Question

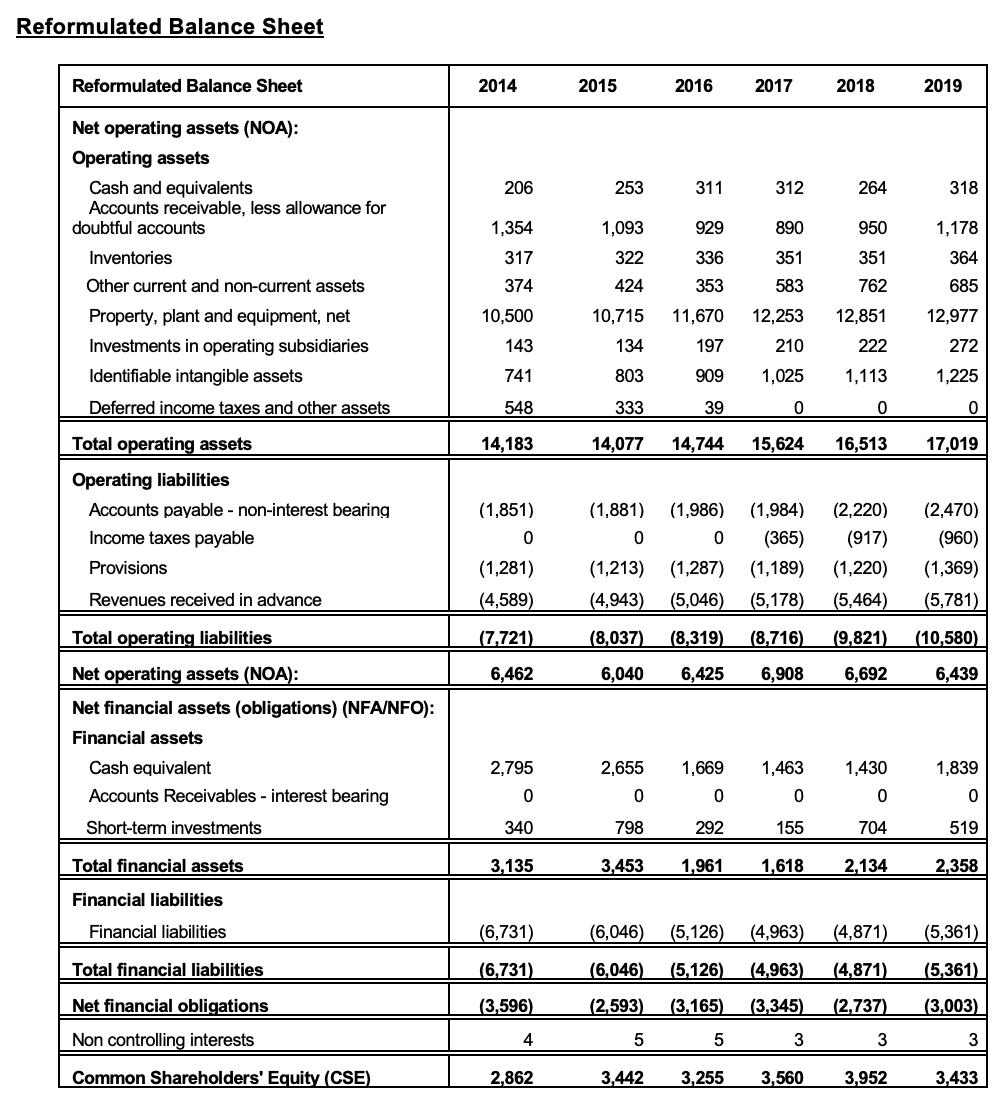

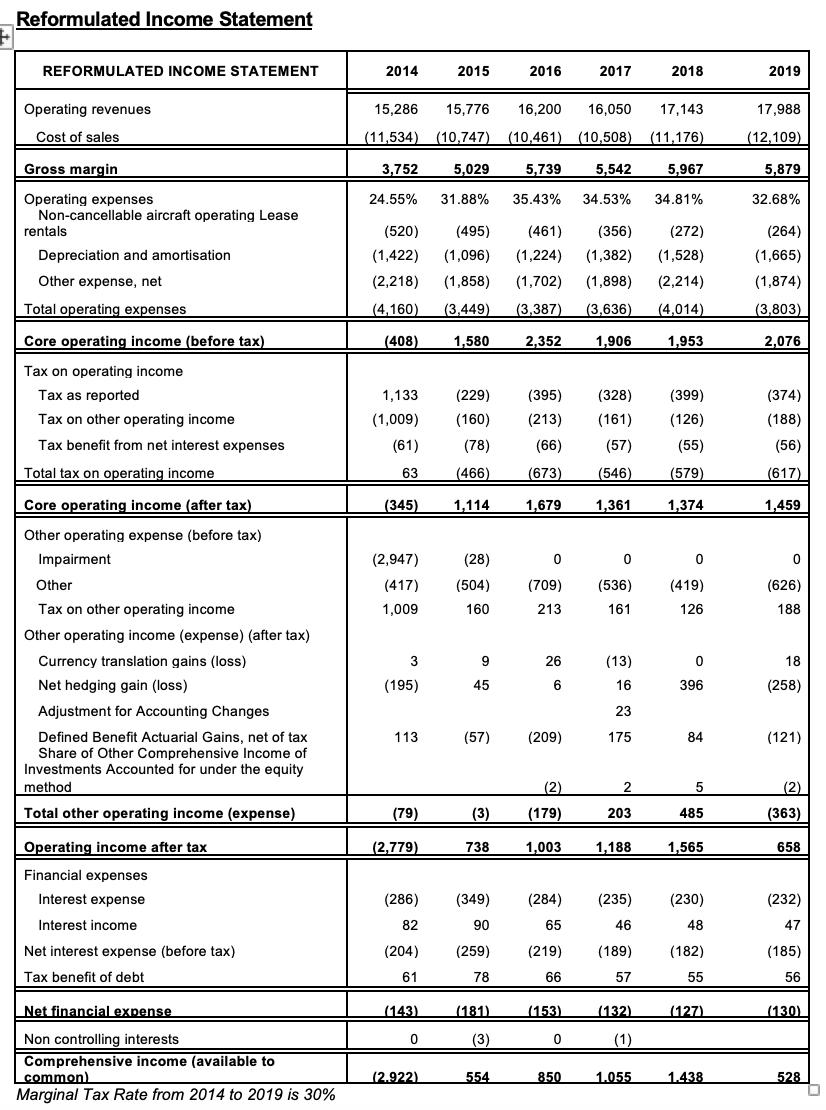

se the reformulated financial statements for Qantas Airways Limited to answer Questions 1, 2, 3 and 4. 1) Free Cash Flow Analysis 2) Profitability Analysis

se the reformulated financial statements for Qantas Airways Limited to answer Questions 1, 2, 3 and 4.

1) Free Cash Flow Analysis

2) Profitability Analysis

3) Systematic Growth Valuation

4) Residual Earnings Growth Valuation

Question 1

Calculate Free Cash flow using Method 1 and Method 2 for 2018 and 2019

`

Question 2

a. Provide first and second level breakdown of the company's return on common equity (ROCE) for 2017, 2018 and 2019

b. Discuss the drivers of profitability for 2017, 2018 and 2019.

Question 3

Provide a systematic analysis of growth for 2017, 2018 and 2019

a. Calculate the following:

i. Revenue Growth

ii. Growth in Common Shareholder's Equity (CSE)

iii. Growth in Comprehensive Income

b. Calculate the components of the change in Return on Net Operating Assets (RNOA.)

i. Change in core sales PM at previous asset turnover level

ii. Change due to change in asset turnover

iii. Change due to change in unusual items

iv. Discuss the drivers of change in RNOA

c. Calculate the components of the change in Return on Common Equity (ROCE).

i. Change in RNOA

ii. Change due to change in spread at previous level of financial leverage

iii. Change due to change in financial leverage

iv. Discuss drivers of change in ROCE

d. Calculate the components of the change in Common Shareholder's Equity (CSE) as follow:

a. Change due to change in sales at previous level of asset turnover

b. Change due to change in asset turnover

c. Change in financial assets

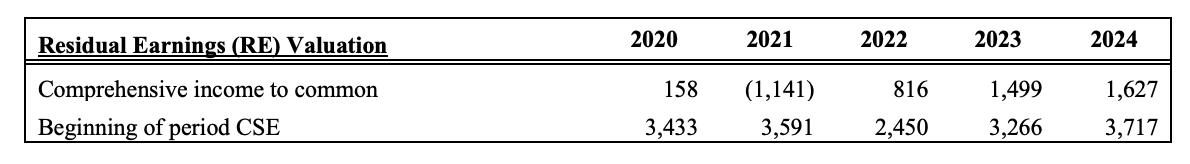

Question 4:

Below are earnings per share for Qantas Airways Limited. The required rate of return is 5.87%. The growth rate is forecasted at a constant rate of 2%. Number of share outstanding is 1,491.00.

Required:

a) Calculate the value per share using the pro forma provided

b) In your opinion, how did the recent pandemic affect the valuation of the company?

c) Calculate the implied growth rate in RE, if the current market price of the stock is $8.12.

d) In the context of investment decision-making, what are the advantages of using the reverse-engineering approach instead of computing the intrinsic value?

Reformulated Balance Sheet Reformulated Balance Sheet Net operating assets (NOA): Operating assets Cash and equivalents Accounts receivable, less allowance for doubtful accounts Inventories Other current and non-current assets Property, plant and equipment, net Investments in operating subsidiaries Identifiable intangible assets Deferred income taxes and other assets Total operating assets Operating liabilities Accounts payable - non-interest bearing Income taxes payable Provisions Revenues received in advance Total operating liabilities Net operating assets (NOA): Net financial assets (obligations) (NFA/NFO): Financial assets Cash equivalent Accounts Receivables - interest bearing Short-term investments Total financial assets Financial liabilities Financial liabilities Total financial liabilities Net financial obligations Non controlling interests Common Shareholders' Equity (CSE) 2014 206 1,354 317 374 10,500 143 741 548 14,183 (1,851) 0 (1,281) (4,589) (7,721) 6,462 2,795 0 340 3,135 (6,731) (6,731) (3,596) 4 2,862 2015 253 1,093 322 424 2016 311 2017 5 312 890 351 583 929 336 353 10,715 11,670 12,253 12,851 134 197 210 222 803 909 1,025 1,113 333 39 0 0 14,077 14,744 15,624 16,513 2,655 1,669 1,463 0 0 0 798 292 155 3,453 1,961 1,618 5 (6,046) (5,126) (6,046) (5,126) (2,593) (3,165) (3,345) (1,984) (2,220) (1,881) (1,986) 0 0 (1,213) (1,287) (365) (917) (1,189) (1,220) (4,943) (5,046) (5,178) (5,464) (8,037) (8,319) (8,716) (9,821) 6,040 6,425 6,908 6,692 2018 264 3 950 351 3,442 3,255 3,560 762 1,430 0 (4,963) (4,871) (4,963) (4,871) (2,737) 704 2,134 3 3,952 2019 318 1,178 364 685 12,977 272 1,225 0 17,019 (2,470) (960) (1,369) (5,781) (10,580) 6,439 1,839 0 519 2,358 (5,361) (5,361) (3,003) 3 3,433

Step by Step Solution

3.56 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 Free Cash Flow Analysis Method 1 Free Cash Flow Net Income Depreciation Amortization Change in Net Working Capital Capital Expenditure For 2018 Net Income Comprehensive Income available to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started