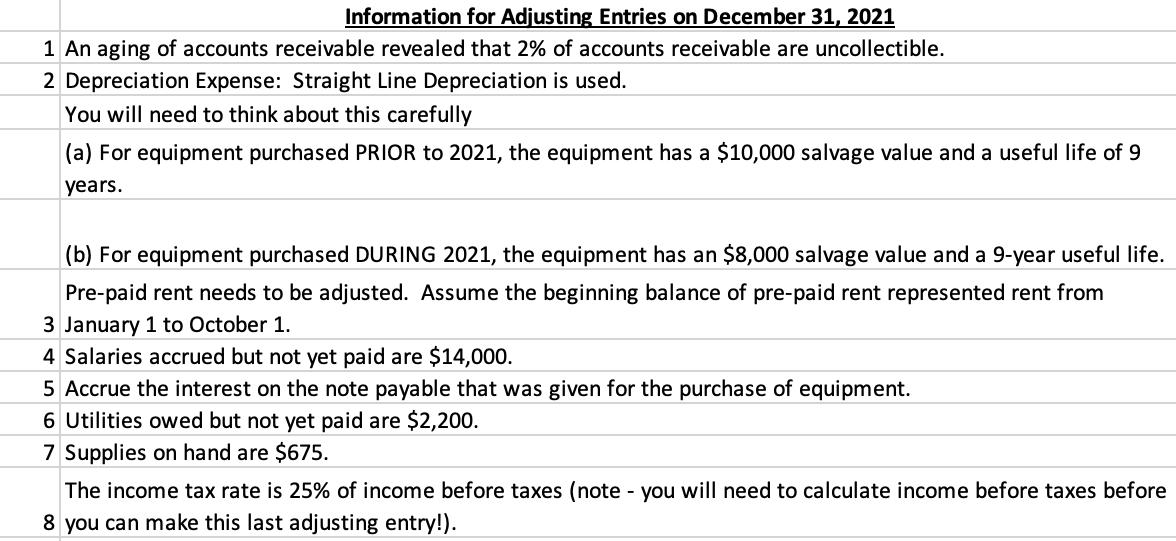

Information for Adjusting Entries on December 31, 2021 1 An aging of accounts receivable revealed that 2% of accounts receivable are uncollectible. 2 Depreciation Expense: Straight Line Depreciation is used. You will need to think about this carefully (a) For equipment purchased PRIOR to 2021, the equipment has a $10,000 salvage value and a useful life of 9 years. (b) For equipment purchased DURING 2021, the equipment has an $8,000 salvage value and a 9-year useful life. Pre-paid rent needs to be adjusted. Assume the beginning balance of pre-paid rent represented rent from 3 January 1 to October 1. 4 Salaries accrued but not yet paid are $14,000. 5 Accrue the interest on the note payable that was given for the purchase of equipment. 6 Utilities owed but not yet paid are $2,200. 7 Supplies on hand are $675. The income tax rate is 25% of income before taxes (note - you will need to calculate income before taxes before 8 you can make this last adjusting entry!).

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

WN Computation of income tax TRADING ACCOUNT PARTICULAR AMOUNT PARTICULAR AMOUNT cost of good sold 2...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started